Newsletter – March 2025

2025 has not started uneventfully in terms of the regulation of interest rate risk of banking book (IRRBB). The EBA has issued the first report (EBA/REP/2025/04)[1] outlined in the 2024 IRRBB heatmap (EBA/REP/2024/02)[2], which primarily explores and makes recommendations on the practices of modeling non-maturity deposits. Additionally, there have been forward-looking steps taken in the areas of supplementary NII measures and hedging strategies. This is an important milestone in the supervision of interest rate risk, as EBA, after reviewing the sector's notably diverse practices, aims to establish minimum expectations. Although these are currently only at the communication level, banks should already consider these aspects when reviewing their models.

The January 2025 newsletter on update of the MNB ICAAP/ILAAP/BMA manual, and the April 2024 newsletter on the new Basel interest rate shocks and the IRRBB heatmap are closely related to these new developments, which we recommend to those who are interested in the topic.

Behavioral assumptions of non-maturity deposits

EBA’s impact studies have identified significant modeling and pricing differences in the practices of various institutions regarding non-maturing deposits (NMD). To establish uniform best practices, the EBA has identified a list of risk factors that influence the behavior of NMDs and has recommended practical tools for supervisors to effectively monitor NMD models:

- Comparing NMD assumptions (repricing buckets, stable balances, sensitivity to market interest rates, movements between related deposit products) across institutions.

- Conducting reverse stress tests to identify NMD assumptions that would lead to breaches of IRRBB limits.

- Analyzing expert judgments and historical data.

- Applying the basic supervisory assumptions listed by the EBA in the evaluation of banking models.

Additions to the NII measures

Both supervisory and good banking practices indicate that, in order to effectively identify and measure risks, supplementary analyses are necessary alongside traditional NII risk measures. The EBA has listed the following:

- Market value changes of fair value instruments: It is crucial to examine how market interest rate movements affect the revaluation of fair-valued items in accounting and how this impacts earnings and regulatory capital. It is important to note that accounting treatment differences, such as whether revaluation is not reported, appears in OCI, or in PnL, can have different effects on capital adequacy compared to economic impacts. Therefore, appropriate measurement and stress testing frameworks need to be established. It is worth mentioning that the consultative version of the RTS on SOT (EBA/CP/2021/36)[3] included the possibility of considering fair valuation effects, but this was not included in the final version.

- Administrative expenses, general costs, and net fee income: These elements can serve as a buffer to offset changes in NII, especially if they are sensitive to interest rate changes.

- Embedded losses/gains due to observed changes in the interest rates and in the market conditions: Some banks have experienced that due to unstable or concentrated funding, they could not achieve as much relative benefit on the funding side as they lost on the revaluation of assets. Conversely, other institutions with significant stable deposit observed that they only needed to reprice their funding with a delay and to a lesser extent than expected, resulting in an extra profit.

Commercial margin on non-maturity deposits

Based on EBA’s observations, a significant number of institutions do not apply scenario-dependent commercial margins to their NMD (Non-Maturing Deposit) portfolios in their NII (Net Interest Income) calculations. The EBA highlighted the following considerations that should be considered when modeling margins:

- Considering current margins and their potential contraction depending on the scenario.

- Distance from a zero or negative interest rate environment, as it is often justified by legal or reputational reasons to assume that deposit rates cannot be negative.

- Delay in repricing, as it is reasonable to assume that deposit rates follow market interest rate changes with a delay of a few weeks, months, or even longer, and only through several steps.

Hedging strategies

According to EBA’s analyses, institutions largely use interest rate swaps to reduce exposures remaining after natural hedges. However, practices can vary significantly depending on the size and complexity of the institutions and positions. For example, micro hedges are typically applied in the case of bonds, while macro hedging strategies are common for loans and deposits.

In this context, EBA has made two important recommendations:

- Interest rate derivative transactions should serve a hedging purpose rather than a speculative one. For instance, the goal of hedging non-maturity deposits should be prudent IRRBB management, not yield optimization.

- The behavioral models of funding should consider the specific characteristics of the funding itself, and the repricing nature of assets on the other side of the balance sheet should not influence the model.

In the medium-to-long term, the EBA will contribute to the IASB (International Accounting Standards Board) DRM (Dynamic Risk Management) project, as it will have a relevant impact on the banking sector. The goal of DRM is to develop a new accounting model based on macro hedging principles, which analyzes the effectiveness of an institution's dynamic interest rate risk management, reducing operational burdens compared to the expectations under IAS 39. The project is expected to publish a draft in the second quarter of 2025. This project has reached this phase after a long time, as a consultation paper on this topic was published back in 2014.

Next steps

EBA will continue its work related to IRRBB, focusing on the following:

- Collaborating with the Basel Committee to process the experiences of the 2023 banking crisis and working with the IASB on the DRM project.

- Implementing the recalibrated shocks by the BCBS in Europe. It is noted that the MNB already expects their application in P2G, as mentioned in the January 2025 newsletter.

- Further mapping industry practices and making recommendations regarding NMD assumptions, hedging strategies, and commercial margins for other products.

Evolution of Eurozone Deposit Time Series

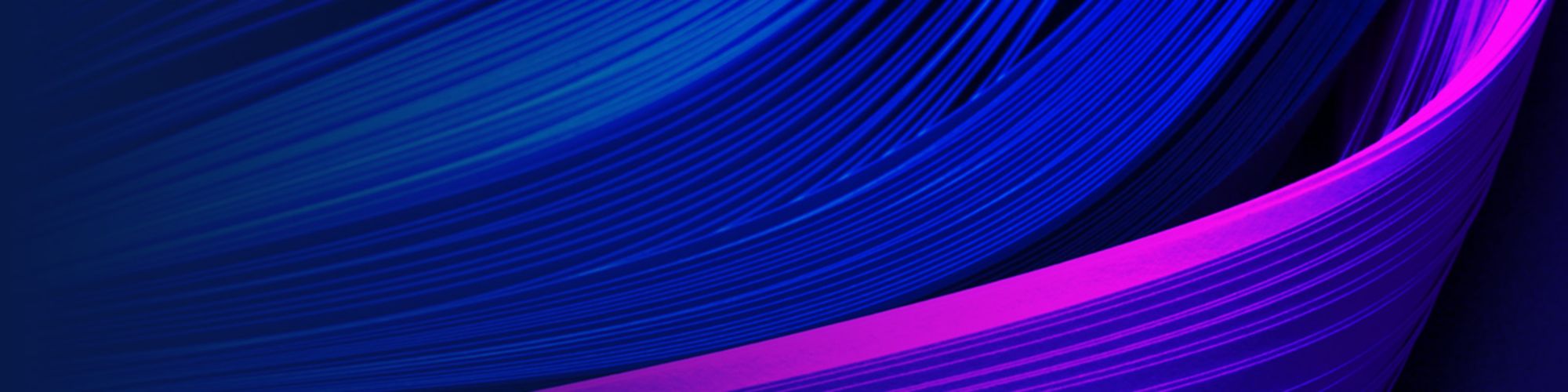

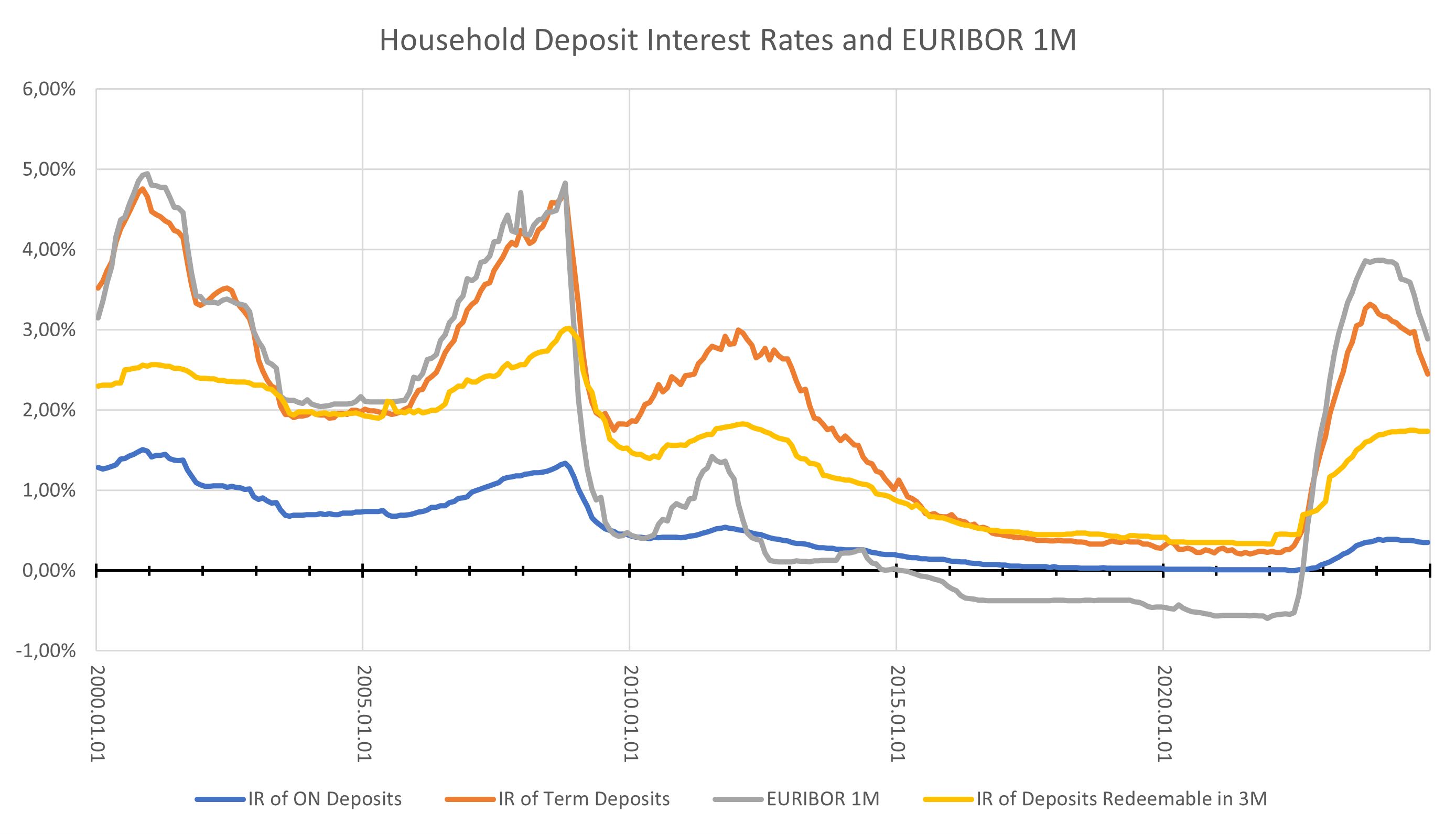

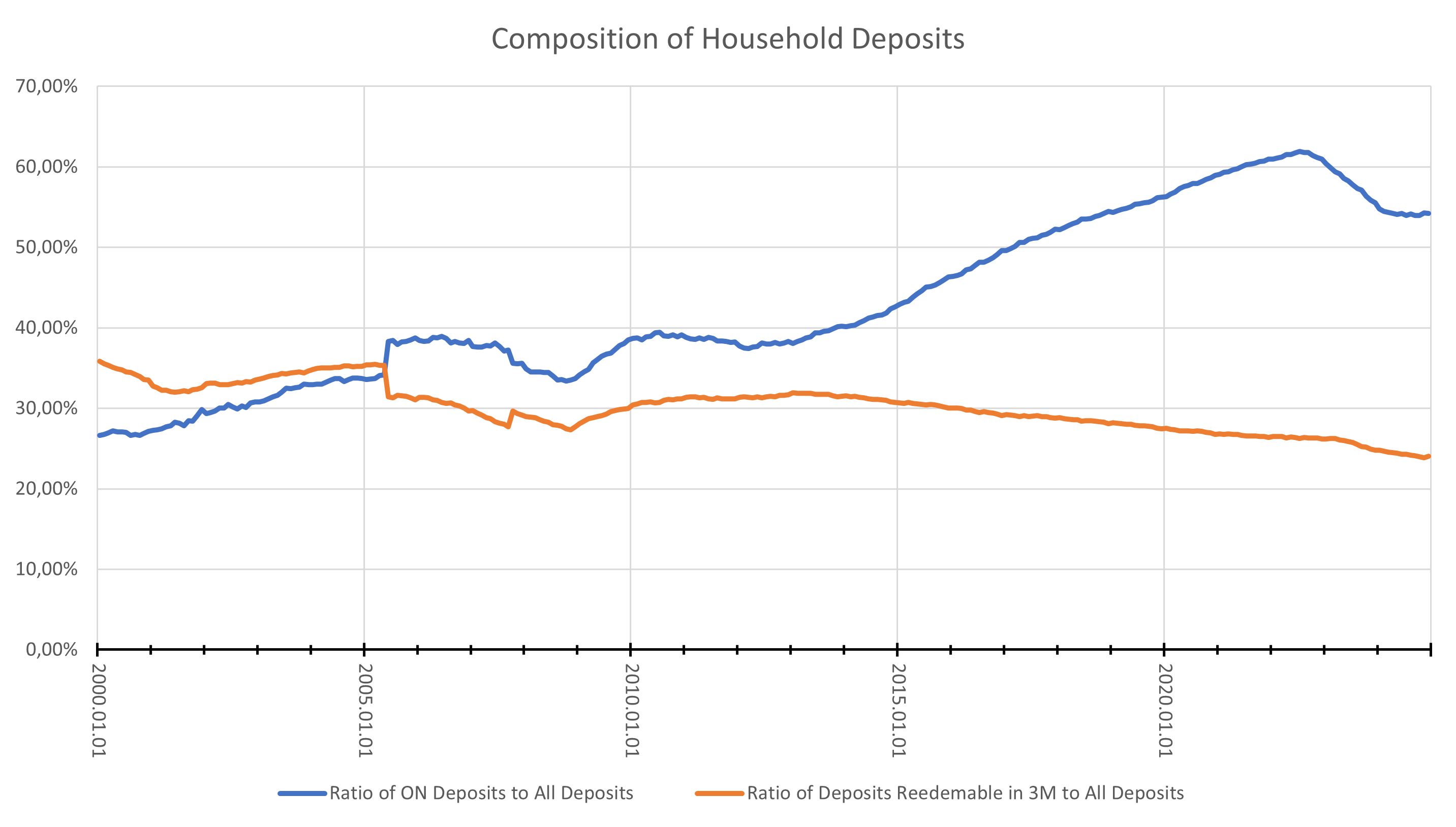

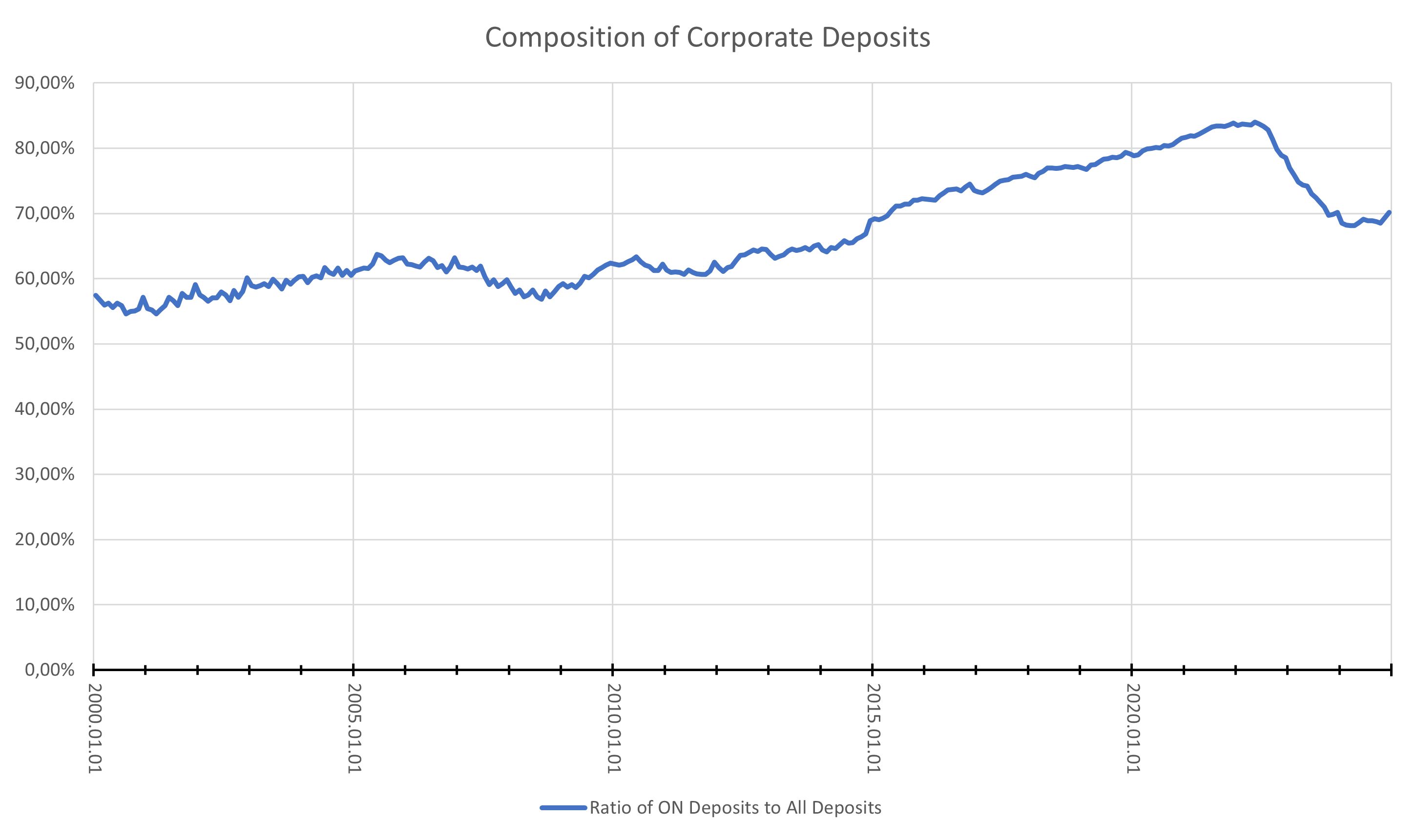

As a supplementary analysis, we examined the evolution of interest rates on deposits in the Eurozone over recent periods, during which the effects of various interest rate environments were evident. Both retail and corporate time series (Figure 