Introduction of the VAT Chain

On 1 January 2025, Belgium introduced the so-called 'VAT Chain,' which aims to fundamentally transform various aspects of Belgian VAT compliance.

While the Belgian VAT Authorities have previously been relatively lenient with (limited) late filing of VAT returns, the provisions of the VAT Chain may now result in:

- ‘Substitute VAT returns’ being drafted by the Authorities;

- penalties for late or non-filing; or

- denial of the company’s right to request the refund of the VAT credit for the respective reporting period. As taxable persons must, among other requirements, have timely filed all VAT returns during the six months preceding a specific reporting period to be allowed to request the refund of the corresponding VAT credit through the periodic VAT return, late filing will equally negatively impact the company’s right to request future VAT refunds.

For a full overview of the currently known implications, please consult this page.

KPMG’s way forward

KPMG is dedicated to protecting your company's rights and interests to the fullest extent. Therefore, we will transition from a VAT compliance process based on email exchanges to a process entirely integrated in an end-to-end single platform.

After extensive analysis and research, we have identified Impero as the solution of choice due to its comprehensive Risk and Control Management capabilities. Impero boasts powerful features such as automated time-bound activity triggering, follow-up on tasks and statuses, embedded document management, and sharing functionality.

Hosted on the Microsoft Azure-based cloud platform, Impero complies with the stringent ISO 27001 and AICPA SOC 2 IT security standards ensuring your company’s data can be exchanged and managed securely.

Impero’s platform is also subject to a yearly ISAE 3000 certification as issued by the International Federation of Accountants, which means that any data shared between your organization and KPMG is being processed in line with the highest standards, including the General Data Protection Regulation (GDPR).

