Key updates

After months of extensive negotiations between the Thai government and the US trade representative, the US government issued an executive order titled “Further Modifying the Reciprocal Tariff Rates” on 31 July 2025 (Eastern Standard Time (EST)), announcing a new set of reciprocal tariffs. Under this Order, the tariff rate imposed on Thailand has been reduced from the previously announced 36% (as of 7 July 2025) to 19%. This revised rate will take effect at 12:01 a.m. (EST) on 7 August 2025. Based on the executive order, the US secretary of commerce and the US trade representative will conduct continuous monitoring in connection with the tariff measures and may recommend additional actions to the US president, including possible adjustments to the tariff rates.

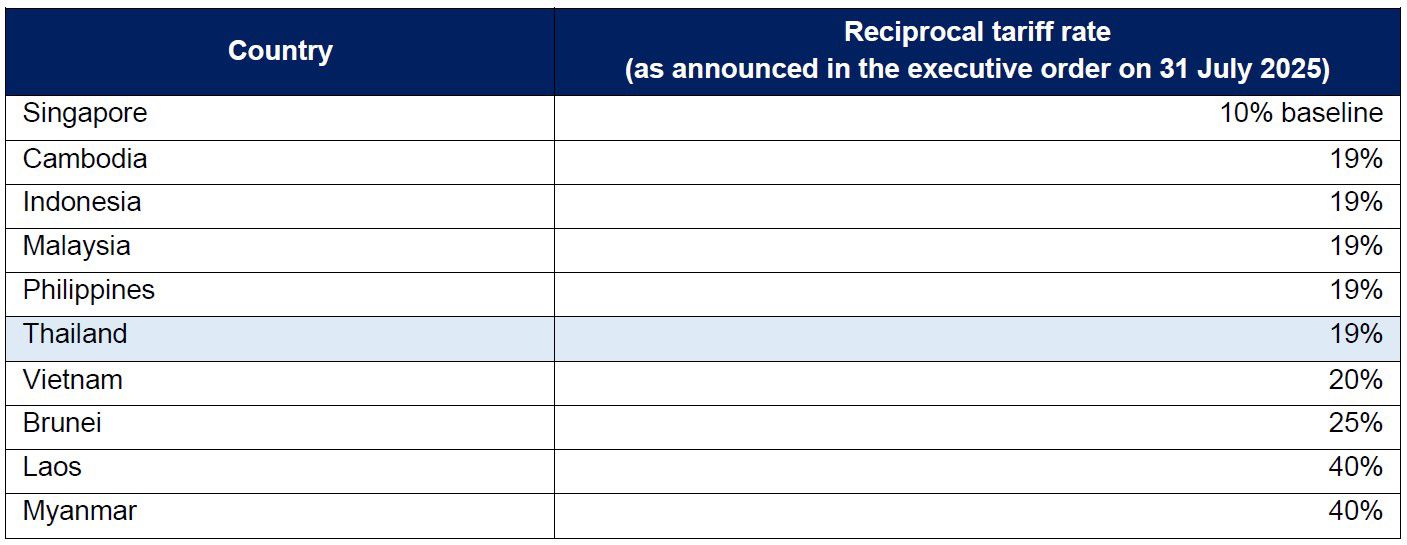

Among ASEAN countries, the following rates have been imposed:

This positions Thailand competitively within the ASEAN region, particularly among its neighboring countries.

Transshipment through third countries

In the same executive order, the US Customs and Border Protection (CBP) has introduced a punitive 40% duty rate on goods determined to have been routed through third countries to evade reciprocal tariffs. This 40% rate will apply in lieu of (i.e. replace) the original reciprocal tariff rate that would otherwise apply to goods from the country of origin.

Additionally, the secretary of commerce and the secretary of homeland security, in coordination with CBP and the US trade representative, will publish a list every six months identifying countries and specific facilities used in circumvention schemes. This list is intended to inform public procurement, national security reviews and commercial due diligence.

