An FIHV may enjoy a tax exemption for profits derived from the following transactions:

- transactions in Schedule 16C assets4 (qualifying transactions); and

- transactions incidental to the carrying out of qualifying transactions (incidental transactions), subject to a 5% threshold.

The qualifying transactions must be carried out or arranged in Hong Kong by or through an ESF office.

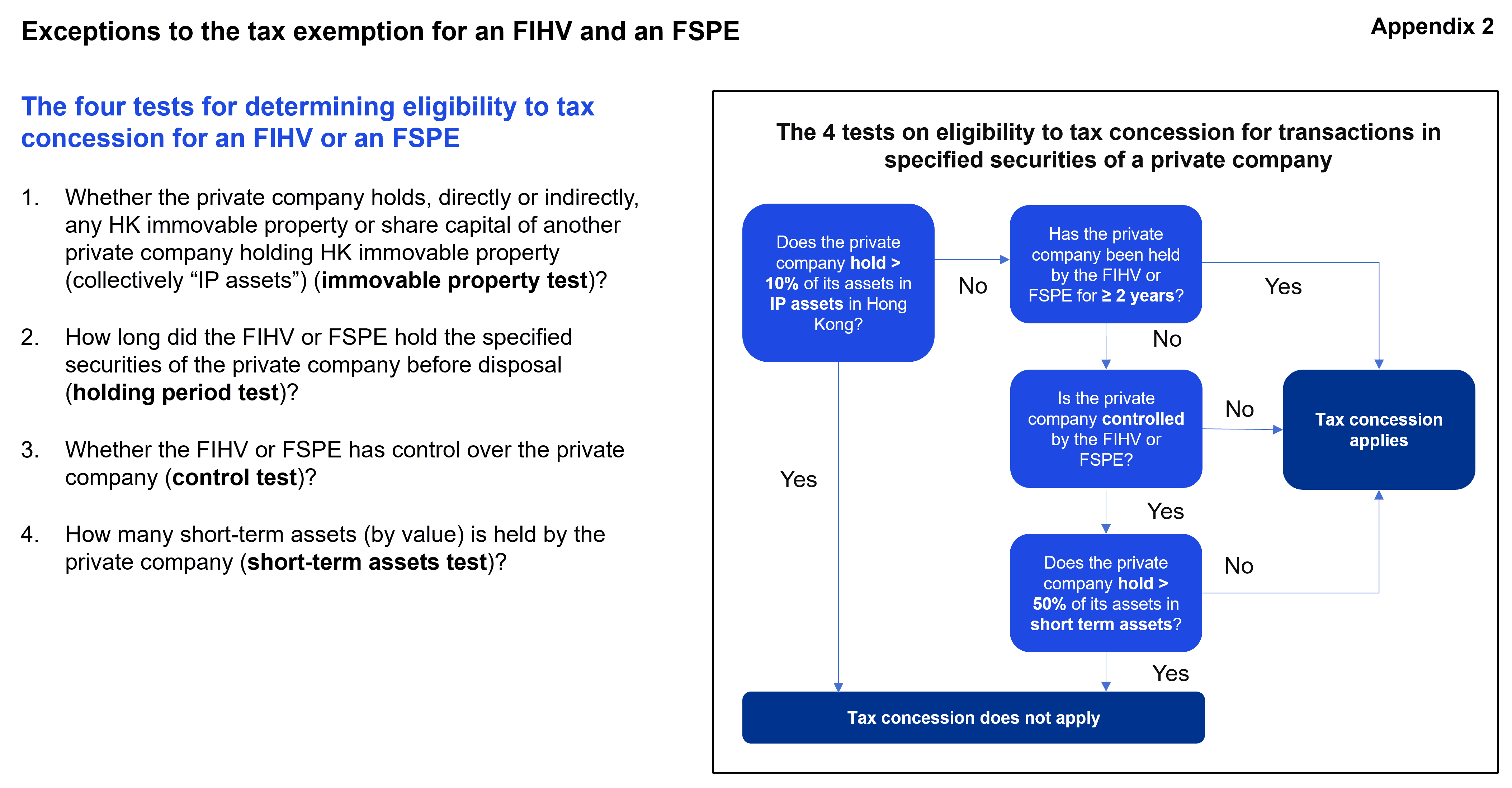

The tax exemption for an FSPE also covers profits from transactions in (i) specified securities (e.g. shares, debentures, bonds and notes) of, or issued by, an investee private company or an IFSPE5 , (ii) rights, options or interests in respect of the specified securities and (iii) certificates of interest or warrants to subscribe for or purchase of the specified securities).

If an FIHV or an FSPE has derived assessable profits from both (i) transactions eligible for a tax exemption and (ii) non-qualifying transactions during a YOA, only those assessable profits derived from non-qualifying transactions will be subject to profits tax (i.e. there is no tainting effect).

KPMG observations:

The suggestion to widen the scope of asset classes beyond those specified in Schedule 16C of the IRO has not been accepted by the government. As such, transactions in assets such as loans, artwork and crypto assets, etc. would not qualify for a tax exemption under the regime.

In addition, similar to the existing unified fund exemption (UFE) regime, dividend and interest income are regarded as income from incidental transactions and therefore would not be tax-exempt under the regime if the 5% threshold is exceeded. Such income may be tax-exempt under the other existing provisions of the IRO.