As climate change continues to be on the rise, businesses need to prepare to tackle the consequent risks. Recent reports by Morgan Stanley, JPMorganChase and the Institute of International Finance all concluded that achieving the goals of the Paris agreement is becoming increasingly unlikely and investors should anticipate increasing impacts of climate change events1.

In typical risk management procedures, risks are provided with a quantitative financial value, estimating their impacts to the business. This article aims to clarify the process of quantifying climate risks for a double purpose: preparing a company to identify, monitor and manage risks as well as aligning with the requirements of the Corporate Sustainability Reporting Directive (CSRD). Quantifying climate risks isn't just about numbers; it's about shaping a narrative around uncertainty that aids in strategic decision-making.

KPMG has experience in approaching climate risk quantification with clients from various industries. We develop roadmaps to bridge theory and practice, enabling a further understanding of what needs to be reported under the CSRD, as well as supporting in key decision-making. Based on leading methodologies, KPMG experts leverage climate data simulations, socio-economic projections, and key experts' insights to inform the company strategy for resilience.

Introduction

With the CSRD reshaping corporate reporting, understanding and quantifying the financial effects of climate risks on the business has become vital to corporate strategy. More recently, the Omnibus packages highlight the need of prioritizing quantitative datapoints over narrative text.

Identifying Relevant Climate Risks

Climate-related risks come in many forms and shapes, depending on the organization’s operations. Examples are: the effects of carbon pricing, extreme weather events and water scarcity. Before delving into quantification, material physical and transition climate risks2 should first be identified and prioritized. This fundamental step determines the focus and scope of the quantification effort. To help with this identification and prioritization, and later with the quantification, diverse data sources can be leveraged, such as those provided by the International Energy Agency (IEA), the Network for Greening the Financial System (NGFS), and the Intergovernmental Panel on Climate Change (IPCC). These organizations provide valuable scenario-based projections that help companies envisage a variation of potential futures, from policy shifts to technological advancements and market changes. Armed with this knowledge, organizations can analyze how their business activities are exposed to the changes in these different scenario projections. Material exposures also require quantitative analysis, both to guide strategic decision-making and to serve as input for CSRD disclosures.