VAT compliance calendar 2026

MONTHLY VAT FILING |

||

Taxable period |

Due date to provide |

Due date to approve |

January 2026 |

08.02.2026 |

20.02.2026 by 16:00CET |

February 2026 |

08.03.2026 |

20.03.2026 by 16:00CET |

March 2026 |

08.04.2026 |

20.04.2026 by 16:00CET |

April 2026 |

08.05.2026 |

20.05.2026 by 16:00CET |

May 2026 |

08.06.2026 |

19.06.2026 by 16:00CET |

June 2026 |

08.07.2026 |

20.07.2026 by 16:00CET |

July 2026 |

08.08.2026 |

20.08.2026 by 16:00CET |

August 2026 |

07.09.2026 |

18.09.2026 by 16:00CET |

September 2026 |

08.10.2026 |

20.10.2025 by 16:00CET |

October 2026 |

08.11.2026 |

20.11.2026 by 16:00CET |

November 2026 |

07.12.2026 |

18.12.2026 by 16:00CET |

December 2026 |

08.01.2027 |

20.01.2027 by 16:00CET |

QUARTERLY VAT FILING |

||

Taxable period |

Due date to provide |

Due date to approve |

Q1/2026 |

12.04.2026 |

24.04.2026 by 16:00CET |

Q2/2026 |

12.07.2026 |

24.07.2026 by 16:00CET |

Q3/2026 |

12.10.2026 |

23.10.2026 by 16:00CET |

Q4/2026 |

12.01.2027 |

25.01.2027 by 16:00CET |

Client interaction with return process

High-level overview of the end-to-end process

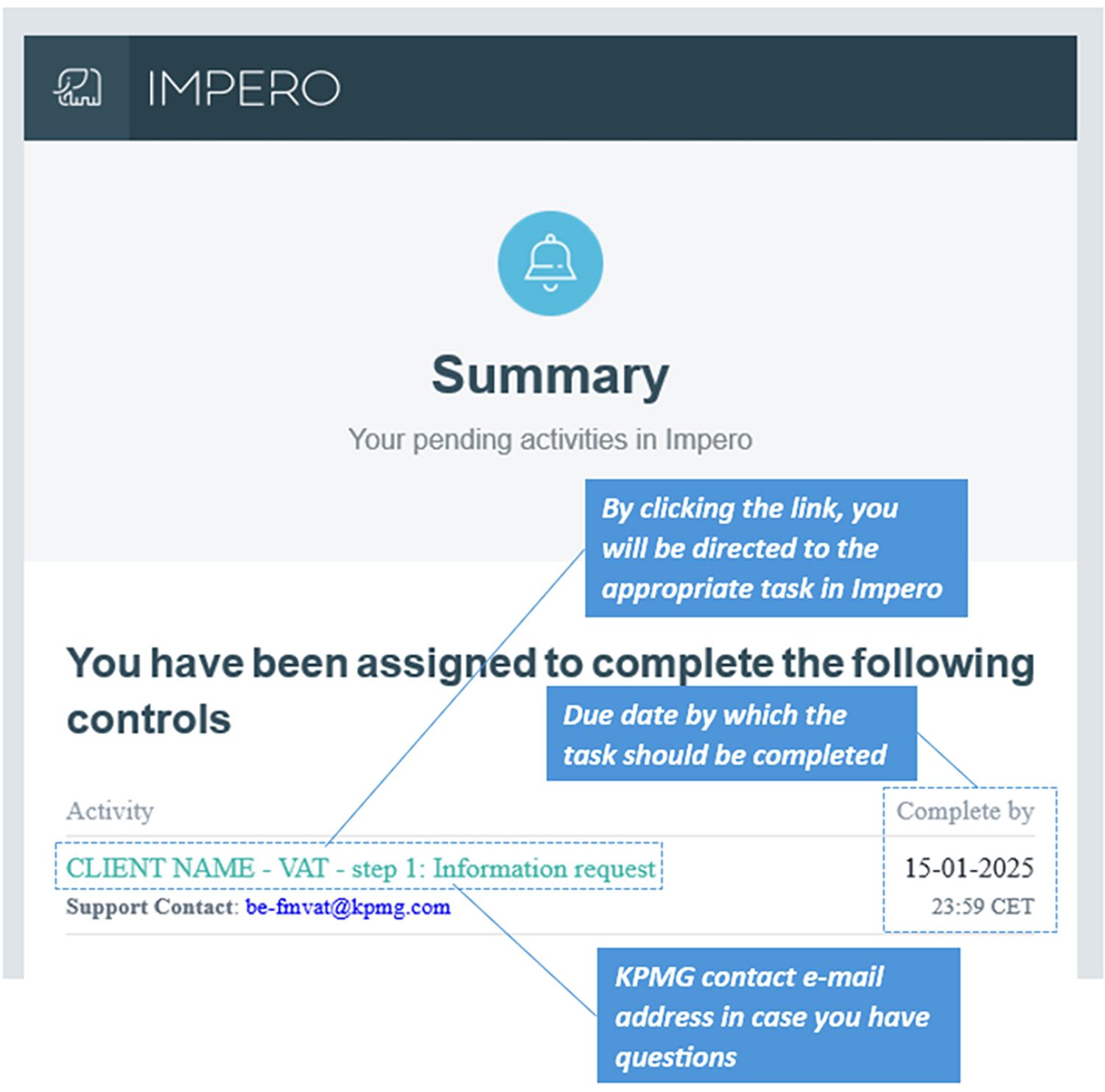

Automatic e-mail notifications will be sent to you towards the end of the taxable period to launch the process and whenever a new task becomes due.

