Banking

Banking

The Banking practice combines industry knowledge, tax, regulatory and program management skills to deliver successful transformation programs.

The Banking practice combines industry knowledge, tax, and other skills

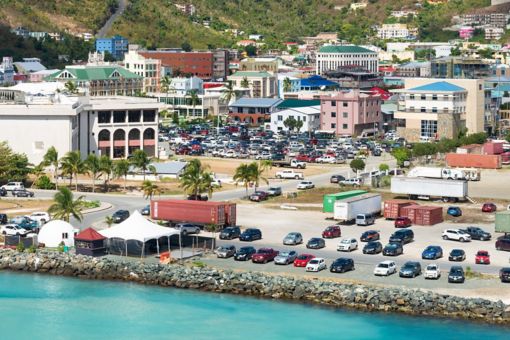

Our Banking practice, which supports The Bahamas, The British Virgin Islands and the Cayman Islands, combines industry, regulatory and tax expertise to provide value to our clients.

The Banking industry across our islands has seen significant change in recent years. Most notably, the reforms in European regulation and oversight have driven enhancements in local regulatory regimes.

The Banking industry is currently going through significant change. Though most of this change is driven based on international pressures, the effects are impacting Banks within the Cayman Islands and across the Caribbean. Various acts and directives within the US and the EU have led to complex regulation and legislation facing a lot of banks across the region.

The Bahamas has a long history as a center for financial services, ranging from banks, trusts and insurance companies. Presently, there are just under 200 banks and trust companies licensed in The Bahamas. The Bahamas banking sector is regulated and supervised by The Central Bank of The Bahamas. Presently, The Bahamas regulator is focused on modernization of local payment systems, a regime for digital assets and an overhaul of its economic substance framework.

The British Virgin Islands remains a significant financial services center. The BVI Financial Services Commission regulates and supervises approximately 300 banks and trust companies. Through a number of amendments in its regulators, The British Virgin Islands will expand its oversight through annual financial returns for registered companies and beneficial ownership reporting.

The Cayman Islands is recognized as a sophisticated and mature financial center. Currently, there are over 100 banks and trust companies in the Cayman Islands, representing many of the largest banks in the world. The Cayman Islands banking sector is regulated and supervised by The Cayman Islands Monetary Authority. The Cayman Islands sustained efforts to maintain strong internationally recognized legal and regulatory frameworks lead to its successful removal from the FATF grey list in 2023.

Our experience

As one of the first international accounting firms to establish an office in the Cayman Islands in 1966, we have developed a long-standing reputation as a leading service provider in the local Banking industry.

Our Banking practice offers specialized services to a wide range of industry clients at local, national, and global levels. Our multi-disciplinary team consists of professionals who are specialists in their fields, with deep experience in the issues surrounding the Banking industry.

We continuously evolve and grow to ensure we have the capabilities, methods, and alliances to deliver insights-driven, fact-based, and technology-enabled services. These services are designed to enhance sustainable value and meet specific client needs, helping our clients achieve successful outcomes.

What we do

We are always available to discuss industry trends and topics of interest to guide your organization on its path to sustainable success. Our close connection with regulators, understanding of key issues, and deep industry knowledge facilitate smooth collaboration and practical execution.

Leveraging our global network, we provide advice on operational and strategic business challenges and opportunities. Our team of professionals in Audit, Tax, and Advisory continuously collaborates with clients regionally and globally. With a wealth of industry experience and specialist knowledge, our banking professionals are equipped to address your business needs effectively.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia