Key findings

Steeper fall in permanent placements signalled

Permanent pay growth weakest in five months

Candidate availability continues to climb

Data collected August 12-23

Summary

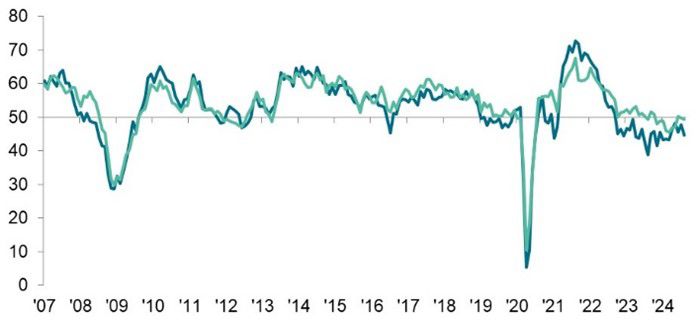

The KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, signalled a softening of UK labour market conditions during August. Latest data showed that permanent placements continued to fall, and at an accelerated pace, amid reports of reduced demand amongst companies for new staff. Temp billings also declined over the month, albeit only marginally.

Permanent salaries meanwhile continued to rise, but at the weakest pace since March and at a rate well below the survey's historical trend. Concurrently, temp pay increased at the weakest pace for three-and-a-half years.

Reduced placements and slower pay growth occurred as recruitment consultants registered a fall in vacancies for a tenth successive month. Staff availability also rose amid some reports of increased redundancies.

The report is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Staff appointments continue to fall during August

August’s KPMG/REC Report on Jobs survey showed another reduction in permanent staff placements, extending the current downturn to 23 months. Moreover, the rate of contraction was the steepest since March amid reports of lower demand from clients and a lack of workplace vacancies. Temp billings also fell for similar reasons, although the rate of contraction was again only marginal, and little changed since July.

Permanent Placements Index

Temporary Billings

50.0 = no-change

Slower growth in permanent staff pay

Permanent staff salaries increased again in August, in line with a trend that stretches back three-and-a-half years. Starting pay was generally raised to attract candidates, especially for positions where supply was limited. However, the increase in permanent pay levels was the weakest since March and well below the survey’s historical average. Moreover, temp pay rose only slightly and to the weakest degree for three-and-a-half years.

Staff demand down slightly again in August

Latest vacancy data signalled a marginal decline in vacancy numbers during August. It was the tenth month in a row that demand for staff has fallen, with slight declines seen for both permanent and temporary workers. Notably, August marked the first fall in temporary staff demand since April.

Strong growth of staff availability signalled

Staff availability continued to increase in August, both for permanent and temporary workers. Although similar, growth was the strongest in four months for temp workers but the slowest since February for perm staff. A mixture of redundancies and lower placement volumes reportedly led to the rise availability.

Regional and Sector Variations

The steepest fall in placements was seen in the South of England. In contrast, there was little change recorded in the North of England.

Whereas there was growth in temp billings in the Midlands and North of England, declines were seen in London and the South of England.

Once again, half of the sectors covered by the survey registered a decline in permanent vacancies. The steepest drop was for IT & Computing. Conversely, of those categories that experienced growth, the fastest increase was seen for Nursing & Medical Care.

Temp vacancies declined across seven sectors in August, with the steepest reduction seen for Executive & Professional. IT & Computing also recorded a noticeable fall. The strongest growth was for Blue Collar.

Comments

Commenting on the latest survey results, Jon Holt, Chief Executive and Senior Partner of KPMG in the UK, said:

“While lower inflation has brought welcome stability to some sectors, and despite a first rate cut in August, monetary policy continues to be restrictive, which means that overall business confidence continues to fluctuate.

“Recent Government warnings that the UK’s economy may weaken further before improving add to the overall sense of uncertainty, affecting recruitment plans. Firms holding back from hiring led to a sharp contraction in the number of people placed into permanent roles in August amid continued decline in demand, extending the downturn in the UK’s labour market.

“The news that while salaries rose last month it was at the weakest rate since March could help make the case for more rate cuts when the Monetary Policy Committee meets to decide the future path of interest rates.

“Both employers and job seekers are still facing a challenging period that will require careful long-term planning and adaptability.”

Commenting, Neil Carberry, REC Chief Executive, said:

“August is always a difficult market to judge because of the summer break, but this month’s survey supports what we have been hearing around the country – employers are still cautious. They are waiting for a clear signal that sustained demand is around the corner. The new government said growth was its main priority – but it needs to deliver now. A vision for a positive, prosperous Britain has to accompany the fiscal realism that is being served up right now. That is the test for the Chancellor and Prime Minister this autumn.”

Neil Carberry said:

“It’s clear that there is underlying momentum in our jobs market, with temp hiring and private sector vacancies essentially flat. Some regions are seeing stronger performance too – notably the North of England. Pay growth has returned to a more normal level, which should reassure the Bank that the positive signal of beginning to cut interest rates was the right call. Firms will welcome this – but they are concerned by the potential challenges of the government’s labour market agenda. Big changes are possible – but moving too fast and breaking things may damage business investment and opportunities for workers. That is why we are encouraging the government to work with business to design changes that employers can work within, and to reassure them that they aren’t taking risks by hiring now. More than anything, as our new ‘Voice of the worker’ campaign shows, people want to work in a myriad of different ways now – any legal changes must support that, rather than prescribing what approved work is from Whitehall.”