Quantifying Climate Risks through Scenario Analysis

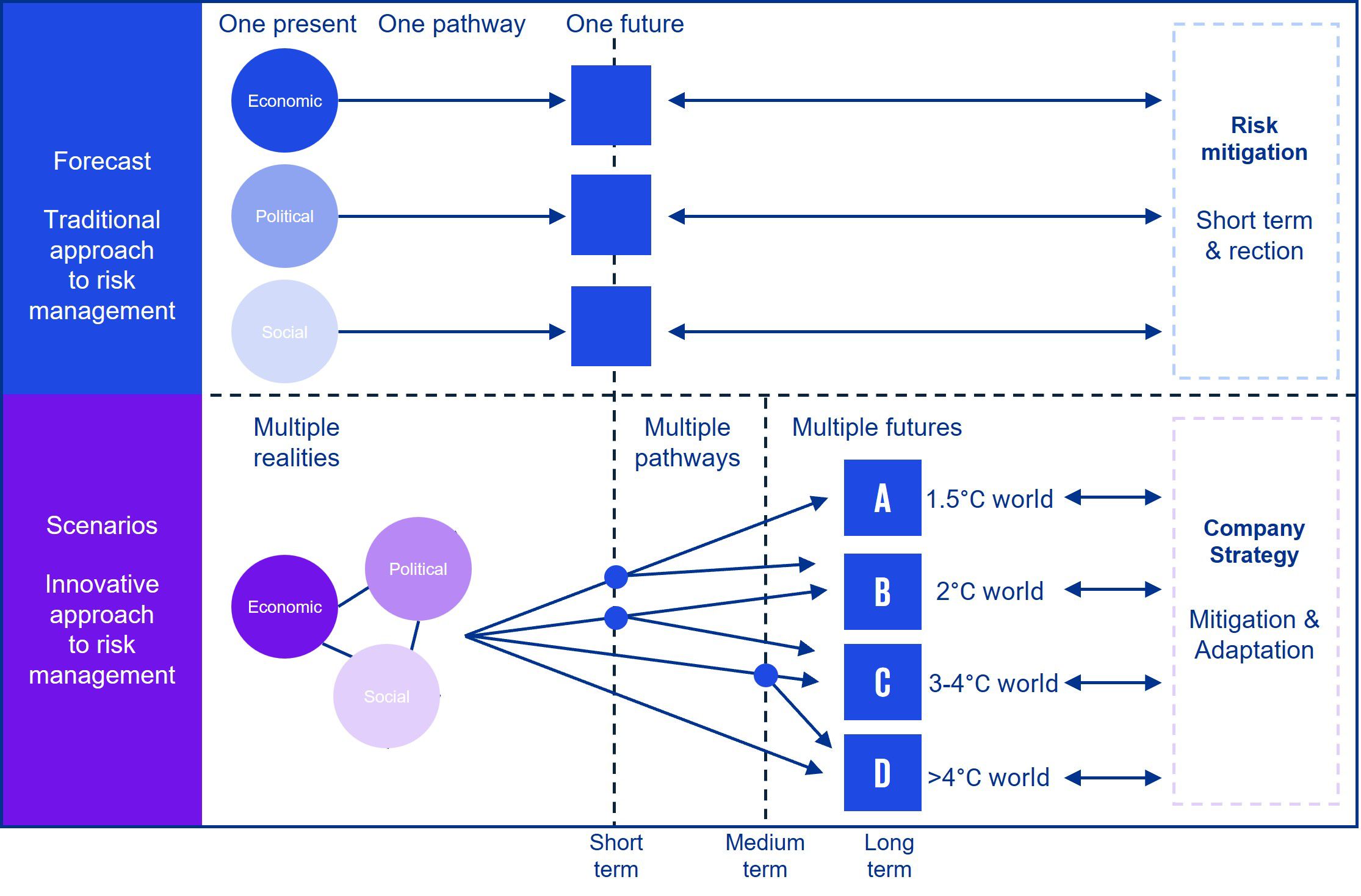

Incorporating scenario analysis into the quantification process offers an alternative to the standard risk management practices, such as likelihood-impact mapping techniques. Within scenario-based thinking, likelihood plays a negligible role; instead, it concentrates on exploring plausible futures. This approach aids strategic decision-making amid the complexities and uncertainties of climate change. Scenario-based thinking enhances strategic resilience by:

- testing a mitigation strategy and its options against a diverse set of scenarios;

- identifying potential future threats or opportunities;

- dentifying trigger points to set contingency plans in motion;

- providing a foundation for continuous monitoring and strategy adjustment.

To explore the strategic options and the array of potential impacts, a thorough understanding of the scenarios’ underlying logic is needed, as well as of the distinctions between different scenarios (or temperature trajectories) and data sources. Climate risk scenario analysis involves a high degree of uncertainty. By recognizing and internally deliberating the most important assumptions in the scenarios, a narrative will emerge that helps organizations to break the uncertainty down into elements that are actionable or, at least, can be monitored and refined.

Figure 1: Quantifying climate risks with forecasts vs scenario analysis.

