Welcome to the third edition of the year of KPMG’s Nordic Deal Trend Report covering M&A activity across the region in Q3 2022. Looking into the coming winter, considering what has happened on the European continent this year so far, it is no surprise that we feel gloomy about developments in society at large. Russia’s war on Ukraine tolls on, inflation and interest rates soar, energy prices skyrocket and we will, most likely, not be able to cover our energy consumption throughout the cold winter months ahead of us.

All that being said, while at the same time looking into announced M&A deals in the Nordics, it is remarkable that we seem to be looking into a much more positive story. Agreed, number of announced deals in the third quarter compared to that of last year seem somewhat weaker – in Q3 2022, 392 have until now been announced, compared to 666 a year ago. Remember, though, that there is a delay in announcements – meaning that the Q3 figure will increase in the period to follow end of the quarter.

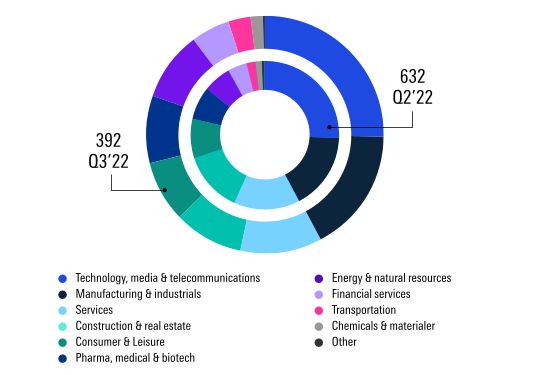

Sector breakdown by deal count Q3’22 vs. Q2’22

What we do note, however, is that comparing first half of this year to that of 2021, the number of announced deals is more or less on par – and remember that all of 2021 was an unusually buoyant year in M&A terms. First half of last year, we saw 1,364 deals. First half of this year, 1,300 have, until now, been announced – still very much above pre-pandemic levels and not as gloomy as one could have expected. Adding to that, total announced deal value first half of this year adds up to EUR86bn across the region, compared to EUR93bn first half of 2021.

Looking into the sector composition of deals, notably, nothing much has shifted there. Tech transactions still make up about 25% of total announced deals, followed by manufacturing, services, real estate and consumer goods. In total, the five largest sectors make up three quarters of all deals – business as usual there. Should we make one small note, it could be that deals in the energy space have ramped up their share of total to about 10%. Expectedly, with how things are developing in society around us and there is an increased focus on being energy self-sufficient, this share of total could increase even further in the next 6–12 months.

On an overall note, following the unusually high deal volumes of last year, we have until now not seen the downward spiral in Nordic M&A that many feared. We still seem to be resilient to a certain extent to what goes on around us in the world and, in particular, on our continent and signs in the market show us that there is still a fair amount of deals in the pipeline going into the fourth and final quarter of the year.

Look forward to seeing what the coming winter has in store for us from a deals perspective.

Contact us

Jan Hove Sørensen

Partner, Head of Corporate Finance

KPMG in Denmark

Stig Meulengracht

Partner, Transaction Services

KPMG in Denmark

Jakob Lumholtz

Manager

KPMG in Denmark

Dale Treloggen

Partner, Leder af Transaction Services

KPMG in Denmark

:cq5dam.web.512.341)