Making direct links between ESG and shareholder value is still difficult. But it is possible to link specific environmental, social, and governance activities to proven levers of value, such as increasing profit margin or lowering cost of capital. By tracking ESG activities across the organization, companies can prioritize those that contribute to shareholder value.

Introduction

Many studies show a correlation between companies that do well on ESG metrics and companies that generate higher shareholder returns than their peers.1 But there is little evidence that links ESG performance directly to shareholder value. Are the companies that perform well on ESG metrics just better run? Do they also manage their cash better? Are they better innovators?

What we can measure today is how specific ESG initiatives, such as decarbonization programs, can create shareholder value and how some initiatives can avoid destroying value. In this paper we look at a how various environmental, social. And governance programs drive specific value levers, such as operating margin or cost of capital. With this knowledge CFOs and other corporate leaders can craft ESG strategies that clearly balance financial benefits and costs.

Quantifying the benefits of ESG

One reason it is hard to determine whether ESG can enhance shareholder value is that there are no niversally agreed methodologies or measurement standards (see "ESG measurement problems"). Measurements of ESG impact on shareholder value continue to evolve and researchers have looked at hundreds of possible links between ESG efforts and financial value.2 This includes studies of the correlation between ESG news and changes in stock prices. One study found that stocks moved more when the ESG-related news (positive or negative) was reported in five or more articles.3

Our strategy takes a bottom-up, enterprise-wide view of ESG efforts and links individual activities to impact on the main drivers of shareholder value. This provides a way to prioritize ESG efforts in ways that add value (or, in aggregate, limit the costs).

ESG measurement challenges

Financial data providers, such as Bloomberg, Refinitiv, S&P, and Sustainalytics, measure the ESG performance of companies, but these efforts reveal significant challenges:

- Poor transparency and data quality: The providers’ methodologies and assessment processes are not fully disclosed. Data may be self-reported by companies, obtained by third parties, or scraped from company websites.

- Inconsistent methodologies: Each firm producing ESG ratings uses a different formula and the weightings of the underlying attributes that comprise the component scores vary widely.

- Apples and oranges: ESG measurement covers many different types of data, from carbon footprint and employee experience to compliance. This makes it difficult to aggregate ESG in a rigorous, or even coherent, way.

- Policies, not practices: Much of the data collected centers on policies which are hard to measure. One organization measures ‘environmental supply chain’ policy in binary terms: companies have policies or they don’t. But this does not assess the effectiveness of the policy.

Due to these measurement problems, ESG ratings are only an indication of sustainability performance. The same company often receives different ESG scores from the various data providers and, in any case, the data are not forward looking. By contrast, bond ratings and analyst forecasts make predictions that will eventually be judged by financial outcomes. This report offers companies a practical way to drive improvements in shareholder value by integrating ESG goals into their operating models.

Focus where the returns are highest

Not surprisingly, the most direct way to enhance shareholder value today is to focus on environmental objectives. Social and governance initiatives can increase value, by enhancing reputation and reducing risk, for example (Exhibit 1).There is also compelling evidence that companies that undertake serious ESG efforts and enlist employees in these efforts can increase employee engagement, raise productivity, and reduce turnover. Research shows that employee engagement is higher in companies with strong ESG programs and, according to analysis by Gallup, companies with highly engaged business units and teams have 14 percent higher productivity and are 23 percent more profitable than peers.4

Exhibit 1. Environmental initiatives have the biggest financial impact

| Environmental | Social | Governance | |

|---|---|---|---|

| What are the issues? |

|

|

|

|

How to address these issues?

|

|

|

|

|

What is the impact?

|

|

|

|

| Where is the value? |

|

|

|

Source: KPMG analysis, survey data from "Does positive ESG news help a company’s stock price?," Kellogg Insight, 2021

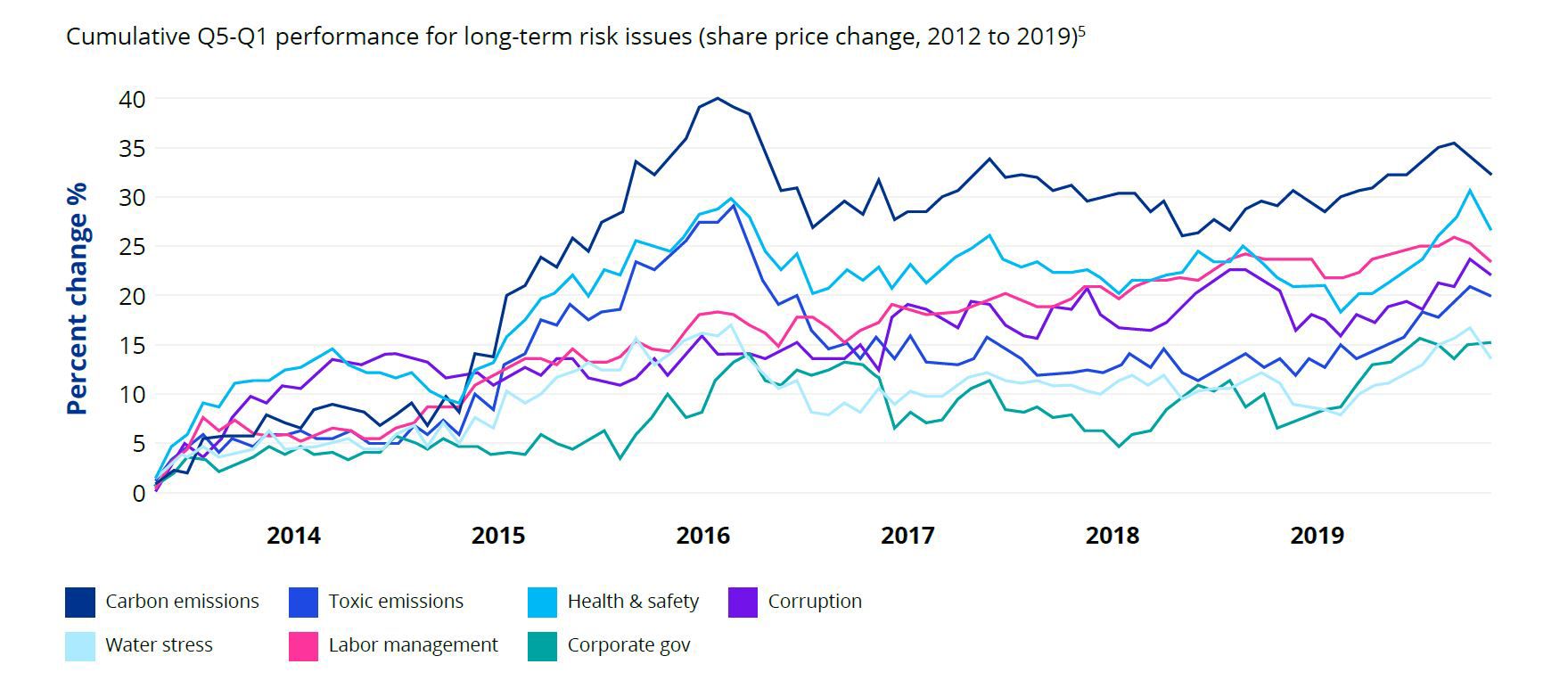

Still, the most direct link to financial value is through environmental efforts, particularly decarbonization and waste reduction (Exhibit 2). Investing in renewable energy requires upfront capital costs, but these can be offset through tax incentives and favorable financing terms. Decarbonization efforts can improve energy efficiency, which has a direct impact on operating costs and margins. Progress on decarbonization also can reduce the risk of negative reperrcussions on a company’s share price or penalties from regulators (in some jurisdictions).

Exhibit 2. Cutting carbon emissions yields biggest financial benefit

Source: MSCI 2020

Note: Data from 2012 to 2019 on all constituents of the MSCI All Country World Investable Market Index. This exhibit shows how the top-scoring quintile (Q5) minus the bottom-scoring quintile (Q1) performed for long-term risk issues, such as resource efficiency

Tying ESG to value levers

While it is difficult to make the case that ESG programs directly create shareholder value, we can show how specific ESG initiatives act on six major drivers of value, ranging from sales growth to cost of capital (Exhibit 3).

How does this work? A manufacturer, for example, might accelerate sales growth by developing sustainable products, which also can command higher prices and build greater customer loyalty.6 Waste reduction and energy efficiency can save operating costs. Addressing climate risk in supply chains and physical infrastructure can also help prevent losses, reduce insurance costs, and avoid negative hits to shareholder value due to write-offs.7

ESG investments can also reduce taxes and cost of capital. Investments in energy efficient buildings, electric vehicles and other assets that advance decarbonization efforts often qualify for tax incentives and credits, which can help raise net margins.8 Companies with strong ESG programs are seen as less risky and can earn higher credit ratings. And "green bonds" that are issued specifically for environmental projects typically have coupons 10 to 45 basis points below those of other corporate debt.9

