The Alternative Investment industry has been continually evolving over the past number of years; however one factor has remained constant – year-on-year increased investor allocations to alternative funds.

Whilst alternative funds would traditionally have attracted much of their capital from institutional investors, there has been a greater level of recent interest from retail investors who are seeking to add further diversification to their portfolio. This will continue to drive growth in the coming years.

The nature of assets held by alternative funds continues to evolve beyond private credit, real estate and infrastructure into new asset classes such as royalties, aviation and digital assets.

In addition, broader macroeconomic factors such as rising interest rates, changes in the international tax landscape and the continued focus from investors on ESG are shaping future trends.

Change has, and will continue to, increase complexity across the full spectrum of the fund life cycle as the sector evolves.

How KPMG can help

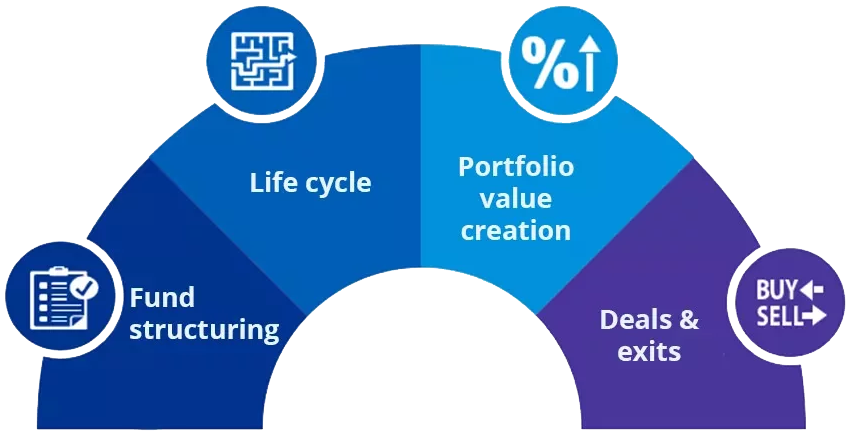

Our multidisciplinary team of experts across audit, tax, consulting and deal advisory are able to advise you across the full life cycle and value chain, irrespective of whether you are an asset manager, service provider or investor.

Our team have deep subject matter expertise in both asset management and across the various investment areas such as credit, infrastructure and renewable energy – we understand the complexities at all levels and have the experience to guide you through them.

Our Alternative Investment services

- Tax structuring

- Strategy

- Accounting Advisory

- Target Operating Model

- Regulatory advice

- Tax compliance

- Audit

- Internal controls testing

- Cyber

- Transfer pricing

- IT strategy

- Integration

- Operations & working capital

- ESG

- Strategy

- Buy & sell side DD

- Corporate finance

- IPO assist

- Valuations

- Tax structuring

- Fundraising

Get in touch

Considering investing in alternatives? Contact our Alternative Investments team below. We look forward to hearing from you.