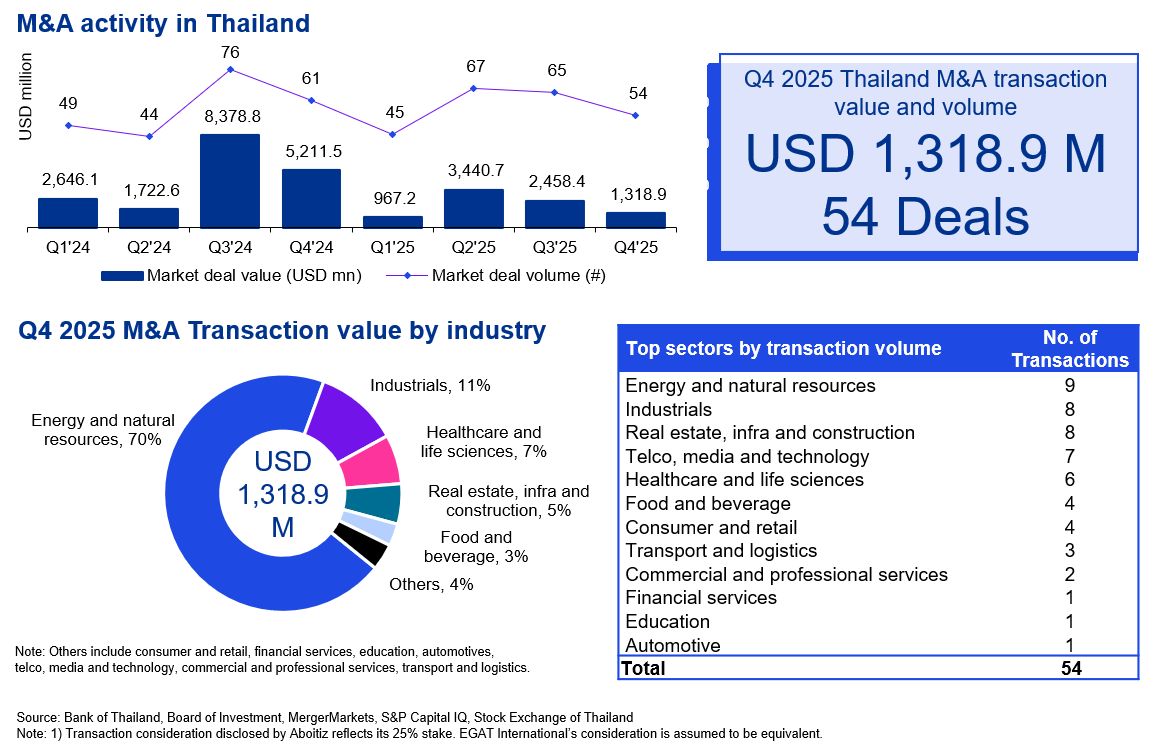

Q4 2025 Thailand M&A activity slowed further, reflecting a more cautious deal environment amid macroeconomic and political uncertainty. Compared with the previous quarter, total deal volume declined from 65 to 54 transactions, while aggregate deal value decreased by 46.4% from USD 2.5 billion to USD 1.3 billion. The quarter comprised 13 inbound, 10 outbound and 31 domestic deals, representing 39.0%, 39.0%, and 22.0% of total deal value, respectively.

