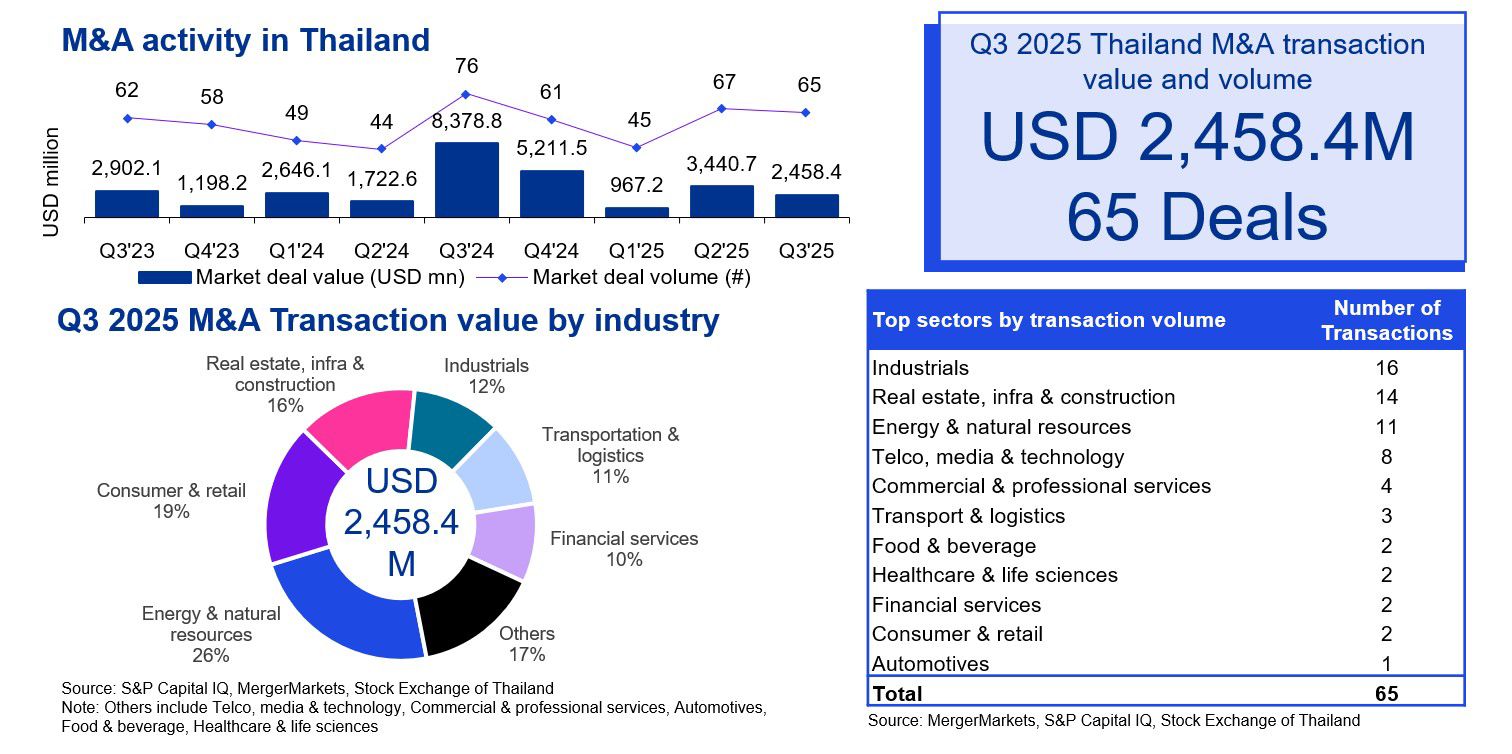

M&A activity in Q3 2025 saw a decline in both deal volume and value. Compared with the previous quarter, the number of transactions declined from 67 to 65 deals, while deal value decreased by 26.5% from USD 3.4 billion to USD 2.5 billion. There were 20 inbound, 7 outbound and 38 domestic deals, representing 31.3%, 41.4%, and 27.3% of total deal value for the quarter, respectively.

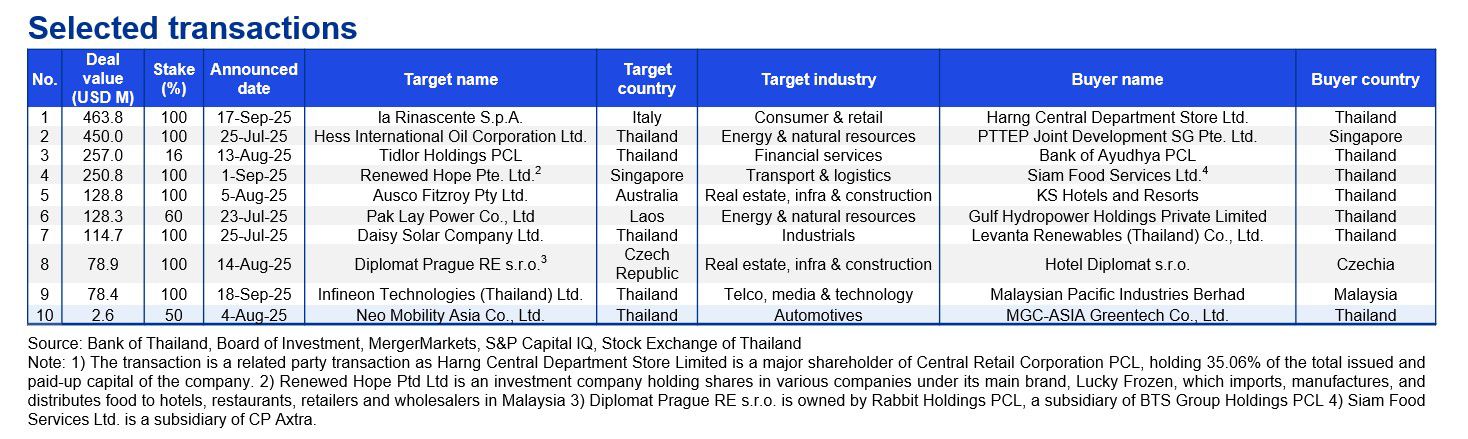

The sector with the greatest deal activity was Industrials, with 16 deals representing 12% of total deal value. Energy & Natural resources saw the greatest deal value, with 11 deals representing 26% of total deal value. The largest deal in this quarter was the acquisition of la Rinascente S.p.A, a high-end Italian department store chain, by Harng Central Department Store Limited1 from Central Retail Corporation PCL. The consideration was USD 463.9 million, which included a shareholder loan repayment of approximately USD 164.1 million.

In this quarter, KPMG in Thailand acted as lead sell-side financial advisor to Arun Plus Co., Ltd., an EV solutions provider and subsidiary of PTT PCL, in the partial divestment of its stake in Neo Mobility Asia Co., Ltd., a distributor and dealer of XPENG EV vehicles, to its joint venture partner Millenium Group Corporation (Asia) PCL. Additionally, KPMG provided financial and tax advisory services to LINE MAN Wongnai in connection with the acquisition of Lamunpun IT Co., Ltd. (JERA Cloud), a cloud and POS solutions provider for beauty and wellness businesses in Thailand, allowing LINE MAN Wongnai to expand its POS business beyond the restaurant sector.

According to the NESDC, Thailand’s Q2 2025 GDP grew by 0.6%, decelerating from 0.7% in Q1 2025. Slowdown in GDP growth was attributable to the reduced activity in the services sector, especially tourism-related, as the number of foreign tourists decreased 25.3% compared with Q1, and 12.2% with Q2 2024. Additionally, the reported number of Chinese visitors between 1 January and 22 September 2025 of 3.3 million was down 35% compared with the same period in 2024. The appreciation of the Thai baht also contributed to the slowdown in the tourism industry. Meanwhile, the Bank of Thailand (BoT) reported stable household debt at 16.31 trillion baht in Q2 2025. In Q3 2025, the BoT cut the policy rate by 25bps to 1.50% due to weak demand and deflation of -0.3% in Q2 2025. The NESDC expects full year 2025 inflation rates to be only 0.0–0.5%, compared to the original targeted range of 1.0–3.0%. On the export front, Thailand has secured a 19% tariff rate with the United States, down from 36% and now aligned with its ASEAN peers. Nevertheless, political uncertainty remains a key consideration for investors considering deals in Thailand, with a general election scheduled by April 2026. New policy priorities are focused on easing the cost of living, addressing high household debt, stimulating tourism and managing the strong baht.

Overall, the economic outlook remains cautious yet poised for selective upside, with the BoT maintaining the policy rate at 1.5% and emphasizing that previous rate cuts are still working their way through the economy. Globally, weakened manufacturing activity in Europe and sluggish demand in the global oil market point to an uncertain outlook for global economic activity. When combined with current domestic trends, these factors may signal a potential slowdown in overall deal activity in Thailand and internationally.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals.

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million.

- All deals included have been announced but may not necessarily have closed.

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected.

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia