Introduction

RegTech (Regulatory Technology) is a thriving part of UK FinTech. The importance of new technology to help financial services remain compliant has been underlined by the recent sanctions against Russia. And yet, RegTech has still not gained prominence in the same way that other FinTech verticals have.

We have collaborated with Innovate Finance to develop this report that provides an explanation of what RegTech is and why it is important. It also highlights the need to build awareness of many RegTech solutions currently offered in the market and the impact they are having on financial services.

What is RegTech?

It has been frequently highlighted that a key challenge faced by the RegTech sector is a lack of awareness as to what RegTech is and how it helps firms. This challenge extends to ongoing disagreement around an exact definition. In the context of this paper, RegTech is defined as a technology-driven service to facilitate and streamline compliance with regulations.

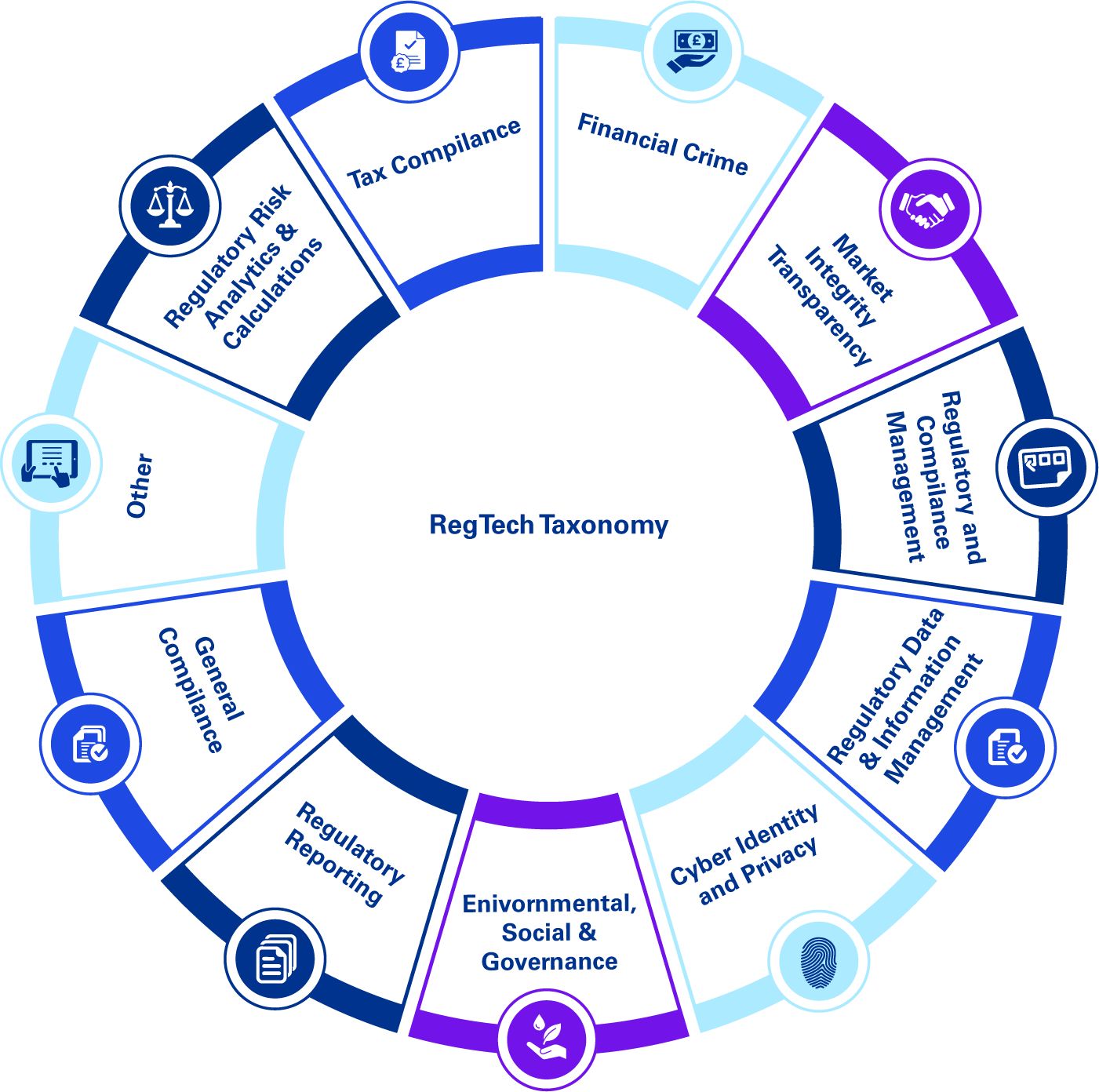

In order to elaborate on the wider scope and applicability of RegTech, this paper refers to the below RegTech Associates taxonomy of the RegTech market.

RegTech Taxonomy wheel

Source: City of London and The Global City (in partnership with RegTech Associates), 2021: A critical year for RegTech (theglobalcity.uk)

The importance of RegTech

Regulatory compliance is fundamental in ensuring that financial services firms build trust with customers, contribute towards market stability, and improve their service offerings. Fines for non-compliance are becoming more frequent and more economically material for firms.

Beyond the case for improved controls and enhanced regulatory compliance, there is an increasing expectation that RegTech can also be used to reduce cost and boost operational efficiency. This shift helps to make the business case for RegTech’s positive impact on the bottom line.

Drivers for the adoption of RegTech

Regulatory constraints, pandemics and geopolitical crises mean it remains difficult for financial institutions to generate consistent profit growth. We will continue to see them embrace technology which facilitates increased efficiency in the risk and compliance function. Investment in RegTech will become increasingly more affordable.

As regulators around the world focus on implementing reforms (ranging from systemic risk to data privacy), the compliance burden for firms will continue to grow.