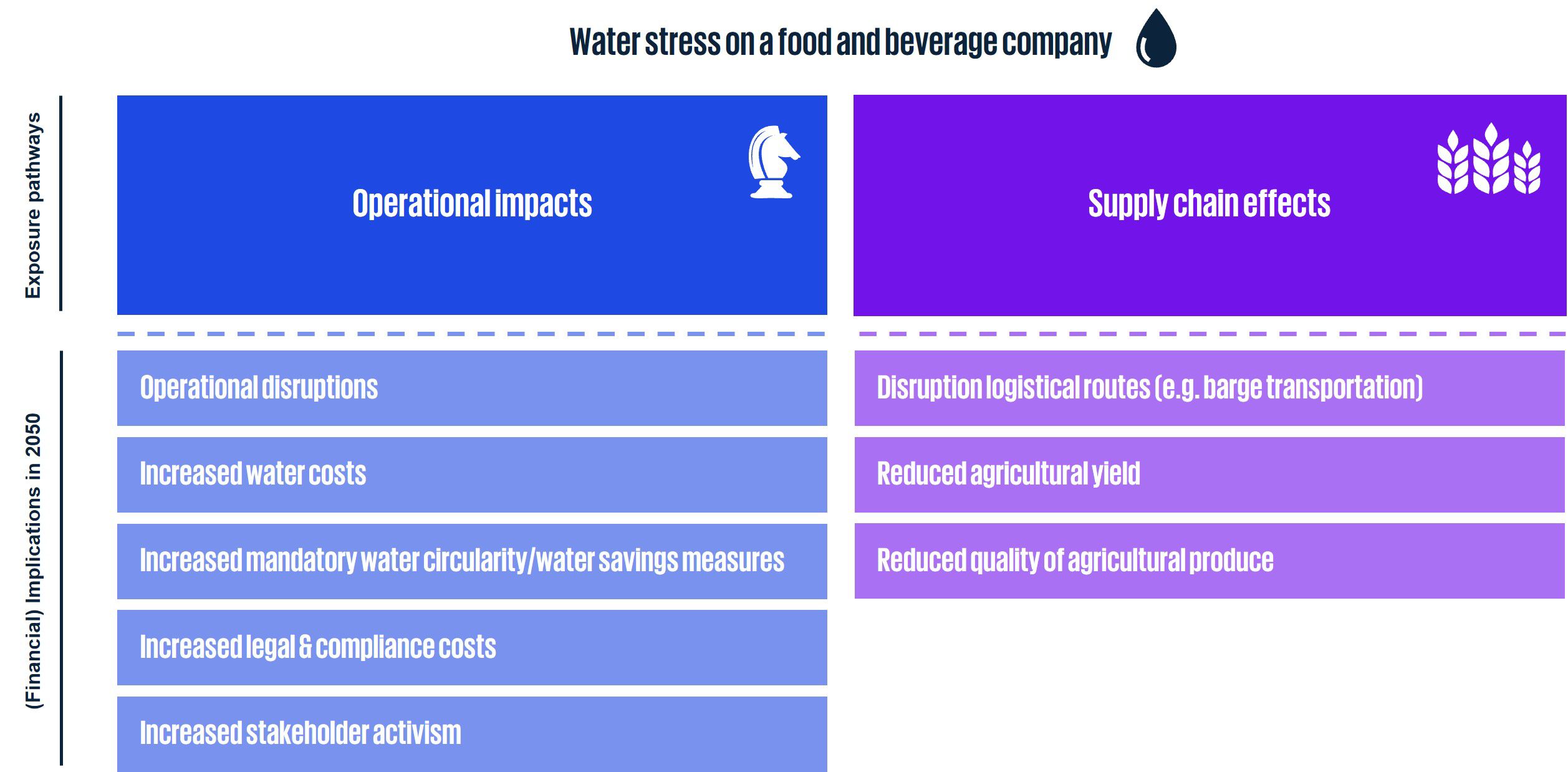

Central to the quantification process is a so-called parameter model for each risk. A parameter model offers a conceptual overview of interlinking parameters that influence the financial impact of that climate risk, incorporating insights from current operations. These parameter models help to determine to which extent a risk can be quantified, by articulating the level of granularity, gaps in quantification, as well as areas and data needs for further refinement. In practice, it means striking a balance between practical feasibility, required accuracy and model complexity. For all risks, the financial impact is dissected into three components: hazard, exposure and vulnerability. These components can be explained as follows:

- The 'hazard' describes the (change in) potential occurrence of the climate-related event. It considers both the (change in) likelihood and impact.

- The 'exposure' describes the existence of a company’s resources, assets or activities within the supply chain stages that could be affected by the hazard. Within this component, the granularity of the analysis is often defined.

- The 'vulnerability' is the net result of the sensitivity and adaptive capacity to the hazard. I.e. if the hazard occurs and one of the exposed assets is affected, by how much is it affected and what adaptive actions are in place?

Figure 2: Potential (financial) impacts of water scarcity/stress as a climate-related risk on a food and beverage company.

