Services | Publications | Blog | Webcasts | Videos | Podcasts | Newsletter | Your contacts

The increasing use of cloud-based business solutions and the networking of data, objects and systems through complex IT infrastructures and business processes are opening up enormous opportunities for the financial sector. Information assets are increasingly becoming the basis for value creation and are a key component in achieving corporate goals.

At the same time, however, this technical change also harbors risks and offers cyber criminals new targets. As the potential for the financial sector grows, so do the opportunities for hackers: they are professionalizing their tactics by developing tools and an increasing number of potential attack vectors. This is why targeted attacks with phishing lead to higher success rates for attackers and greater losses for victims.

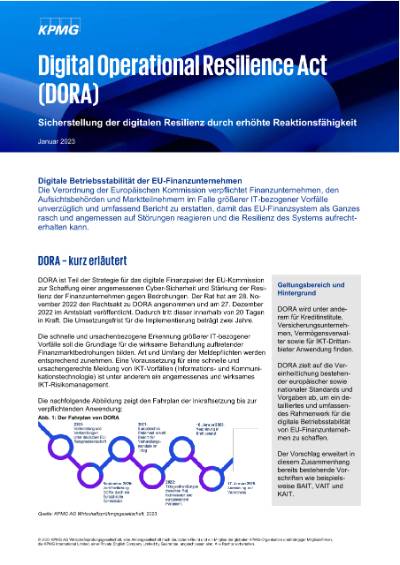

Financial players are also under additional pressure to act as a result of stricter laws, new regulations and stricter control of IT by supervisory authorities. New regulations such as the Digital Operational Resilience Act (DORA) bring further requirements, but also aim to standardize different requirements at EU and national level as well as between sectors.

We take s a holistic view of IT compliance and cyber security. Our expert teams support you along your digital transformations to make them secure and compliant

Our services for the financial sector

Publications

Blog Articles (in German only)

Weitere Blogbeiträge

- Contract Lifecycle Management: DORA-Vorgaben für Verträge effizient steuern

- Der Übergang vom reaktiven zum proaktiven Schwachstellenmanagement

- AI Act & DORA: Was jetzt für KI-Anwendungen und IDV-Systeme gilt

- Cybersecurity-Trends 2025: Die Herausforderungen für CISOs

- DORA-Umsetzung: Unterschätzte Bedeutung der Konfigurationsdatenbank CMDB

- Multimodale Modelle: Chancen und Risiken für die Finanzindustrie

- Die CNAPP: Ein Multitool zur Kontrolle der Cloud-Plattform

- DORA - auch nach dem Stichtag bleibt 2025 viel zu tun

- Globale IT-Aufälle: Ein aktueller Weckruf für Finanzunternehmen

- KI in den Händen von Endanwendern

- Wenn der Algorithmus angreift: KI als Herausforderung für die IT-Compliance

- Ausblick auf BaFin-Krisenübungen: Lehren aus dem Cyber-Stresstest der EZB

- Die Konfigurationsdatenbank als Grundlage der Cybersicherheit

- Cybersecurity: Mit Schwachstellenmanagement die Kernbankensysteme schützen

- Daten, DORA, Dry Run: Fragen und Antworten zum Cyber-Stresstest der EZB

- Angriffssicher? Der Cybersecurity Stresstest der EZB

- DORA: So gelingt die Umsrtzung

- DORA zwingt Finanzunternehmen zum gemeinsamen Blick auf Risiken

- DORA ist da: EU macht Tempo bei Cyber-Resilienz

- CISO, übernehmen Sie: Vertrauen als Wert in der digitalen Welt

Video

More security in the cloud

Christian Nern (Partner, Financial Services) in conversation with Michael Kleist (Area Vice President Sales, DACH Region, CyberArk)

What is the importance of cloud adoption for financial institutions? Watch our video on "What financial services companies should know about cloud security" here and learn more.

Webcast (in German only)

Webcast-Unterlagen

- Webcast – IT-Compliance Update: “Zwischen Green IT und Sustainable Finance“

- Webcast – IT-Compliance Update: „CMDB und Informationsverbund: Was die Kombination so effektiv macht“

- Webcast – IT-Compliance Update: „EZB-Stresstest zur Cyber-Resilienz: Wie die Vorbereitung gelingt“

- Webcast – IT-Compliance Update: „Cloud Security: Sicherheit, Resilienz und typische Tücken“

- Webcast – IT-Compliance Update: „Dora und die IKT-Drittdienstleister: Agenda 2025 - Umsetzung jetzt erfolgreich gestalten"

- Webcast – IT-Compliance Update: „Dora – So gelingt die Umsetzung“

- Webcast – IT-Compliance Update: „Neues Tool von KPMG: Berechtigungskonzepte digital verwalten“

- Webcast – IT-Compliance Update: „Dora: Auf Kurs mit Umsetzung nach Augenmaß“

- Webcast – IT-Compliance Update: "Threat Modeling: Ist Ihre IT-Infrastruktur wirklich sicher?"

- Webcast – IT-Compliance Breakfast: "IT-Compliance Update: Aktuelle Veröffentlichungen und Ausblick"

- Webcast – IT Compliance Breakfast - "Cyber Security eine Gefahr in Deutschland? Wie Finanzunternehmen widerstandsfähig bleiben"

- Webcast – IT Compliance Breakfast - "Digitale Identität: Mit IAM- & CIAM-Lösungen zum Wettbewerbsvorteil"

- Webcast – IT Compliance Breakfast - "Die BaFin kommt – jetzt auch zu IT-Dienstleistern. Was ist zu tun?"

- Webcast – IT Compliance Breakfast - "BAIT/VAIT-Neuerungen: Folgen für SIEM und Log Source Management“

- Webcast – IT Compliance Breakfast - "Herausforderung DORA - Die Cloud unter der Lupe“

- Webcast – IT Compliance Breakfast - "Cloud im Fokus der IT-Aufsicht“

- Webcast – IT Compliance Breakfast - "BAIT und VAIT reloaded: Lösungen für das Response Management“

- Webcast – IT Compliance Breakfast - "Quantifizierung als Schlüssel für zukünftige Informationssicherheit“

Hot Topics in the financial sector

- Accelerating the Journey to the Cloud

- Data as a production factor in the financial institution of the future

- Incorporating Sustainability in Finance

- Mapping out the Future of Finance

- Prioritizing on Customer Needs

- Setting a Course for the Future of Risk

- Starting a Revolution with Digital Assets

- Operational Excellence