The financial sector must attempt to navigate new products, services and regulations, in the context of widespread political uncertainty. Layered on top of this, is the complexity created by the data environment, legacy systems and operating models. The common data formats and connectivity options offered by RegTechs can help to reduce some aspects of this complexity.

As consumers continue to demand a better and faster experience, regulators are also now placing increasing focus on consumer outcomes. This means financial institutions need to either invest in developing their own technology or embrace developed RegTech offerings.

Corporations are also a significant stakeholder in their own right and demand RegTech solutions that address cost efficiency as well as improved systems and data integration. These solutions will satisfy both their regulatory requirements and provide positive internal experiences for their staff and customers.

RegTech User cases

What are the benefits that clients adopting RegTech solutions can expect to reap? Explore the four main areas from within a selection of the domains identified in the taxonomy wheel.

Cyber, Identity and Privacy combined with Financial Crime - RegTechs offer a range of technology-enabled identity verification solutions, including customer onboarding, company structure identification, beneficial ownership and document signing to empower organisations from a variety of sectors to not only comply with these regulatory programmes but also keep pace with wider market changes.

Regulatory Reporting - Solutions offered by RegTechs in this domain range from secure and encrypted Cloud-based real-time data processing, and local licence-based software deployment on client systems through to secure localised remote data processing.

Sustainability and ESG - RegTech solutions not only support ESG disclosure requirements, but they can also support gathering the relevant information for clients to meet ongoing regulatory requirements and increase focus on mitigation and/or remediation activity; streamline processes by combining with other related areas, such as KYC and anti-financial crime; identify ESG reg flags in possible investment assets; allow financial managers to make informed, strategic ESG-related Decisions.

Regulatory and compliance management – RegTechs embed various compliance solutions within business processes to allow institutions to demonstrate regulatory compliance and traceability of requirements to policies, processes and controls.

Reduced cost

Reduced cost

Better compliance

Better compliance

Tackling complexity

Tackling complexity

Improved consumer experience

Improved consumer experience

Corporate experience

Corporate experience