Key US trade negotiation highlights with other countries

Below is a high-level summary of recent US trade negotiations with key partners outside of ASEAN:

- US – China: The US has agreed to temporarily reduce tariffs to a combined 30% (which includes a 20% fentanyl tariff and 10% reciprocal tariff). Discussions are ongoing regarding a possible extension of the 90-day window post 12 August 2025.

- US – Canada: A 35% tariff under International Emergency Economic Powers Act (IEEPA) has been imposed on Canadian goods effective 1 August 2025, citing Canada’s failure to adequately cooperate in addressing the inflow of fentanyl and other illicit drugs. Goods that qualify under the United States–Mexico–Canada Agreement (USMCA) remain exempt from these tariffs.

- US – European Union (EU): The US has announced a 15% reciprocal tariff on EU goods (including autos and auto parts, pharmaceuticals and semiconductors), with certain products exempted. In return, the EU will, among other things, purchase US energy and invest in the US.

- US – India: A 25% reciprocal tariff has been imposed on imports from India, effective 1 August 2025. A penalty has also been announced, though specific details have not yet been released by the US government.

- US – South Korea: A 15% reciprocal tariff will apply to a range of Korean goods, including automobiles and automotive parts. In response, South Korea has agreed to increase investment in the US, particularly in the shipbuilding sector.

- US – Japan: The US will apply a 15% tariff on Japanese goods. In response, Japan has committed to increase imports of US rice and investment in the US.

Thailand’s key commitments to the US

As for Thailand, the key commitments proposed by the Thai government, based on the latest news, are as follows:

- Tariff exemptions for US goods: Approximately 90% of tariff lines (~10,000 items) will be exempted from import duties. These include goods that are not produced domestically or for which supply is insufficient, such as medical instruments, advanced automotive components and specialized food products.

- Reduction of non-tariff barriers (NTBs): Thailand will relax certain sanitary and phytosanitary (SPS) measures, customs procedures and product certification requirements for US imports. A post-clearance audit system will be introduced to allow goods to be released prior to inspection, with the objective of expediting customs clearance.

- Opening of the Eastern Economic Corridor (EEC) and infrastructure projects: Thailand will grant fast-track services and Board of Investment (BOI) incentives to US companies investing in the clean energy, semiconductor/ICT and logistics sectors.

- Procurement of US energy and aircraft: The Thai public and private sectors will jointly increase procurement of liquefied natural gas (LNG) and US-made aircraft (i.e. Boeing).

- Commitment to reduce the trade surplus: Thailand has pledged to reduce its trade surplus with the United States by 70% within three to five years.

- Stricter origin verification rules: Thailand will adopt stricter origin verification rules to prevent transshipment or circumvention of origin requirements.

- Temporary relief from digital services tax: Thailand will offer US tech companies, such as AWS and Google Cloud, a temporary reduction of the digital/cloud service tax.

- Expanded agricultural quotas: Thailand will increase import quotas for US corn, barley and soybeans.

- Tariff retention on strategic sectors: Import duties will be maintained on essential commodities such as rice, sugar, processed fruits and other goods from Thailand’s competitive agri-food sector, in order to protect domestic producers and farmers.

- Commitment to regional stability: As part of broader diplomatic assurances, Thailand has reaffirmed its adherence to the Thai-Cambodian ceasefire, supporting regional peace and economic stability.

KPMG in Thailand has extensive experience in helping Thai and foreign MNEs navigate major changes in the tariff landscape and reduce the impacts on their supply chains. If you have any questions or would like to discuss how the tariffs volatility may affect your business, please feel free to contact us.

Kindly note that this Tax News Flash is based on publicly available information as of 1 August 2025 (GMT+7). We recommend monitoring official channels for updates or changes. For consistency purposes, all dates mentioned above are in EST unless otherwise specified.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Why work with KPMG in Thailand

KPMG in Thailand, with more than 2,500 professionals offering Audit and Assurance, Legal, Tax, and Advisory services, is a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.