KPMG’s 2021 CEO Outlook asked 133 energy leaders within the oil and gas and power and utilities sectors about their strategies and outlook over a 3-year horizon and found that leaders of the world’s largest energy organizations are focusing their investments on talent and technology as the industry faces continued uncertainty from COVID-19 and the climate crisis. The KPMG 2021 Energy CEO Outlook reveals an industry that remains resilient and focused on long-term, sustainable growth. Energy CEOs are increasingly concerned about climate risk and an emerging talent crisis within their sector and leaders are looking for consistent, collaborative, and global approaches to tackling the challenges ahead.

More than half (63%) of energy CEOs report the lion’s share of demand pressure stemming from investors and regulators for increased reporting and transparency on ESG issues today. In response to the raising concerns around climate risk and investor demands, nearly half of energy CEOs (27%) have indicated ESG reporting as a top priority for future measurement and reporting processes.

However, nearly half (46%) of the CEOs state their single biggest challenge is crafting their ESG narrative in a compelling fashion and that this is most critical for keeping employees engaged. Over half (56%) report their pay is already tied to ESG performance with 85% indicating the annual bonus as the key mechanism.

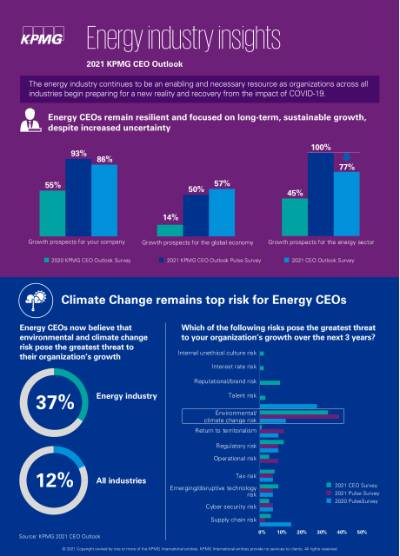

With such a pivotal moment ahead, it should come as no surprise that more than a third of energy leaders (37%) now view climate risk as the greatest threat to their organization’s growth. This was substantially higher than any other industry surveyed. As energy CEOs navigate a path forward during this time of transition and uncertainty, the vast majority of the them would like to see climate risk concerns addressed on the world stage, with 79% believing world leaders must inject the necessary urgency in the climate agenda when they meet for the upcoming COP26 world summit.

Shifting sentiments around talent

The energy industry has faced talent and skill shortages before, but there’s a sense that the sector is headed toward a potential talent crisis, with 29% of CEOs saying recruiting and retaining employees is their number one operational priority over the next 3 years. Attracting talent also appears to be driving up recruitment, with most (86%) of energy leaders planning to increase their headcount over the same period.

The acceleration in new working practices and a greater focus on well-being is also driving energy CEOs to think differently about talent. Almost half (43%) of respondents recognize focusing on employees’ mental health and well-being as key success factors to ensure employees are engaged, motivated, and productive in a world where hybrid working is increasingly common.

Turning to technology for unlocking long-term growth

To help unlock growth over the next 3 years, 86% of energy CEOs see technological disruption as more of an opportunity than a threat. This indicates a potentially strong sense of optimism around tech innovation and the impacts to come.

Collaboration is also playing a key role in driving the industry’s focus, with more than half (59%) of CEOs planning to join industry consortia focused on development of innovative technologies and more than a third (37%) looking to collaborate with innovative start-ups, such as FinTech, InsurTech and HealthTech firms. Meanwhile, 50% of CEOs are looking to set up their own accelerator or incubator programs.

Contact us

Explore more

About KPMG’s CEO Outlook

Now in its seventh year, the KPMG CEO Outlook provides an in-depth three-year outlook from thousands of global executives on enterprise and economic growth.

The report covers 1,325 CEOs in 11 key markets (Australia, Canada, China, France, Germany, India, Italy, Japan, Spain, UK and US) and 11 key industry sectors (asset management, automotive, banking, consumer and retail, energy, infrastructure, insurance, life sciences, manufacturing, technology, and telecommunications).

A third of the companies surveyed have more than US$10B in annual revenue, with no responses from companies under US$500M. The survey was conducted between 29 June and August 6.

NOTE: some figures may not add up to 100 percent due to rounding.