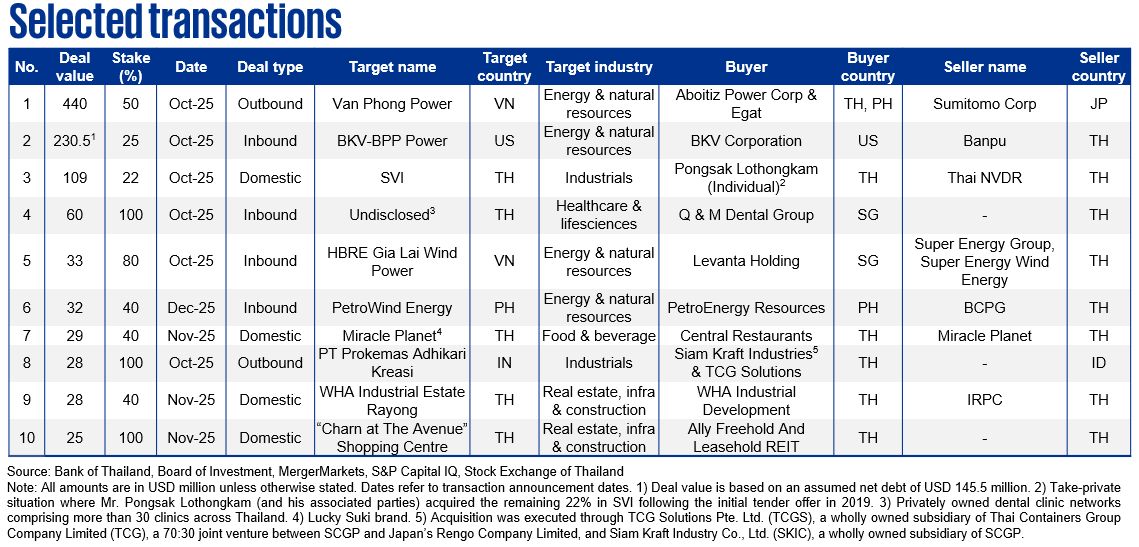

The sector with the greatest deal activity and value was energy and natural resources, with 9 deals representing 70.0% of total deal value. The largest deal in this quarter was the acquisition of a 50.0% stake in Van Phong Power Co Ltd, a Vietnam-based coal-fired power plant operator, by Aboitiz Power Corp of the Philippines and EGAT International Co Ltd of Thailand., who each acquired a 25.0% stake from Sumitomo Corporation. The total consideration was USD 440.0 million1. This transaction is part of Aboitiz Power’s renewable investment program to ensure a balanced long-term energy transition and EGAT’s strategy to enhance energy supply and pursue energy transformation initiatives in Asia.

In this quarter, KPMG in Thailand acted as lead sell-side advisor to a Thailand-based chemical manufacturing company serving the tannery, automotive and luxury goods industry, in connection with its share divestment to a leading chemical producer from China. Additionally, KPMG provided financial due diligence, tax due diligence and advice on completion accounts services to Proterra Investment Partners Asia in connection with its majority acquisition of Lanna Agro Industry Ltd. (“LACO”), a leading Thai manufacturer and producer of frozen edamame and snacks.

Macroeconomic conditions continued to shape deal activity towards the end of 2025. Softer domestic demand and weaker service sector momentum weighed on business sentiment, while a stronger Thai baht increased acquisition costs for inbound buyers. At the same time, the Bank of Thailand’s 25bps policy rate cut in December 2025, alongside targeted government stimulus measures including the THB 122 billion small‑loan relief program and consumption schemes such as Kohn La Khrueng and Tiew Dee Mee Kuen, helped stabilize liquidity conditions and support the medium-term outlook. These measures provide a basis for steady economic activity and a more supportive environment for medium to long term deal flow.

Looking ahead, political uncertainty following the dissolution of the House and the upcoming February 2026 elections may continue to delay transaction execution, particularly for larger strategic investments. Nevertheless, corporates and sponsors remain active in evaluating opportunities, with Board of Investment incentives across electronics, electric vehicles and advanced manufacturing expected to underpin deal flow as market conditions improve.

Data criteria

- Aggregate deal values include only transactions with disclosed consideration. Deal values are available for approximately 25-35% of announced transactions, while certain private transactions are not publicly announced and therefore excluded from the dataset.

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million.

- Deals are included in their respective industry sector based on the industry of the target’s business.

- Deal value represents the publicly disclosed equity consideration for the acquired stake.

- All deals included have been announced but may not necessarily have closed.

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected.

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia