- July 2025: The IRD’s further guidance on the foreign-sourced income exemption regime

- May 2025: The IRD’s views on tax issues discussed in the 2024 annual meeting between the IRD and the HKICPA

- November 2024: Treatment of foreign-sourced in-kind dividends under the FSIE regime

- February 2024: Hong Kong is now off the EU grey list for tax purposes

- December 2023: The tax certainty scheme for onshore equity disposal gains will come into operation on 1 January 2024

- December 2023: Green light obtained for expanding the FSIE regime to cover all foreign-sourced asset disposal gains

- October 2023: The bill on the tax certainty enhancement scheme for onshore equity disposal gains has been published

- October 2023: The draft legislation expanding the FSIE regime to cover asset disposal gains is published

- August 2023: The government’s latest proposals on the tax certainty scheme for onshore equity disposal gains

- June 2023: The latest updates on the foreign-sourced income exemption regime

- April 2023: The HKSAR Government consults on the inclusion of foreign-sourced asset disposal gains under the FSIE regime

- February 2023: The FSIE regime will be expanded to cover capital gains for the Hong Kong SAR to get off from the EU grey list for tax purposes

- December 2022: The draft legislation on the foreign-sourced income exemption regime was passed

- December 2022: Latest updates on the foreign-sourced income exemption regime in Hong Kong SAR

- November 2022: A closer look at the new foreign-sourced income exemption regime in Hong Kong SAR

- November 2022: The 10 points to note for applying for the Commissioner’s Opinion under FSIE regime

- October 2022: The draft legislation of the FSIE regime in Hong Kong SAR is out

- September 2022: “Commissioner’s Opinion” as an interim measure to confirm compliance with the economic substance requirements under the revised FSIE regime

- June 2022: The HKSAR Government’s proposed changes to the offshore regime for passive income in Hong Kong SAR

Latest from tax alerts

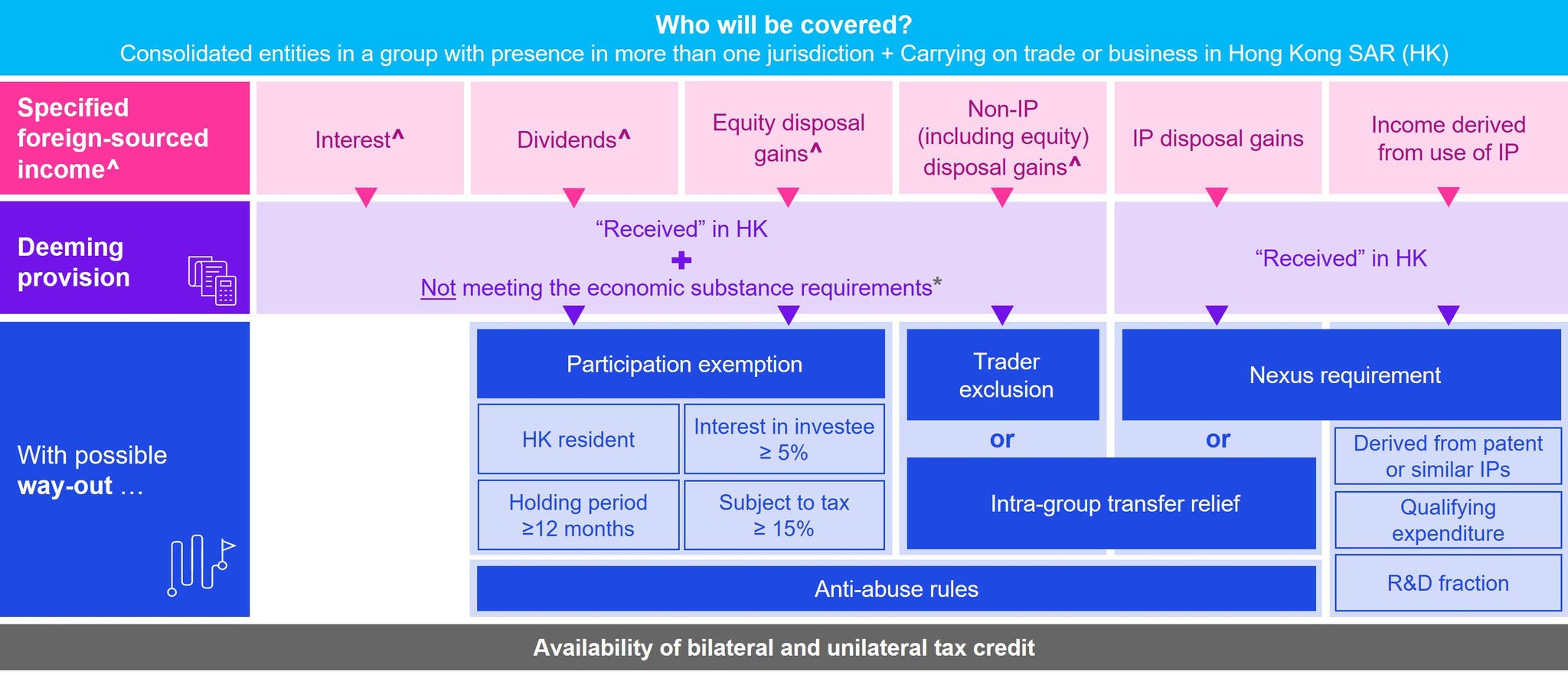

What is FSIE?

^ Excludes interest, dividends or non-IP disposal gains derived by

(1)regulated financial entities from a regulated business; or

(2)entities eligible for preferential tax regimes in HK

* Adequate number of qualified employees in HK to carry out specified economic activities

* Adequate amount of operating expenditures in HK for carrying out specified economic activities

* Reduced substantial activities test for “pure equity holding entity” (PEHE)

* Permissible outsourcing of the relevant activities conducted in HK