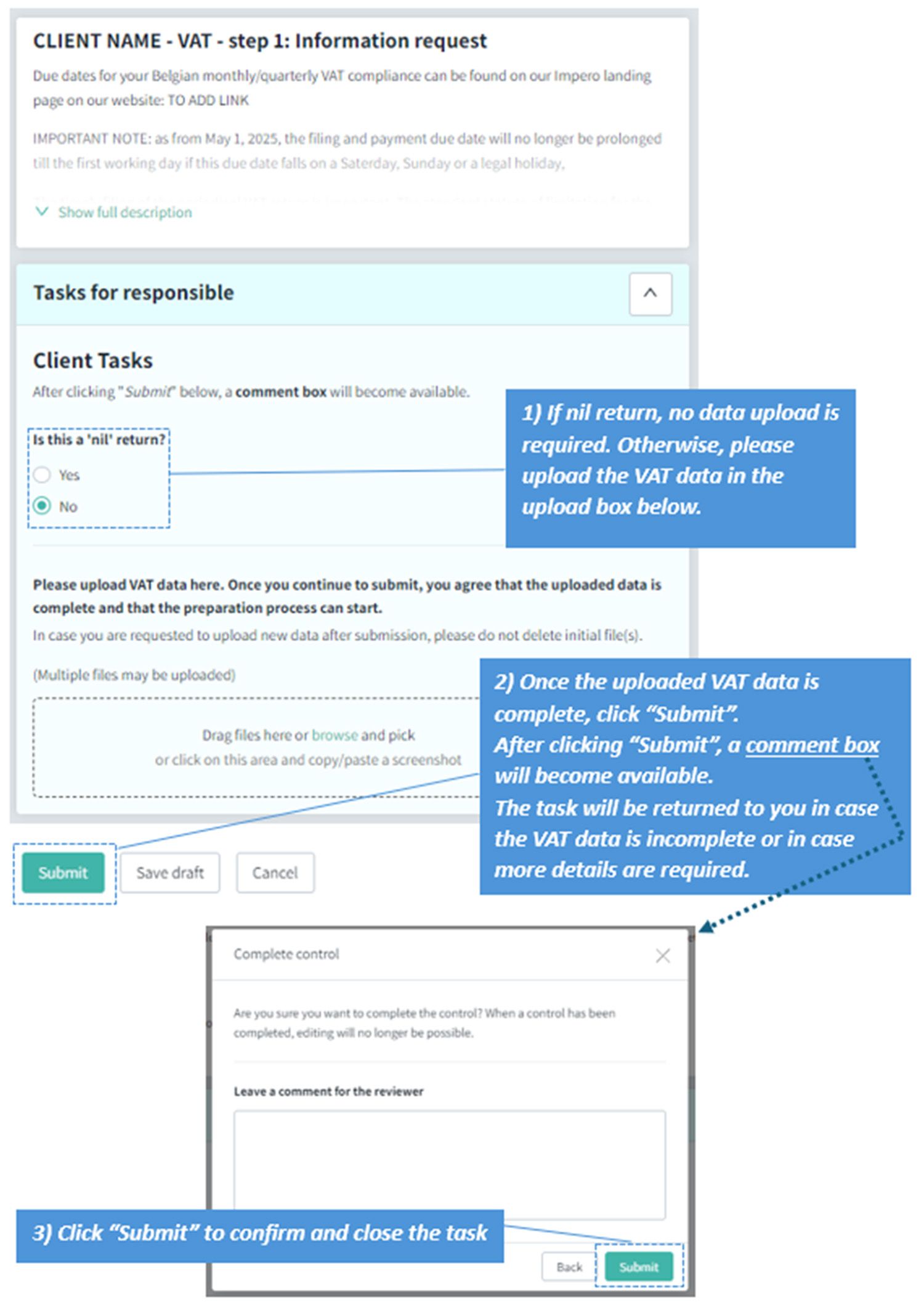

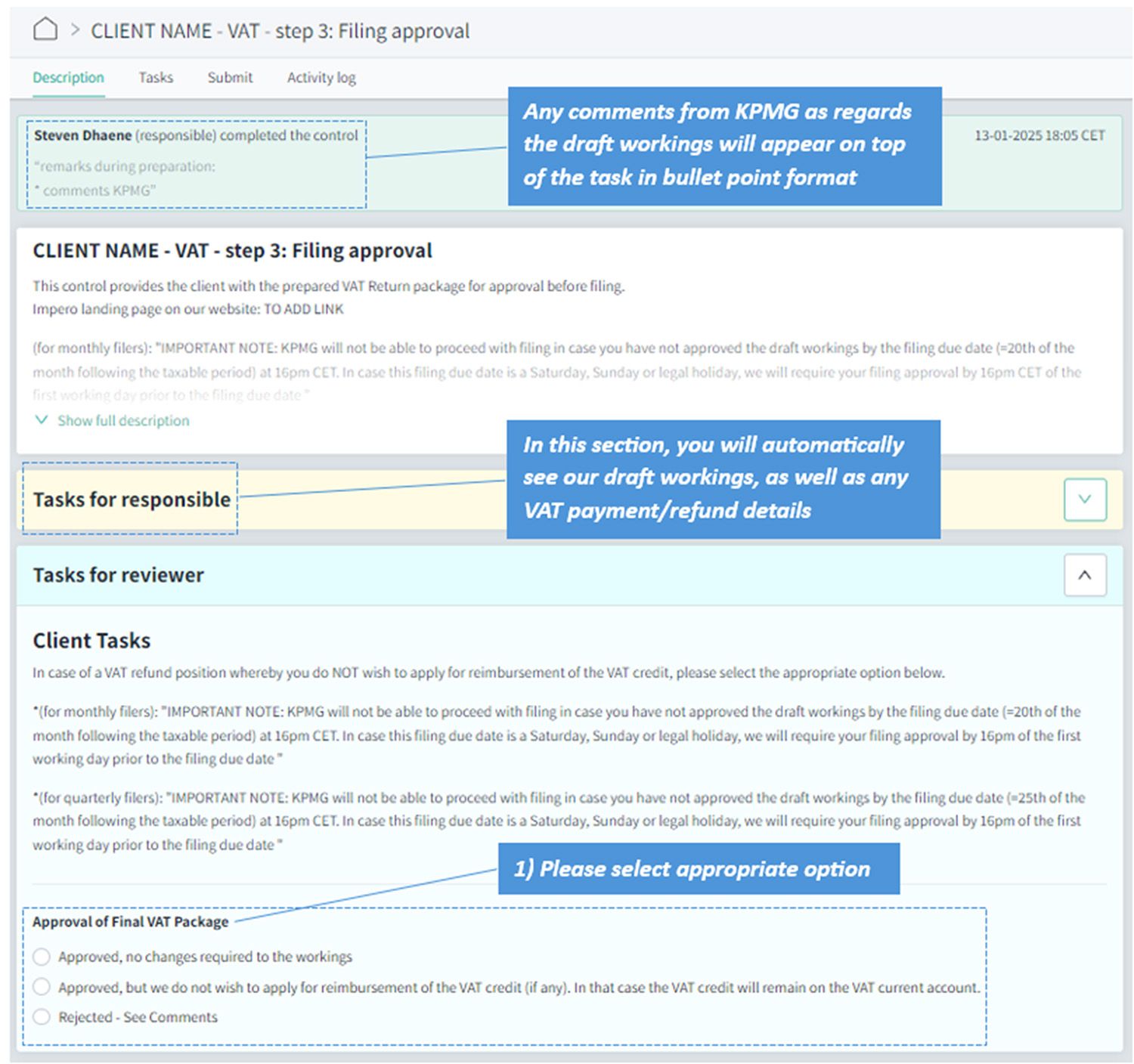

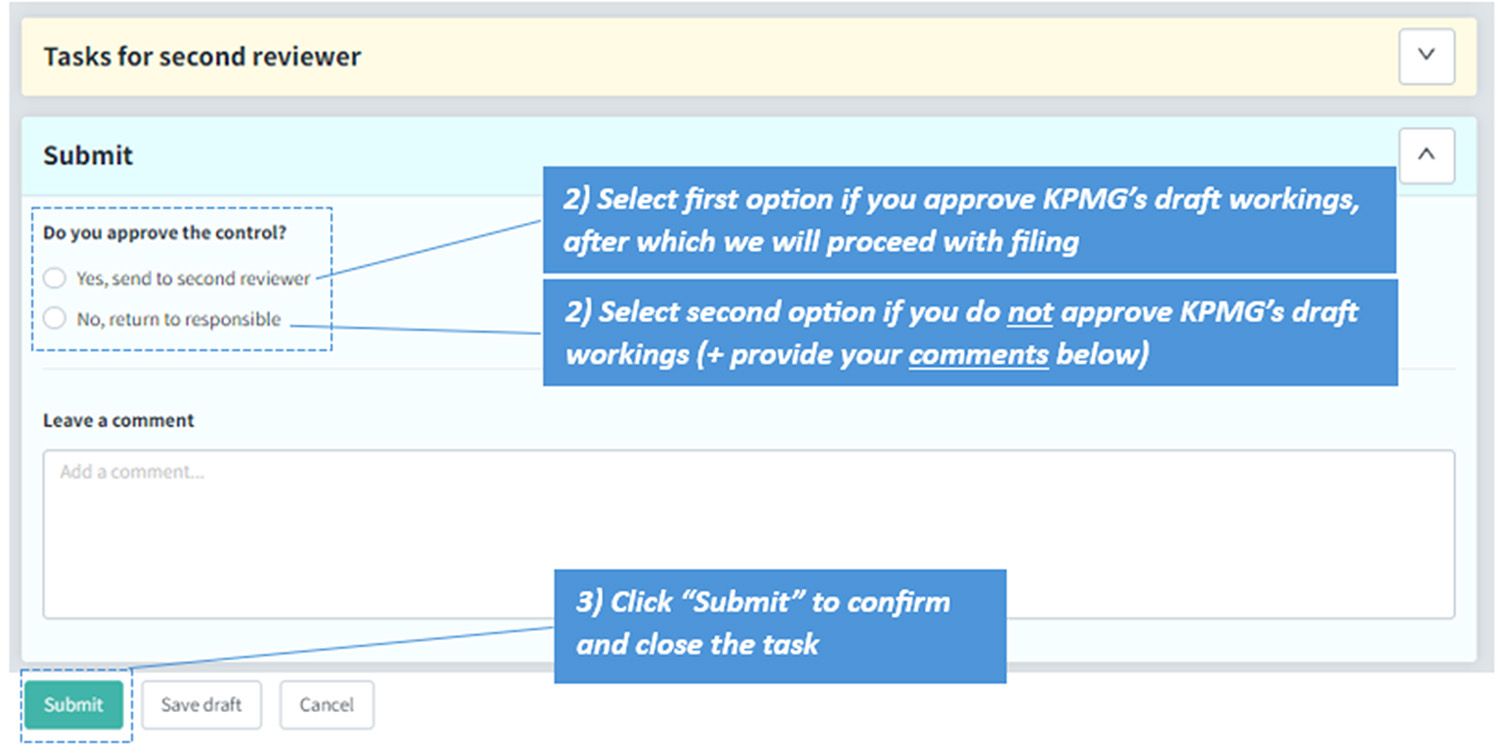

The fields in Impero which require your action, will be in light blue.

Preparation by KPMG

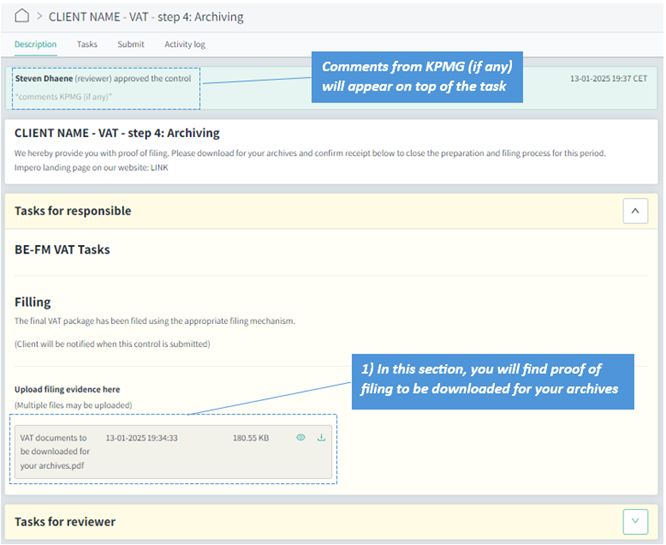

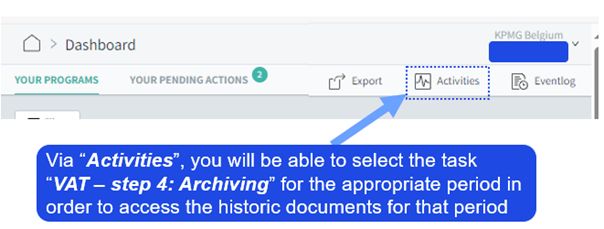

Additional feature for “On-demand historic VAT returns”

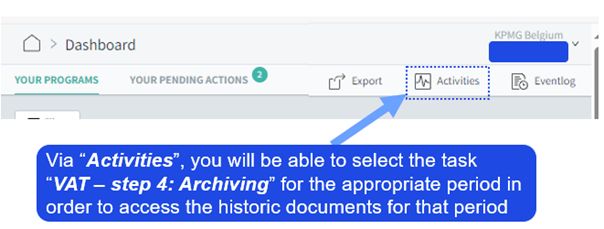

Please download the filing confirmations and underlying documents for your archives before submitting Step 4. However, you can still access these documents after completing and closing Step 4 by logging into the platform and navigating back to Step 4 for the respective reporting period.

FAQ / How-to

Getting started with Impero

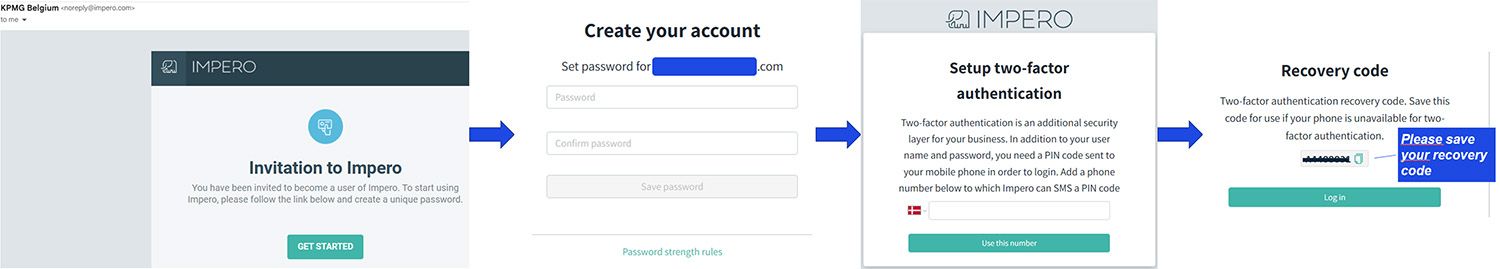

You will receive an email invitation from Impero with instructions on how to register and access the platform.

Automatic e-mail notifications will be sent to you at different stages of the workflow, such as:

- When a new process is initiated and requires your input;

- Each time a new task becomes due; or

- Reminders as deadlines approach.