Exhibit 3. How ESG activities affect drivers of value

| Positive ESG Benefits | Negative ESG Costs | |

|---|---|---|

| 1 Sales growth rate |

|

|

| 2 Operating margin |

|

|

| 3 Incremental investment rate |

|

|

| 4 Cash tax rate |

|

|

|

5 Cost of capital

|

|

|

| 6 Debt/write-offs |

|

|

Source: KPMG analysis

Here are some examples of how ESG activities can affect specific value levers:10

Improved operating margins and lower cost of capital

A large electricity supplier with $1 billion in sales evaluated a business case to exit early from coal-generated power and switch to wind and solar power. This business decision led to estimated total cost savings of $31 million over a 9-year period, consisting of:

87 percent related to a lower cost of capital for sustainability initiatives

12 percent related to increased productivity of existing employees

1 percent of the cost savings related to improved employee retention and lower turnover due to sustainability commitments

Reduced production costs

A global pharmaceutical company, at risk of losing revenue due to a patent expiration, developed a modified enzymatic process that reduced its environmental impact. This resulted in a financial benefit of more than $1.5 million per 100 metric tonnes a year in the following ways:

81 percent less water use

82 percent less energy use

75 percent reduction in greenhouse gas emissions

Increased sales

An apparel company invested in a new circular business model that focuses on returned clothing items and innovative design methods. These moves resulted in more than $2 million in net benefits in one year, due to the following:

- Incremental profit from the take-back program

- Greater customer loyalty and retention

- Lower cost of customer acquisition

- Increase in favorable media exposure

ESG benefits in beverages manufacturing

To quantify the impact of an ESG- focused strategy using a real- world example, KPMG analyzed the financial data of 40 U.S.-based beverage companies to create a financial model. A composite picture was developed of the impact on shareholder value of the 40 companies derived from a set of ESG initiatives.

In this example, not all the ESG- related measures enhanced value. Operating profit fell by one percent and the incremental fixed capital rate rose due to upfront investments in ESG programs, trimming shareholder value slightly. But these negative effects were outweighed by the positive impact of ESG initiatives on sales growth, the cash tax rate, and the cost of debt.11 This illustration shows why it is important to take an enterprise-wide approach to sustainability: some effects lowered value, but taken as a whole, they resulted in a net positive benefit.

Exhibit 4. Where beverage companies can realize value from ESG efforts

| Value Driver | Current | ESG potential | Value (pre-ESG) | Value (post-ESG) | Percent change w/o ESG impairment | Percent change w/ ESG impairment |

|---|---|---|---|---|---|---|

| Sales growth rate | 7.0% | 7.25% | 100.0 | 101.2 | 1.2% | 1.2% |

| Operating profit margin | 20.0% | 19.8% | 100.0 | 99.0 | -1.0% | -1.0% |

| Incremental fixed capital rate | 43.0% | 45.0% | 100.0 | 99.9 | -0.1% | -0.1% |

| Incremental working capital rate | 4.0% | 4.0% | 100.0 | 100.0 | 0.0% | 0.0% |

| Cash tax rate | 22.3% | 22.0% | 100.0 | 100.4 | 0.4% | 0.4% |

| Cost of debt | 3.0% | 2.85% | 100.0 | 100.8 | 0.8% | 0.8% |

| ESG Liability ($) (1) | — | -25 | 100.0 | 95.1 | 0.0% | -4.9% |

| Total w/o ESG impairment(2) | — | — | 100.0 | 101.3 | 1.3% | — |

| Total w/ ESG impairment(2) | — | — | 100.0 | 96.4 | — | -3.6% |

Note (1): ESG liability is a cost to the company for not engaging in ESG activities. Examples include paying a fine for pollution or settling a lawsuit for a human rights violation.

Note (2): If a company performs well in ESG and avoids an ESG liability (e.g. impairment), it can expect to drive positive shareholder value. However, an ESG impairment can destroy shareholder value.

Source: KPMG analysis of 40 beverage companies

Making it happen

With an understanding of how ESG initiatives and activities affect value, companies can integrate ESG goals into enterprise strategy in ways that maximize value. These include:

- Incenting top management by connecting rewards (monetary or otherwise) directly to ESG-related decisions that drive shareholder value. Such measurements might include higher customer satisfaction scores, higher employee retention rates, and faster improvements in productivity.

- Building a cross-functional team with a wide range of financial and operating experience. This will enable the company to focus on the different areas of the business where the benefits are likely to be biggest and most easily quantifiable. While the direction of the strategy will be decided at the top, inputs to this process should come bottom-up and from the bottom and across the company.