1, Figure 2, Figure 3, and Figure 4) show that the interest rates on overnight and agreed maturity deposits, as well as the ratio of overnight to total deposits, often react to market interest rate changes with a delay. This adjustment can take months, or even 1-2 years. Regarding the volume of redeemable deposits at notice up to 3 months, it is noted that significant volumes are only present in France, the Netherlands, Germany, Italy, and Belgium, while in other countries they are negligible. The data source is the ECB Data Portal[4].

Effective estimation of future impacts must be based on a thorough understanding of processes, reasonable assumptions, appropriate modeling techniques, and, if necessary, well-justified expert opinions. When applying models based on daily frequency time series, it is also necessary to manage seasonal effects, for which our October 2024 newsletter provides an example. It is advisable to link deposit models with liquidity risk management, the FTP framework, and business planning to leverage synergies.

Figure 1: Household Deposit Interest Rates and EURIBOR 1M

Figure 2: Composition of Household Deposits

Figure 3: Corporate Deposit Interest Rates and EURIBOR 1M

Figure 4: Composition of Corporate Deposits

[1] The EBA publishes its heatmap following scrutiny of the interest rate risk in the banking book | European Banking Authority

[2] EBA reflects on the short/medium term objectives of its interest rate risk in the banking book Heatmap | European Banking Authority

[3] Regulatory Technical Standards on IRRBB supervisory outlier tests | European Banking Authority

[4] https://data.ecb.europa.eu/main-figures