Transitions and acquisitions

Unsurprisingly, a number of Irish companies are looking to move up the value chain. General contractors such as Sisk and Collen began this pivot over a decade ago as they deepened their exposure to high-tech and mission-critical projects.

Specialists like Ardmac and H&MV have followed suit, while Cunningham Contracts has successfully expanded from residential and civils work into recurring life science and data centre accounts.

In the UK, JSM Group has moved from telecoms and utilities civils into high-voltage connections, substations and DC utilities, a trend mirrored by general contractors such as Skanska and McLaren as they target higher-complexity work.

Mercury and Winthrop represent further strong examples of Irish engineering contractors that have built dominant market positions in mission-critical delivery across Europe and beyond, each now exceeding €1bn in annual turnover. Beyond Europe, ambitious players such as Sisk, Mercury, CEL, and LPI are making the move into US mission critical.

Expansion is often driven by acquisition or partnership with mission-critical specialists, enabling companies to shorten learning curves, enhance margins, and compete for long-term, programme-based work rather than one-off developments.

Key patterns here would include:

- Targeted acquisitions of M&E, commissioning, and offsite manufacturing firms (e.g. Suir Engineering’s acquisition of Taylor & Fraser).

- Strategic recruitment of specialist project teams, often with data centre or pharma experience, to build credibility with global clients.

- Pivot projects, where residential firms win initial mission critical retrofitting or maintenance contracts before gradually expanding in-house capability.

- Investment in digital tools such as BIM, digital twins, and modular fabrication.

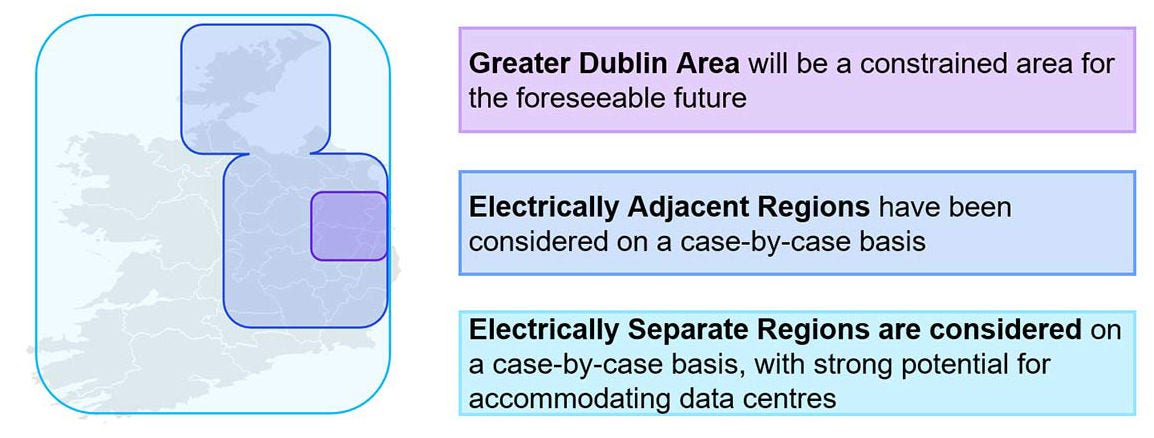

- Expansion into energy and utilities as mission-critical work becomes increasingly intertwined with power availability, grid upgrades and sustainable energy integration.