New ministerial regulation increases Thai Social Security wage ceiling under Section 33, effective from 2026

The Ministry of Labor has issued a new ministerial regulation which prescribes adjustments to the maximum wage ceiling for calculating Social Security Fund contributions for insured employees under Section 33 of the Social Security Act B.E. 2533.

Key highlights

Effective date

This regulation will be effective from 1 January 2026 onwards.

Maximum wage base adjustment

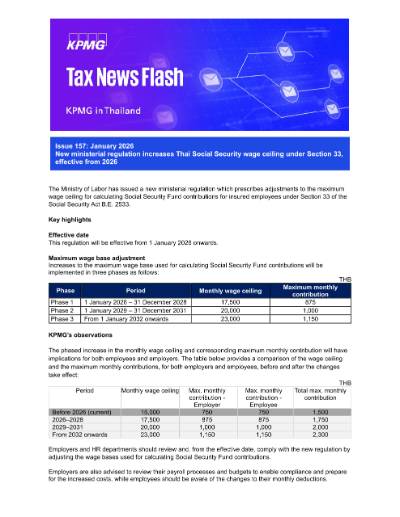

Increases to the maximum wage base used for calculating Social Security Fund contributions will be implemented in three phases as follows:

THB

Phase |

Period |

Monthly wage ceiling |

Maximum monthly contribution |

Phase 1 |

1 January 2026 – 31 December 2028 |

17,500 |

875 |

Phase 2 |

1 January 2029 – 31 December 2031 |

20,000 |

1,000 |

Phase 3 |

From 1 January 2032 onwards |

23,000 |

1,150 |

KPMG’s observations

KPMG’s observations

The phased increase in the monthly wage ceiling and corresponding maximum monthly contribution will have implications for both employees and employers. The table below provides a comparison of the wage ceiling and the maximum monthly contributions, for both employers and employees, before and after the changes take effect:

THB

Period |

Monthly wage ceiling |

Max. monthly contribution - Employer |

Max. monthly contribution - Employee |

Total max. monthly contribution |

Before 2026 (current) |

15,000 |

750 |

750 |

1,500 |

2026–2028 |

17,500 |

875 |

875 |

1,750 |

2029–2031 |

20,000 |

1,000 |

1,000 |

2,000 |

From 2032 onwards |

23,000 |

1,150 |

1,150 |

2,300 |

Employers and HR departments should review and, from the effective date, comply with the new regulation by adjusting the wage bases used for calculating Social Security Fund contributions.

Employers are also advised to review their payroll processes and budgets to enable compliance and prepare for the increased costs, while employees should be aware of the changes to their monthly deductions.

Please feel free to contact us if you have any questions or require any assistance.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia