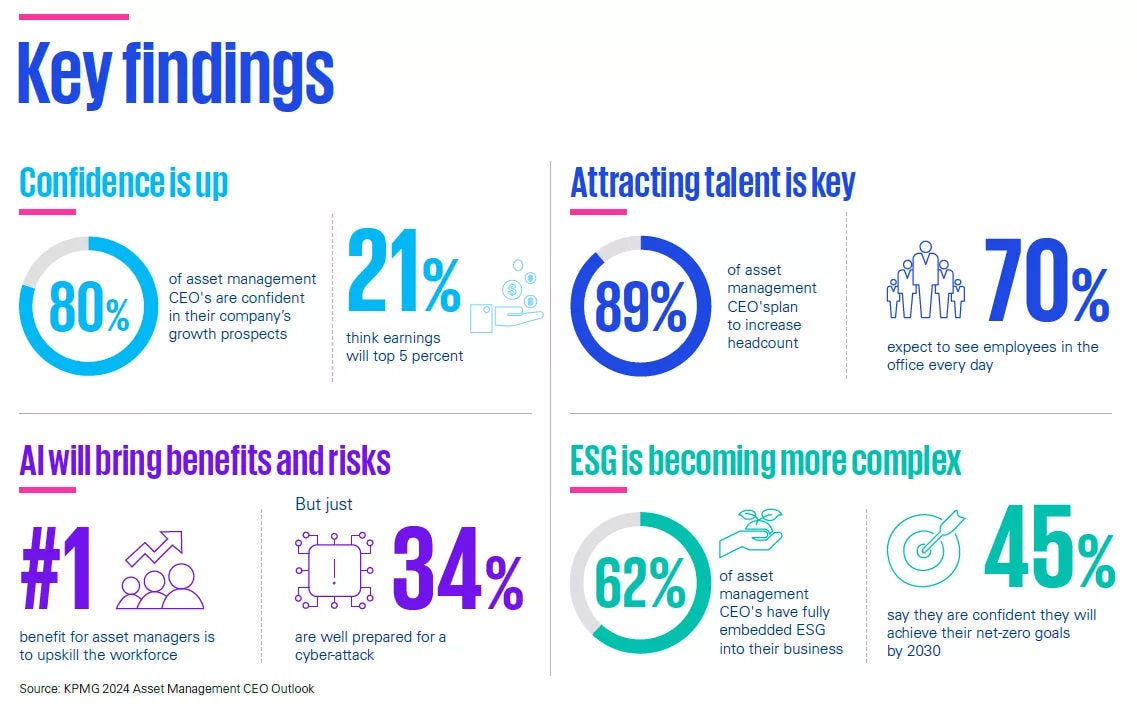

The KPMG 2024 Asset Management CEO Outlook provides a comprehensive analysis of the current state and future prospects of the global asset management sector.

Conducted by KPMG Global, this thought leadership piece offers valuable insights that are particularly relevant to the Irish market, highlighting the key trends, challenges, and opportunities that asset management CEOs are focusing on.