Investor facing / aggregation vehicles

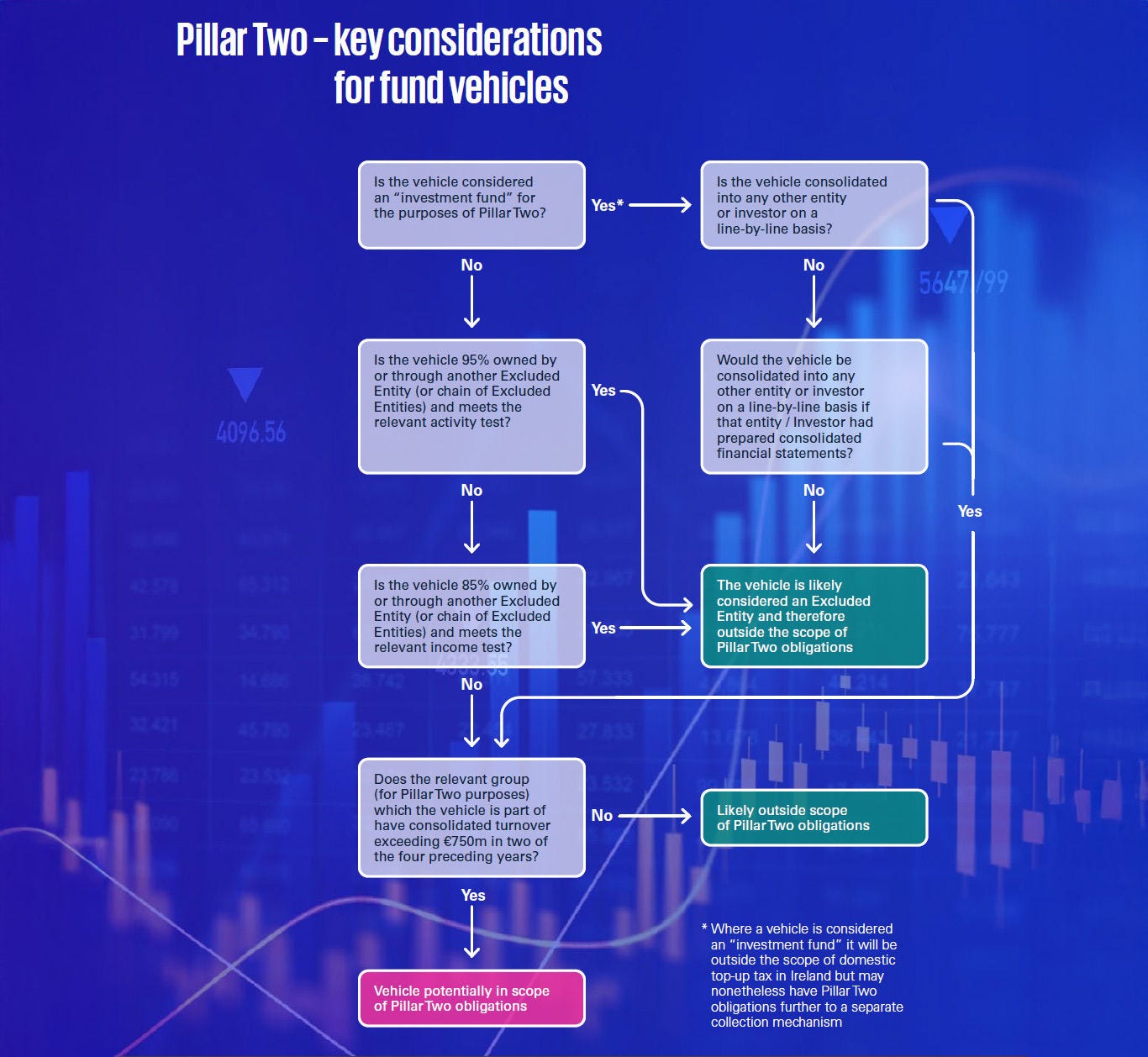

A vehicle which is considered an investment fund for the purposes of Pillar Two will be outside the scope of the Irish rules in respect of one of the collection mechanisms (specifically, the domestic top-up tax mechanism) – the definition of an investment fund for the purposes of the rules is included further below.

However, in order to be considered an Excluded Entity and outside the scope of the alternative collection mechanism (specifically, the income inclusion rule) further to (a) above, the fund vehicle cannot be consolidated on a line-by-line basis into any other entity. In assessing this, there is also a deemed consolidation test (i.e. it is necessary to consider if line-by-line consolidation would be necessary if the investor in the vehicle prepared consolidated financial statements).

Although many funds are widely held or there are multiple investors such that they would never need to be consolidated, there are circumstances whereby a fund may need to be consolidated into an investor (e.g. where there is a significant investor or if the manager is seeding the fund for any reasonable amount of time).

Where it is possible to conclude that the vehicle is the ultimate parent entity, it is then necessary to ascertain if it falls into the relevant definition of an investment fund, which requires the fund to have all of the following characteristics:

- it is designed to pool assets (which may be financial and non-financial) from a number of investors (some of which are not connected);

- it invests in accordance with a defined investment policy;

- it allows investors to reduce transaction, research, and analytical costs, or to spread risk collectively;

- it has a main purpose of generating investment income or gains, or protection against a particular or general event or outcome;

- investors have a right to return from the assets of the fund or income earned on those assets, based on the contributions made by those investors;

- the entity or its management is subject to a regulatory regime in the jurisdiction in which it is established or managed (including appropriate anti-money laundering and investor protection regulation); and

- it is managed by investment fund management professionals on behalf of the investors.

Many investment funds should meet the above criteria however, there are circumstances where the criteria may not be clearly met. For example, a fund-of-one which is designed as such may not be able to satisfy the criteria in relation to the pooling of assets from a number of investors.