The heat is on! The ECB pushes for greater climate risk management

On 3 February 2023, in his opening address to the European Central Bank (ECB) Industry Outreach event on climate-related and environmental risk, Frank Elderson, Vice-Chair of the Supervisory Board of the ECB outlined the way in which he sees the ECB’s recent supervisory exercises around climate and environmental (C&E) risks in 2022 as the stepping stone to what he called “an immersive supervisory approach”.

Indeed, speaking about the activities of the ECB over the last three years, he outlined quite a book of work; activities included the publication of the Guide on climate-related and environmental risks in late 2020, the 2021 bank self-assessments, followed last year by the climate risk stress test and the thematic review on C&E risks, in addition to the performance of an in-depth gap analysis on C&E risk disclosures, a first set of on-site inspection on C&E risk at selected banks in the euro area and integration of C&E risks in on-site inspections (OSIs) on commercial real estate.

One could be forgiven for thinking that the pressure on banks to up their game may be released sometime in 2023. Instead, Elderson reiterated the ECB’s ongoing commitment to integrating C&E risks in all parts of the supervisory dialogue and interaction – “an approach that is mainstream for material risks”. This was reiterated in his speech on 27 March 2023, underscoring that the C&E topic is “urgent and vitally important”.

The previous years were part of a fact finding and learning exercise. The ECB has now gathered all the necessary granular information on the implementation progress and gaps with its expectations of banks it supervises. This allows the development of detailed action plans and the specification of bank-specific supervisory actions for 2023-2024.

The ECB immersive supervisory approach for C&E is expanding, with scrutiny on banks‘ progress, with expectations only to intensify

As highlighted in our article about the ECB’s priorities for 2023-2025, Elderson’s speech echoes the formal intention of the ECB to ensure that banks continue to incorporate C&E risks within their business strategy and their governance and risk management frameworks. Expectations for banks to be fully compliant with supervisory expectations by the end of 2024, are already manifesting in some elements of the 2022 SREP results. Moreover, while there were no direct additional capital requirements applied for C&E last year, this is expected to change in the future.

KPMG professionals already observed this year that this immersive supervisory approach is expanding. For example, the pilot phase of C&E OSIs at a selection of SSM banks that is now coming to an end, is planned to be rolled out more extensively across Europe. Some banks have already been contacted.

What can banks expect from OSIs on C&E to be conducted by JSTs in 2023?

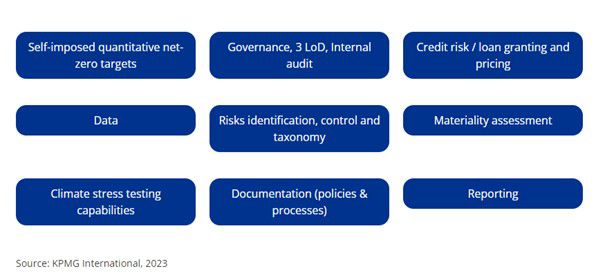

In line with the above, what has been the main ECB focus until now and what should banks expect throughout the course of 2023? It is clear that banks can expect a variety of areas to be assessed as part of the planned OSIs this year, to ensure that C&E is being appropriately integrated into their business-as-usual processes.

What does this mean in practice?

One key area of focus of scrutiny by the ECB is net-zero targets. Banks are expected to demonstrate relevant actions and compliance with targets or statements that have been made in terms of their long-term strategy, especially when targets were communicated publicly.

The ECB also clearly stated that it expects (by end of March 2023) that all banks have a sound and comprehensive materiality assessment and business environment scan in place, and insufficient documentation of the non-materiality of certain portfolios will no longer be acceptable.

Moreover, banks should expect a deep dive around the integration of C&E into the credit risk life cycle, especially around the credit granting process. In particular, inspection teams are investigating how physical risks and transition risks have been integrated into the process, especially when onboarding smaller clients.

Adequate incorporation of C&E risks into the valuation of collateral has already been a strong area of focus of the ECB, as observed last year with the CRE OSIs. Assessing the implications of physical risks on collateral values will remain a priority, such as the impacts of severe weather events and/or the long-term effects of C&E risks such as rising sea levels or flooding.

The robustness of the second line of defense is also expected to remain under the microscope, especially when considering resources and how the policies and procedures integrate climate risk.

What should banks do to prepare?

As noted, C&E risks are now an integral part of supervisory activities, and the ECB is increasingly embedding its assessments into a broad range of ECB activities. For example, banks should bear in mind that they may be subject to a dedicated C&E on-site this year, or a more traditional on-site that has an element of C&E risks embedded into it. Banks should also expect remediation activities regarding closing gaps in their C&E risk framework as part of the SREP process to be central to any assessment.

With this in mind, there are a few actions that we can suggest to help banks getting prepared:

Revisit and reassess the latest communication from the JST to ensure that plans and roadmaps are on track to become compliant with the C&E expectations of 2024.

Review publicly made statements regarding net-zero targets against progress, and ensure that the bank prepares internal progress reports for decision takers, that reconcile with the targets.

Ensure sufficient granular and relevant data sources and collection methods, while avoiding overreliance on proxies, which is necessary to accurately measure, report and disclose C&E risks indicators.

Review policies and procedures especially around the credit granting and impairment process to ensure that the potential impact of both physical and transition risks has been adequately included into loan portfolios, investments and operations.

Ensure robust climate risk models and methodologies, including the development of scorecards incorporating critical data elements relating to climate risks into risk models.

Integrate C&E risks into the Internal Capital Adequacy Assessment Process (ICAAP) as well as stress testing models, methodologies and frameworks.

The ECB’s intense and diverse methods of supervisory scrutiny of C&E in the last three years can feel somewhat of a pressure cooker for banks. All in all, as we move into springtime and European temperatures begin to rise once more, it is important for banks to keep a cool head and focus on their journey towards the deadline of end of 2024 for full compliance.

Discover more

Contact us

Erik Rood

Partner, Financial Risk Management

KPMG in the Netherlands

We will keep you informed by email.

Enter your preferences here.