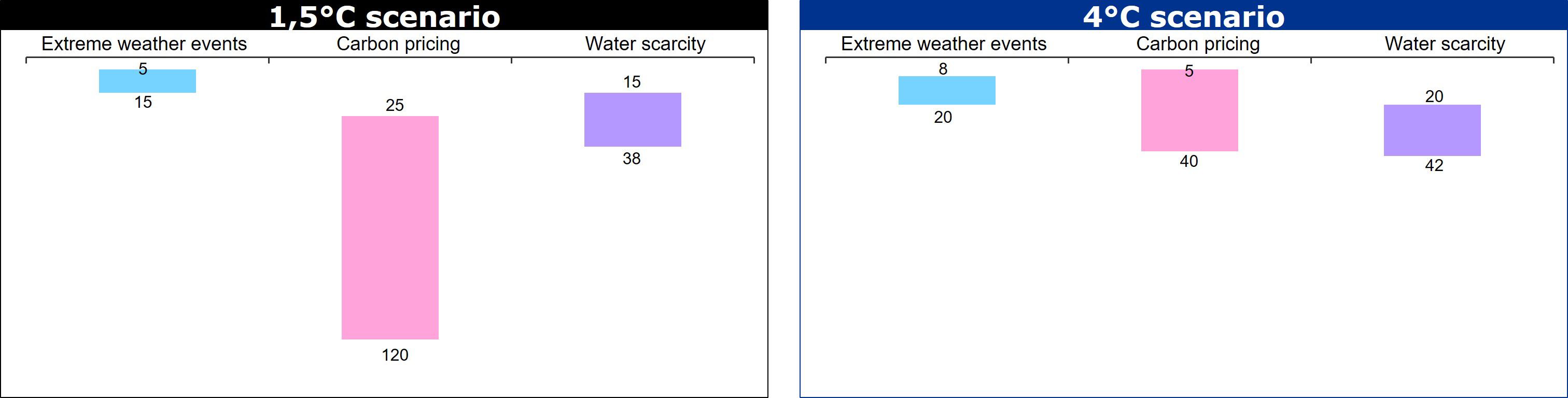

By examining these components separately, we can determine if the required data is available and which aspects might require expert judgment. This allows for a more granular modeling. Afterwards, when all components are combined, they can result in the (financial) impacts as shown above for the water scarcity risk. The results of the quantification efforts are provided in a range. The figure below illustrates what that could mean for three climate risks, based on dummy data. Generally, when interpreting the results, it is important to consider the assumptions and the key drivers of the impact.

Figure 3: Impact of climate risks given as a range, using dummy data.

Case Study: Quantifying Water Risk

To illustrate how the quantification process works in practice, we consider a climate-related risk that is material in the supply chain of many (product-based) organizations: water scarcity risk. Climate change exacerbates water scarcity, which poses a significant threat to the production continuity of, for example, retail companies.

Accurate quantification of water stress risk involves assessing water stress levels at all relevant locations. Drawing on data from sources such as the World Resources Institute (WRI), we analyze both present conditions and forecasted future scenarios, and deep dive into the potential financial implications that such a scarcity could impose on the company’s operation continuity.

Working hand in hand with experts from the organization, a model to translate regional water stress levels into potential financial impacts is developed. This collaboration ensures that the model is grounded in practical insights. Additionally, historical observations in water-stressed areas can be used to project monetary ramifications across varied scenario temperature trajectories, for an array of time horizons. This detailed assessment helps organizations understand the financial stakes tied to climate risks.

By embedding this comprehensive model into their risk management practices and strategy, the company is equipped with a nuanced understanding of financial stakes tied to climate risks, making a significant step toward in-depth climate risk management and compliance with CSRD in the coming years.

This case exemplifies the proactive initiatives that businesses must embrace. It's not just about responding to imminent reporting requirements; it's about embedding these quantified risks, ensuring every strategic decision is made with a balanced understanding of environmental factors and financial consequences.

Closing Thoughts: By Starting Today, You Secure Tomorrow

With climate change-related risks intensifying, and CSRD's lens turning towards quantification with the most recent Omnibus updates, companies that start now to systematically quantify their climate risks are setting their course towards lower uncertainty and more refined stakeholder insights in their future reports. Climate risk assessment is a journey of maturity, with each step enhancing understanding and refining decision-making.

Let's start to address your climate concerns and embed them into your decision-making, while aligning with regulatory requirements.

- Source: https://www.theguardian.com/environment/2025/apr/02/us-banks-climate-goals-fail-air-conditioning

- Physical risks resulting from climate change can be event-driven (acute) or longer-term shifts (chronic) in climate patterns. Transition risks result from mitigation and adaptation requirements related to climate change, by transitioning to a lower-carbon economy (TCFD Final Report, 2017).