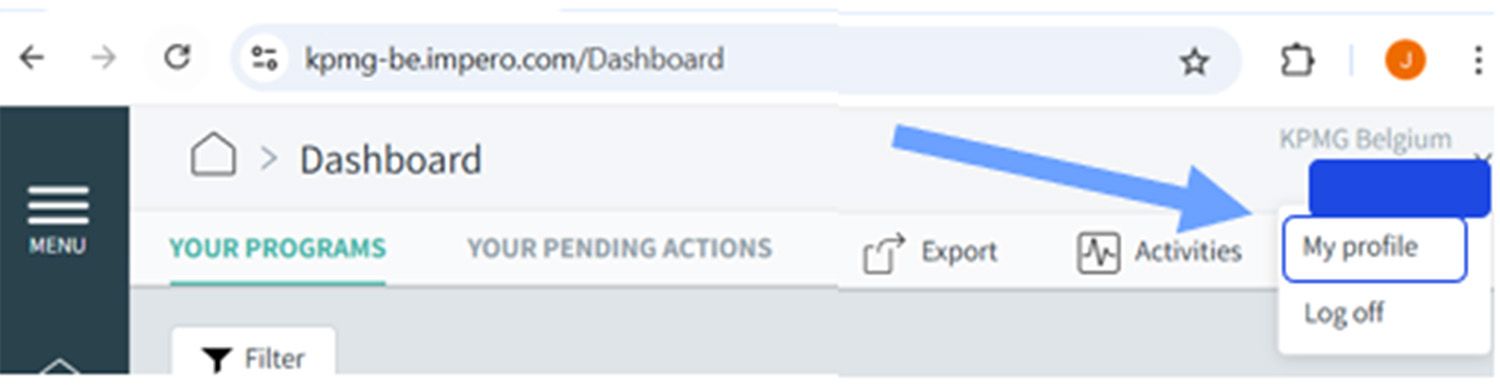

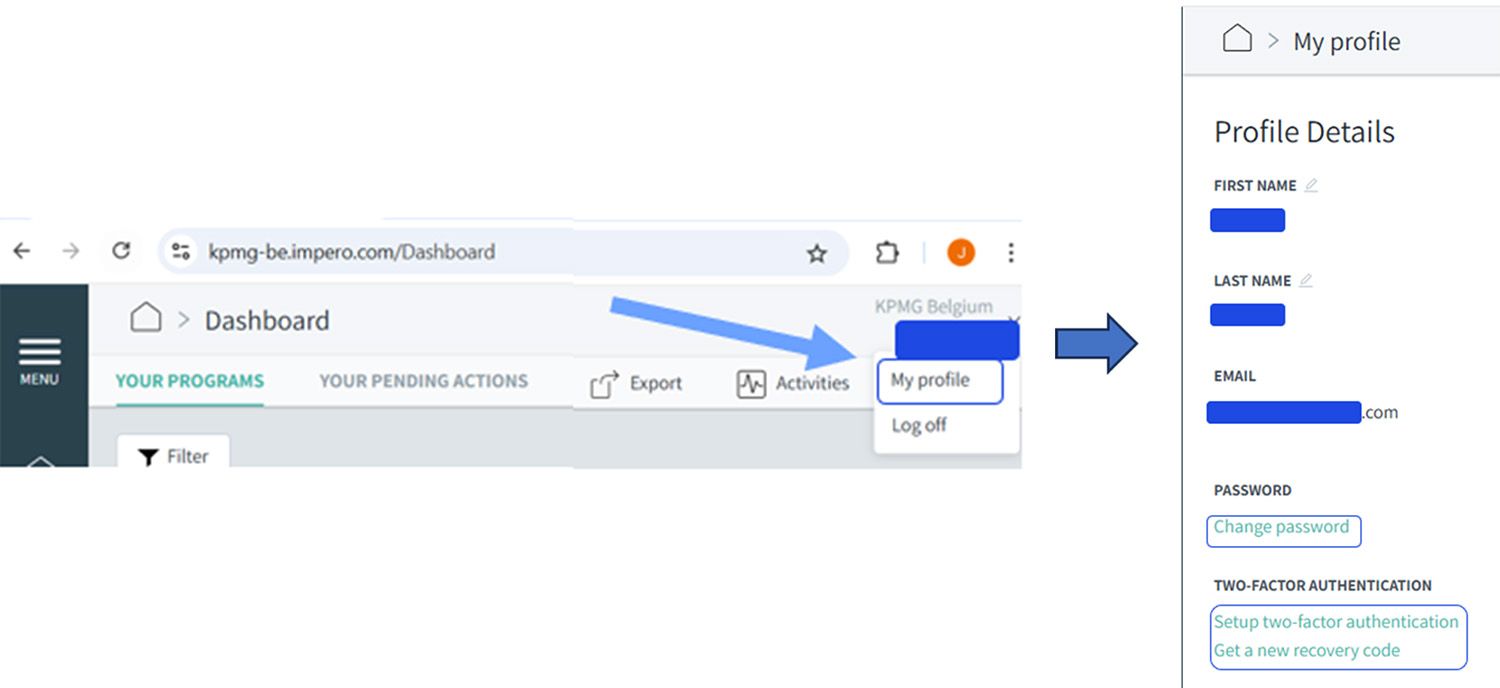

Yes, Impero supports multiple languages, including Danish, German, English, Spanish, and French. To switch languages, click on your name in the upper right corner, select "My Profile," and then choose the preferred language from the dropdown list in the “Language and time zone” section. Please note, this will only change the language of the website interface; the tasks themselves will remain in English.

User management

Under “My profile”, you can update:

- your name;

- your mobile phone number used for 2-Factor Authentication via the user profile in Impero; and

- your password.

Please reach out to BE-FM VAT (be-fmvat@kpmg.com).

Please reach out to BE-FM VAT (be-fmvat@kpmg.com) and provide the following details of the new contact person(s):

- First name;

- Last name; and

- Email address.

Please reach out to BE-FM VAT (be-fmvat@kpmg.com).

Please reach out to BE-FM VAT (be-fmvat@kpmg.com) and provide the following details:

- Name of the current contact person being replaced; and

- First name, last name, and email address of the new contact person.

We will update the contact details in the system accordingly.

A minimum of two contact persons must be appointed for Belgian VAT compliance. Both individuals will receive messages from Impero; however, only one will typically need to take action as specified in the message from Impero. The second person will serve as a backup in case the primary contact is unavailable, such as when they are out of the office. Any changes made by one contact in Impero will be visible to all designated contacts. Once one of the contacts submits the task, it will no longer be accessible to others.

- If the delegate is already included in the process and has an account: all contact persons will receive Impero notifications.

- If the delegate is a new contact: please notify BE-FM VAT (be-fmvat@kpmg.com) and provide the following details to create the new user account:

- First name of the delegated person;

- Last name of the delegated person; and

- Email address of the delegated person.

Uploading data

You can continue to provide us with the same source data as before.

Yes, at each relevant step in the process, you have the option to save your work as a draft. Click on "Save Draft" and you can return to it later when you're ready to continue with your submission.

The uploaded information is only accessible to:

- The KPMG VAT Compliance Team; and

- Client contact persons designated within the Impero platform.

VAT Return Process and Deadlines

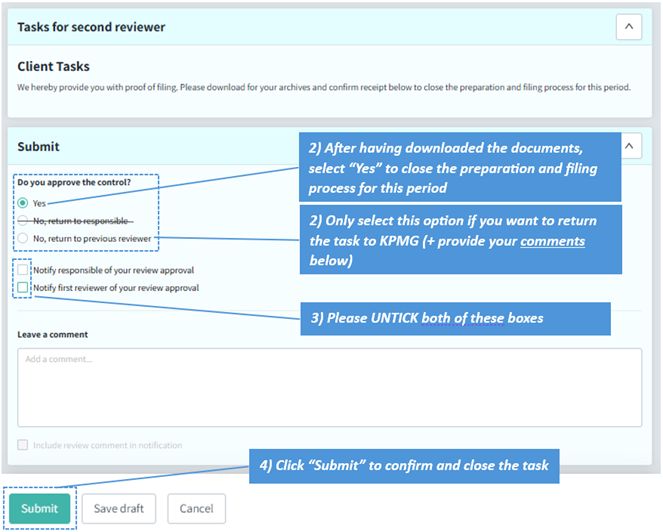

When you click “approve” in Step 3, this is considered final approval and filing will take place shortly after. KPMG will not be able to proceed with filing as long as your approval has not been received in Impero.

KPMG will not be able to proceed with filing unless your express approval has been received in Impero. This may result in late filing. You will receive automated reminders as the due date approaches and are requested to complete the approval request in due time (see VAT compliance calendar above) to ensure timely filing.

You will receive automated reminders, prompting you to execute your action. When the predefined due date is exceeded, the activity status becomes “overdue”. The KPMG VAT Compliance Team will determine appropriate action, which may entail that they reach out to you and/or other contact persons through other channels (e.g. e-mail or phone) than Impero. It should be noted that reaching the “overdue” status implies that KPMG can no longer guarantee timely filing and/or that additional fees may apply. Late filing will in principle also be penalized by the Authorities and may have other implications. Please visit our website for more information on the implications of the VAT Chain in Belgium.

An e-mail with a brief description of the nature of the request can be sent via e-mail to BE-FM VAT (be-fmvat@kpmg.com). This may result in Step 1 being reopened. Any additional documents should not be sent via e-mail to BE-FM VAT , but only through Impero.

- BEFORE the official filing due date? Reach out to BE-FM VAT (be-fmvat@kpmg.com) with a short description of the issue, a corrective return could possibly still be filed as long as the official due date has not passed.

- AFTER the official filing due date? Reach out to BE-FM VAT (be-fmvat@kpmg.com) with a short description of the issue, in principle no corrective return can be filed after the filing due date; the KPMG Compliance Team will provide guidance on the appropriate course of action.

Payment instructions are included in Step 3 of the process within the platform.

KPMG will always request for the VAT refund, unless otherwise instructed by you during the approval step (please see more information on the KPMG website about the new VAT chain rules.

Please download the filing confirmations and underlying documents for your archives before submitting Step 4. However, you can still access these documents after completing Step 4 by logging into the platform and navigating back to Step 4 for the respective reporting period.

Technical issues

Please reach out to BE-FM VAT (be-fmvat@kpmg.com) with a description of the issue.

Please reach out to BE-FM VAT (be-fmvat@kpmg.com) with a description of the issue.

Contact

Ideally, all communication connected to a VAT return passes through Impero. However, exceptional circumstances may require a direct line to KPMG. In such a case, you can send an email to the central mailbox: BE-FM VAT (be-fmvat@kpmg.com).

Explore

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia