Implementation of the FSIE regime in Hong Kong

The FSIE regime became effective in Hong Kong on 1 January 2023. For details and impacts of the regime, please refer to the various KPMG Hong Kong SAR tax alerts4.

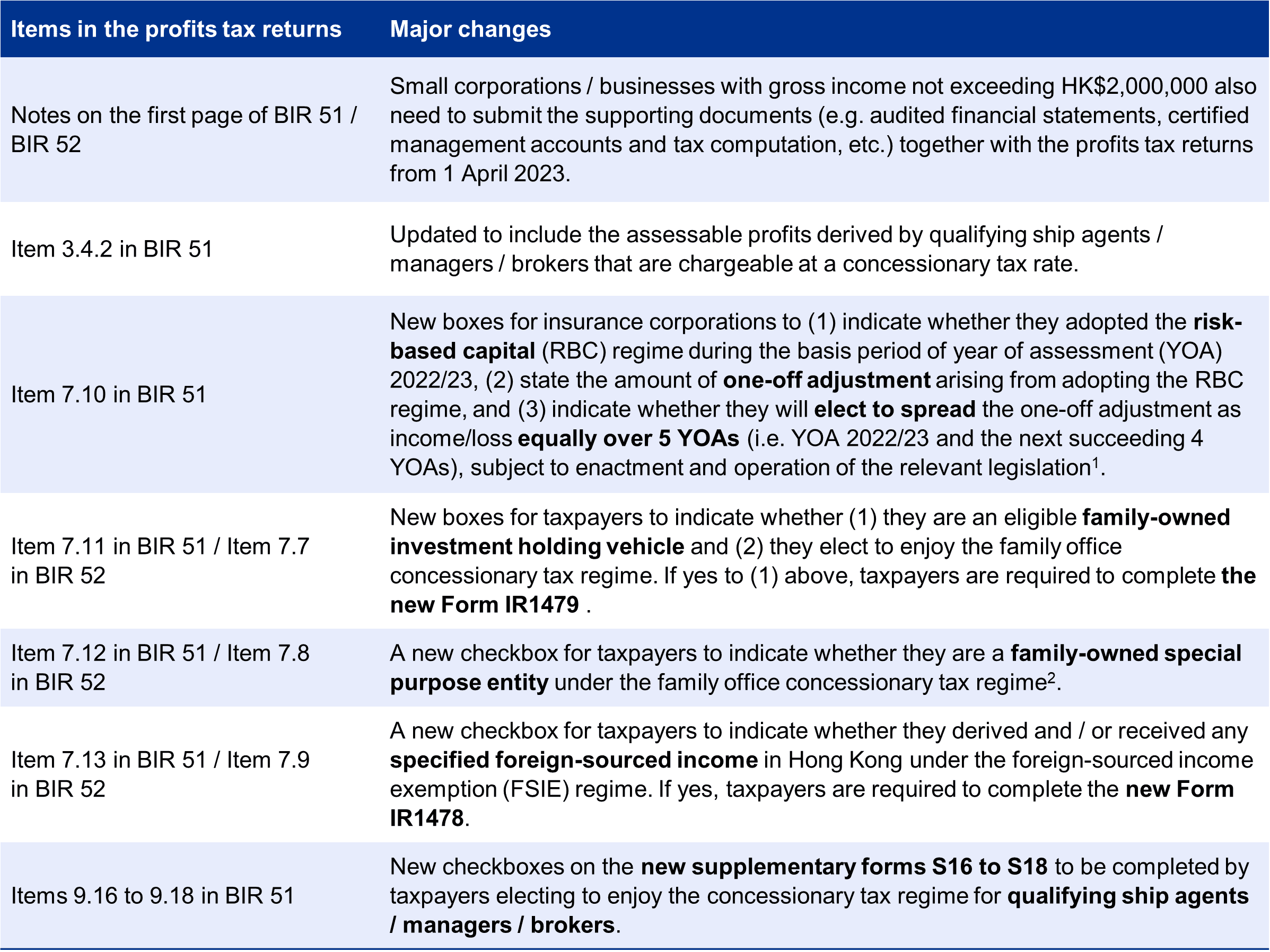

For taxpayers within the scope of the FSIE regime and with an accounting year-end date falling between 1 January 2023 and 31 March 2023 (i.e. M code entities), they should consider whether they derived/received in Hong Kong any foreign-sourced interest, dividends, equity disposal gains or royalties (i.e. specified foreign-sourced income) during the period from 1 January 2023 to 31 March 2023. Adjustment in the tax computation is required to exclude specified foreign sourced income accrued but not yet received in Hong Kong and tax exemption should be claimed for specified foreign sourced income accrued and received in Hong Kong if the applicable exemption conditions are met.

The new Form IR1478 will also need to be completed and filed electronically. If the taxpayer has previously obtained a Commissioner’s Opinion or an advance ruling on compliance with the economic substance requirement under the FSIE regime, it only needs to answer a few questions about the opinion/ruling and confirm that the circumstances and arrangements specified in the opinion/ruling remained valid during the basis period of YOA 2022/23. Otherwise, the taxpayer is required to provide details about the fulfilment of (1) the economic substance requirement in section 3.3 of the form or (2) the participation exemption conditions in section 5 of the form (where applicable).