- If ESG objectives are integrated into business strategy, financial planning, and performance management,, the company can develop metrics around activities that maximize the strategic and financial benefits of ESG investments. These metrics would need to be established through strategic planning processes that receive executive management and board oversight.

- Embedding ESG goals into the operating model by designing products and processes that incorporate ESG objectives. Ultimately, the entire operating model can be designed with ESG goals in mind, not to the exclusion of other business objectives, but integrated with them.

- Ensuring ESG reporting is accorded the same level of priority as financial reporting. This will entail gathering the relevant data from a wide range of sources in the organization, and analyzing them systematically and rigorously. It also involves providing executives with a single dashboard that enables them to track both financial and non-financial indicators simultaneously in a format that improves decision making.

- Creating an ESG-aware culture with high employee engagement by making it everybody’s business to further the company’s ESG objectives. This can be done by making employees and other stakeholders aware of the environmental impact of their corporate activities and the rate of progress of the company and individual departments toward furthering ESG goals. Employees, vendors and even customers can be given incentives to help the company meet these objectives. For example, some of the savings from energy efficiency could be passed on to these stakeholders.

Exhibit 5. A roadmap for an ESG program that maximizes value

| The ESG Journey | |||

|---|---|---|---|

| Assess | Design | Operationalize | Measure & Report |

|

|

|

|

| Technology enablement, data sources, control infrastructure, policies and procedures, and governance framework | |||

| Program and change management | |||

| Value creation | |||

Source: KPMG Impact

How KPMG can help

KPMG meets clients where they are on their ESG journey and work with them from strategy to reporting. We have deep strategy and sustainability experience and can help prepare materiality and maturity assessments,

assess market positioning, and set ESG targets. We take a practical approach to our cost-benefit analysis to help prioritize ESG initiatives that enable our clients not only to meet their sustainability goals but also to create financial value and a positive return on investment.

Whether it’s setting a decarbonization strategy to meet net zero targets or implementing employee retention initiatives to reduce turnover, we have the capabilities to help operationalize ESG programs. We also advise our clients on ways to offset the cost of these investments through tax credits and incentives and favorable borrowing rates. Our approach also incorporates a risk management strategy to meet increasing pressures from stakeholders and a reporting strategy to enhance the ESG narrative. KPMG helps clients achieve ESG value creation and do the right thing for the planet and its people.

This report is part of the KPMG IMPACT series covering topics under Environment, Social, Governance, ESG Reporting, and Sustainable Finance. Our IMPACT content series demonstrates that embedding ESG across the enterprise will turn ESG aspirations into action by leveraging insights from data to create value for your organization. This paper focuses on the linkage between all five topics and value creation. For more on these, visit the KPMG IMPACT website.

------------------------------------------------------------------------------------------

- Source: Tensie Whelan, Ulrich Atz and Casey Clark, “ESG and Financial Performance: Uncovering the relationship by aggregating evidence from 1,000-plus studies published between 2015-2020,” Rockefeller Asset Management and NYU Stern Center for Sustainable Business, February 10, 2021

- Source: Tensie Whelan, Ulrich Atz and Casey Clark, “ESG and Financial Performance: Uncovering the relationship by aggregating evidence from 1,000-plus studies published between 2015-2020,” Rockefeller Asset Management and NYU Stern Center for Sustainable Business, February 10, 2021

- Source: George Serafeim and Aaron Yoon. “Does positive ESG news help a company’s stock price?” Kellogg Insight, August 2, 2021

- Source: ”Employee Engagement and Performance: Latest Insights From the World’s Largest Study,” Gallup, 2020.

- Source: Giese et al., "Which ESG Issues Mattered Most? Defining Event and Erosion Risks," MSCI, June 2020.

- Source: Jos Veldwijk, “The Role of Sustainability in Customer Loyalty,” Customer Think, October 12, 2020

- Source: “Time to address real estate climate risk,” KPMG LLP, February 2022.

- Source: “The United States Experience with Economic Incentives for Protecting the Environment,” U.S. Environmental Protection Agency by Robert C. Anderson, 2001

- Source: Thorsten Ehlers and Frank Packer, “Green Bond Finance and Certification,” BIS Quarterly Review, September 2017.

- Source: Tensie Whelan. “Monetizing the Return on Sustainability Investment (ROSI).” NYU Stern Center for Sustainable Business, 2022.

- Source: Ashish Lodh, “ESG and the cost of capital, MSCI Research,” February 25, 2020