In particular, we note this development when looking at announced, aggregate deal value – the average value for the first two quarters of this year stands at more than EUR43bn. In comparison, the average value per quarter for 2023 and 2022 stood at EUR36bn and EUR45bn, respectively. It seems that as has been the situation, especially over the past year, with a market struggling with inflation and higher interest rates, the outlook for deal-making in our part of the world remains a more positive one – there is a newfound sense of realism between buyers and sellers, and strategic discipline and financial scrutiny are now playing a greater role in driving deal activity.

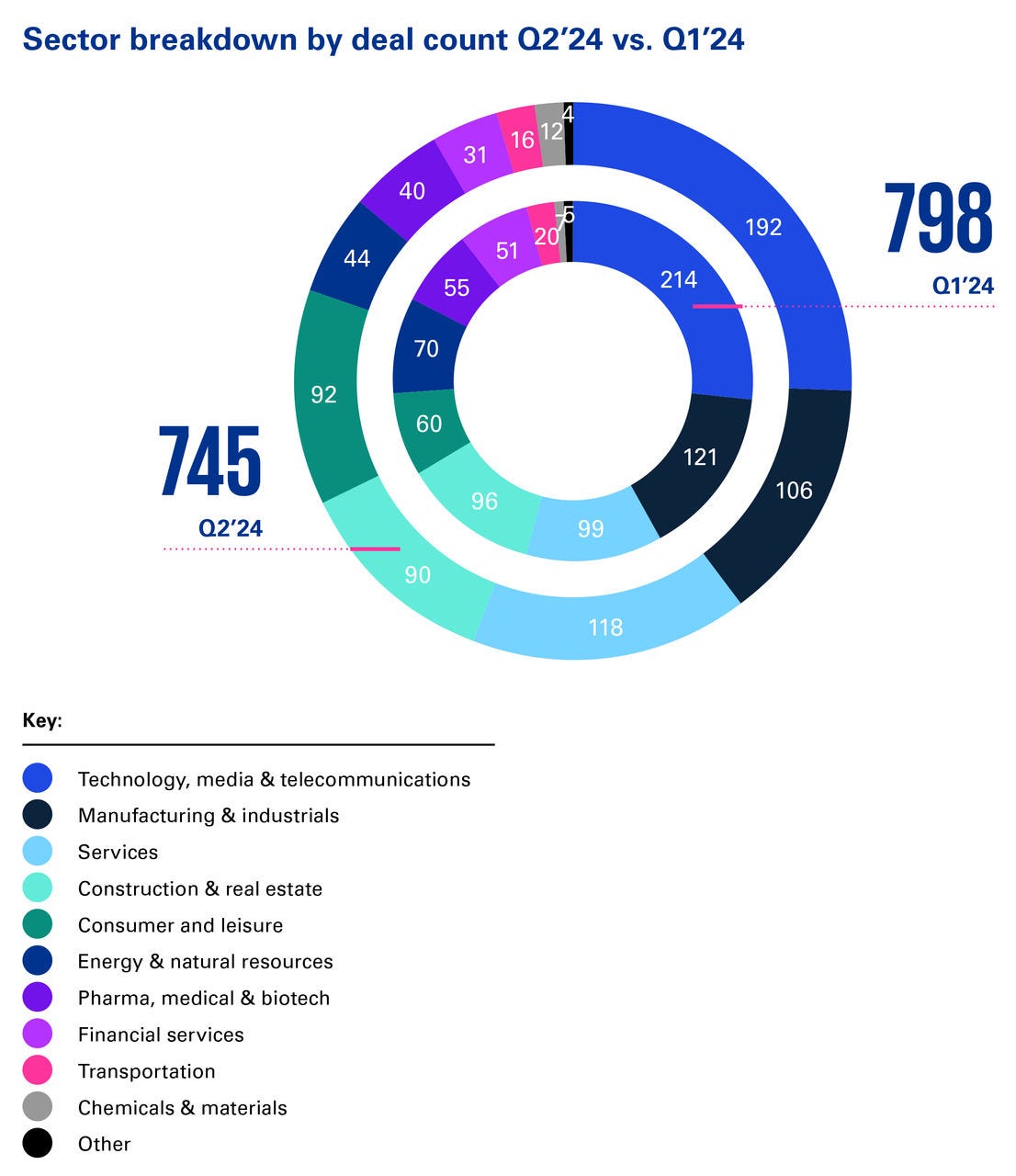

When looking at the distribution of announced deals by industry segment, we are looking at the usual suspects. The tech sector retains its leading position in our part of the world, making up more than 25% of announced deals. Other top-5 segments are services with 16%, manufacturing which stands at 14% and construction and real estate and consumer markets, which both total 12%. Again, we see that the composition of the top-5 segments make up more than three-quarters of announced deals in the second quarter of the year.

While M&A activity has declined from its peak in 2021 – in particular in a value sense, the market in the Nordic region is still strong by historical standards when considering number of deals taking place. Moreover, we expect the evolving business environment – marked by more comprehensive due diligence, tighter financial discipline, and a greater focus on long-term strategic value – to encourage sustained growth and create a healthier market with more profitable outcomes for both companies and investors.

Wishing you a great summer, and we look forward to seeing what the rest of 2024 brings from an M&A perspective.