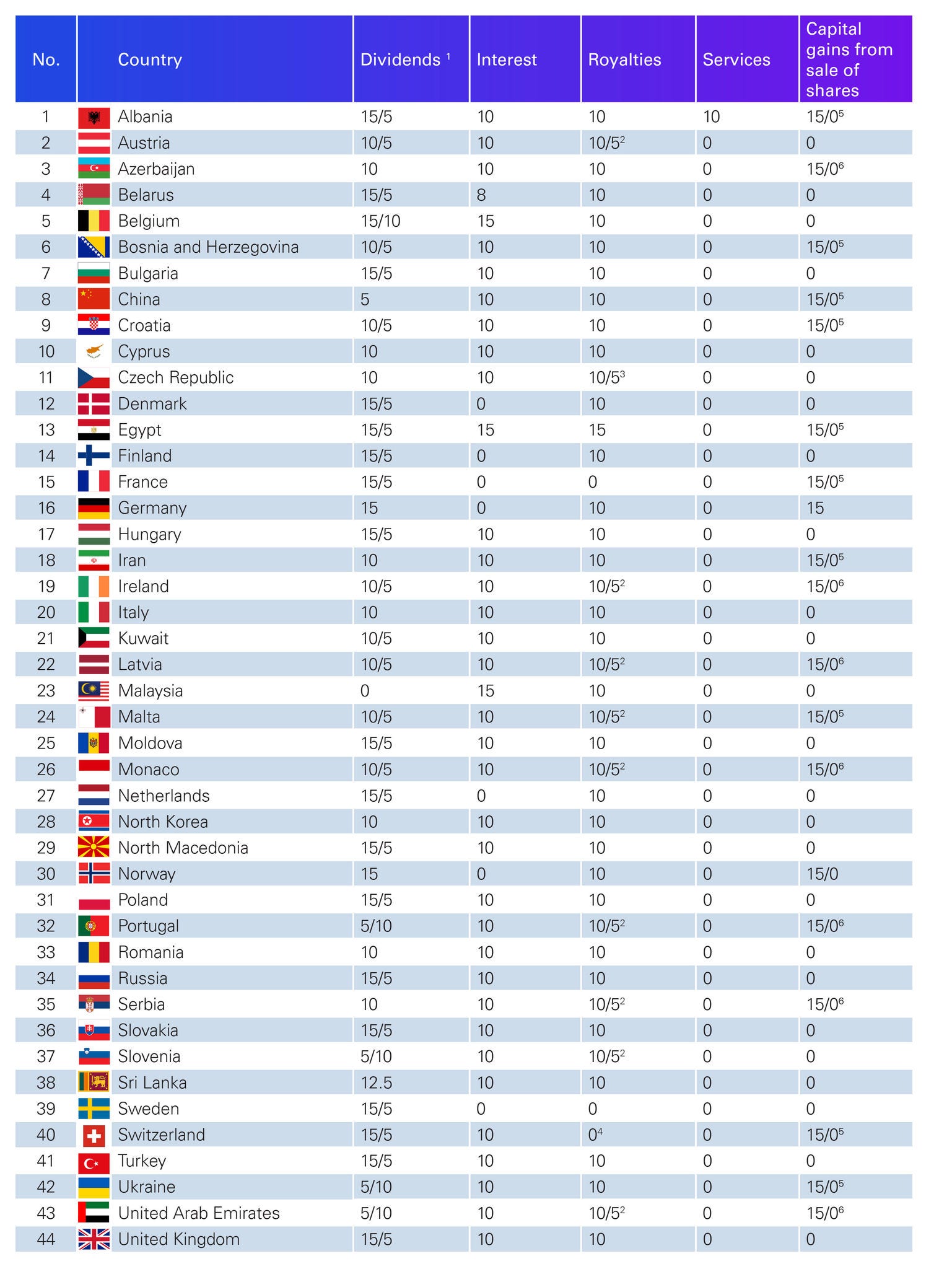

1 If the recipient company holds at least 25% (20% in DTT with Switzerland,10% in DTT with Ireland and Monaco and 5% in DTT with UAE, Austria and Portugal) of the paying company, the lower of the two rates shown applies.

2 For the use of, or the right to use, any copyrights of literary, artistic or scientific work, including cinematography films, films and tapes for television and radio, the tax shall not exceed 5% of the gross amount of the royalties.

For the use of, or the right to use, any patent, trade mark, design or model, plan, secret formula or process, or for the use of, or the right to use, industrial, commercial or scientific equipment or for information concerning industrial, commercial or scientific experience, the tax shall not exceed 10% of the gross amount of the royalties.

3 For the use of, or the right to use, any copyright of literary, artistic or scientific work except for computer software and including cinematography films or films or tapes used for radio or television broadcasting, the tax shall not exceed 5% of the gross amount of the royalties.

For the use of, or the right to use, any patent, trade mark, design or model, plan, secret formula or process and computer software, or for the use of, or the right to use, industrial, commercial or scientific equipment, or for information concerning industrial, commercial or scientific experience, the tax shall not exceed 10% of the gross amount of the royalties.

4 Provided by the Protocol to the treaty between Montenegro and Switzerland. Valid until Switzerland imposes withholding tax on royalties.

5 Gains from the alienation of shares of the capital stock of a company whose assets consists directly or indirectly principally of immovable property located in Montenegro may be taxed in Montenegro by 15% rate.

6 Gains derived by a resident of other Contracting State from the alienation of shares or comparable interests deriving more than 50 per cent of their value directly or indirectly from immovable property located in Montenegro may be taxed in Montenegro by 15% rate.