Overall candidate supply continues to rise rapidly

The overall availability of candidates expanded for the sixth straight month in August. Although the rate of improvement slowed from July, it was nevertheless the second-sharpest recorded since December 2020. There were widespread reports that redundancies and a general slowdown in hiring activity had driven the latest rise in labour supply, with both permanent and temporary candidate numbers expanding at rapid rates.

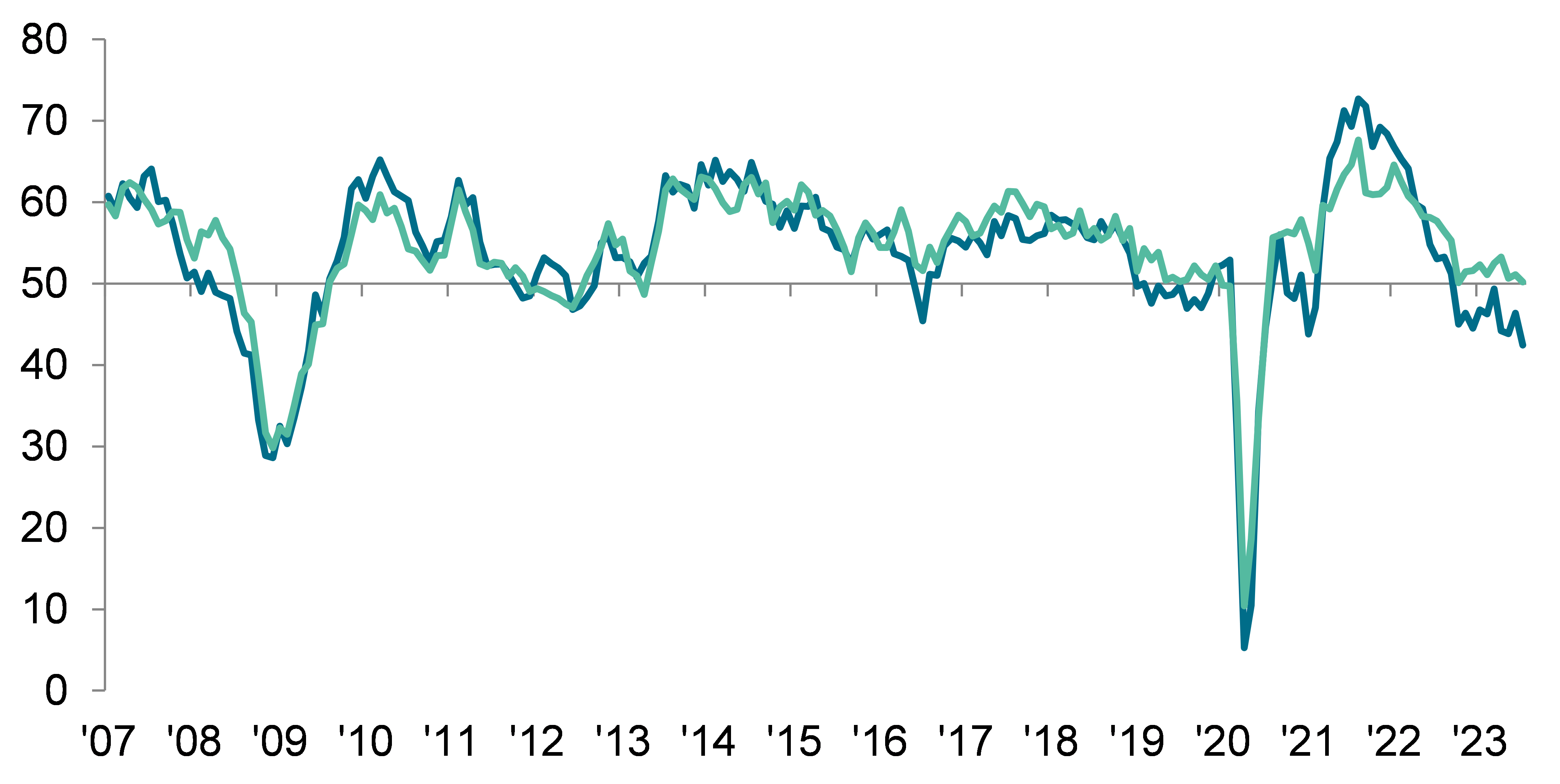

Total vacancy growth slips to two-and-a-half-year low

Overall vacancy growth softened for the sixth successive month in August. Furthermore, the latest increase in demand for staff was the weakest seen in the current two-and-a-half-year sequence of expansion and only marginal. The slowdown was driven by a softer rise in permanent vacancies, which increased only fractionally, as growth of demand for temporary staff remained strong.

Pay pressures remain elevated

Starting salaries and temp wages rose sharply in August, with recruiters often commenting that competition for scarce candidates and the higher cost of living had led employers to raise pay. However, the rate of starting salary inflation edged down to the joint-weakest since March 2021, and was much slower than that recorded a year ago. While temp pay growth picked up from July, it was the second-softest since April 2021.

Regional and Sector Variations

Permanent placements fell rapidly across all four monitored English regions, led by the Midlands.

All four monitored English areas bar the Midlands registered a drop in temp billings during August. London recorded the quickest reduction overall.

Sector data indicated that the strongest increase in demand was seen for temporary staff in the private sector. Short-term vacancies meanwhile continued to rise only slightly in the public sector. Demand trends meanwhile diverged for permanent staff, with vacancies broadly unchanged in the private sector but rising modestly in the public sector.

Half of the ten monitored job categories registered higher demand for permanent staff in August. Hotel & Catering recorded the strongest rate of vacancy growth. Secretarial/Clerical and Retail meanwhile saw the steepest falls in demand.

Short-term vacancies expanded in the majority of the covered employment categories during August, led by Hotel & Catering. Demand for temporary Executive/Professional workers meanwhile stagnated, and fell in the Construction and Retail categories.

Comments

Commenting on the latest survey results, Claire Warnes, Partner, Skills and Productivity at KPMG UK, said:

“The August summer break has seen little change in the ongoing tight labour market conditions. If you’re looking for a new role – the market remains in your favour, as starting pay continues to be driven up by inflationary pressures and a high demand for candidates with specific skills across many sectors.

“For recruiters, the picture is still complex. Despite an increasing pool of candidates this month, the economic outlook is keeping businesses cautious. Many employers aren’t ready to commit to permanent roles, and those who are indicate they cannot find candidates with the right skills, causing these placements to fall at a rapid pace during August – the sharpest for three years. Temporary billings slipped for the first time since July 2020, as squeezed budgets mean there’s little room to bring on short-term staff. But certain sectors, like healthcare are bucking this trend, with sustained high demand for both temp and permanent staff. And as the appetite for tech and AI expertise keeps increasing, the IT sector needs temporary workers to support more projects.

“The underlying issue is that skills - or a lack of them – remain central to the tensions in today’s labour market, and significant investment now for the long term prospects of the economy is vital.”

Neil Carberry, REC Chief Executive, said:

“August is always a slower month for new permanent roles, but this has been exacerbated in 2023 by the lack of confidence to start the new hiring we saw among firms in the Spring. As inflation begins to drop, it is likely that firms will return to the market later in the year – employer surveys suggest confidence may be returning. But for now, the labour market has more slack than it has since the heights of the first lockdown. Firms continue to use temps to fill any short-run needs, with the small drop in August representing little change from the past few months.

“Recruiters routinely describe this sober overall picture as harder, but not necessarily bad. Vacancies are still in a strong position. There are huge variations between sectors, too. Hospitality, Accounting, Logistics, Manufacturing, Engineering and Healthcare continue to grow strongly for both permanent and temporary roles, meaning employers are still experiencing shortages. Demand for permanent healthcare staff has now risen for 37 months, for instance. In many of these sectors temporary staff are keeping employers going – including in the NHS, where agencies have been unfairly blamed for failures of training and procurement practice from NHS England. A focus on effective skills reform will be vital to addressing shortages overall in all the shortage sectors.

“With demand weakening, we see the drivers for rising pay being more to do with companies’ pay settlements for existing staff, rather than market demand. Those finding new jobs are benefitting from rises that many firms put in place for their teams earlier in the year. That said, data shows pay pressures remain sharp for permanent workers in some sectors driven by ongoing shortages.”