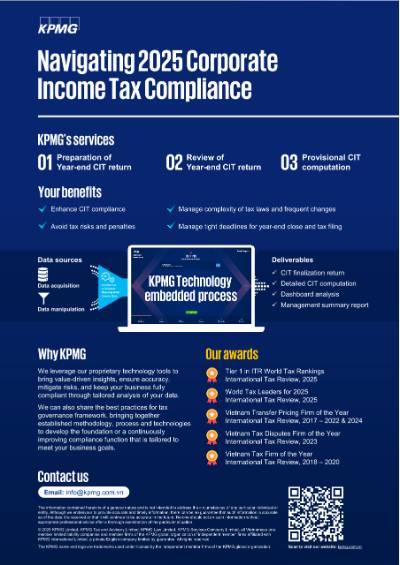

KPMG's services

- Preparation of Year-end CIT return

- Review of Year-end CIT return

- Provisional CIT computation

Your benefits

Enhance CIT compliance

Avoid tax risks and penalties

Manage complexity of tax laws and requent changes

Manage tight deadlines for year-end close and tax filing

Why KPMG

We leverage our proprietary technology tools to bring value-driven and actionable insights through tailored analysis of your data.

We can also share the best practices for tax governance framework, bringing together established methods, processes and technologies to develop the foundation or a continuously improving compliance function that is tailored to help meet your business goals.

Our awards

Tier 1 in ITR World Tax Rankings

International Tax Review, 2025

World Tax Leaders for 2025

International Tax Review, 2025

Vietnam Tax Disputes Firm of the Year

International Tax Review, 2023

Vietnam Transfer Pricing Firm of the Year

International Tax Review, 2017 - 2022 & 2024

Vietnam Tax Firm of the Year

International Tax Review, 2018 - 2020

Our latest Edition

Contact us

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia