Capital market performance

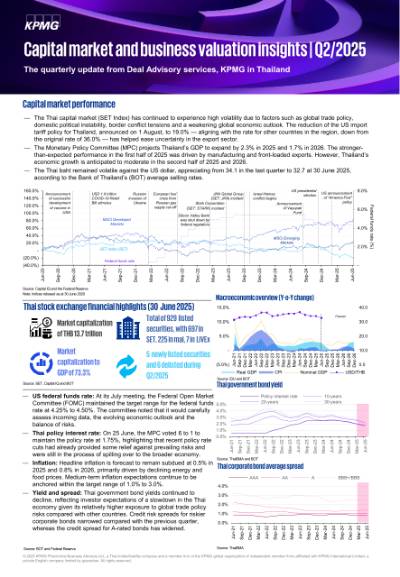

- The Thai capital market (SET Index) has continued to experience high volatility due to factors such as global trade policy, domestic political instability, border conflict tensions and a weakening global economic outlook. The reduction of the US import tariff policy for Thailand, announced on 1 August, to 19.0%—aligning with the rate for other countries in the region, down from the original rate of 36.0%—has helped ease uncertainty in the export sector.

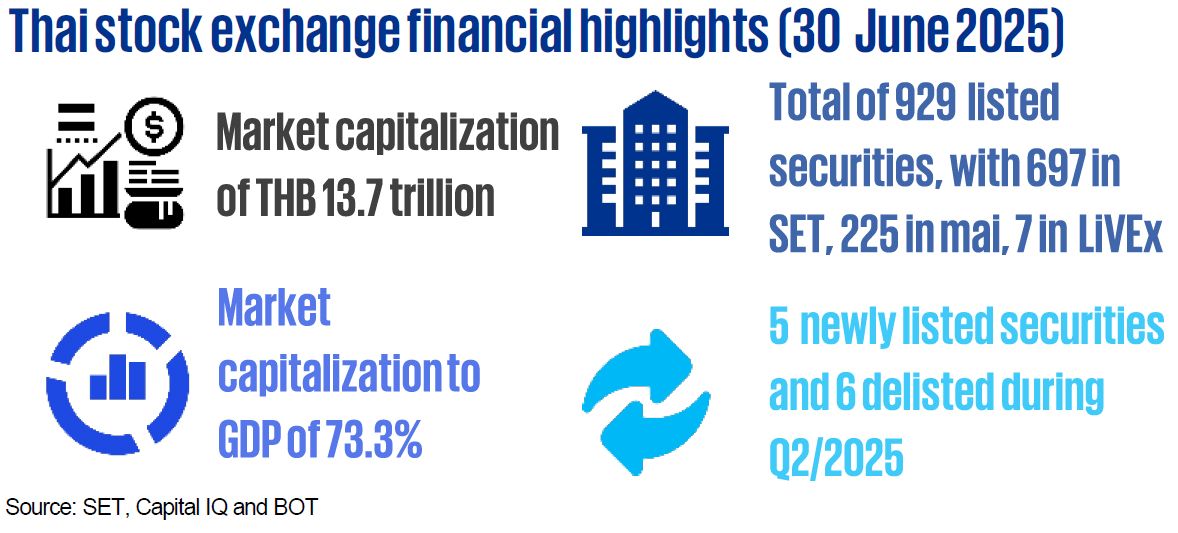

- The Monetary Policy Committee (MPC) projects Thailand’s GDP to expand by 2.3% in 2025 and 1.7% in 2026. The stronger-than-expected performance in the first half of 2025 was driven by manufacturingand front-loaded exports. However, Thailand’s economic growth is anticipated to moderate in the second half of 2025 and2026.

- The Thai baht remained volatile against the US dollar, appreciating from 34.1 in the last quarter to 32.7 at 30 June 2025, according to the Bank of Thailand’s (BOT) average selling rates.

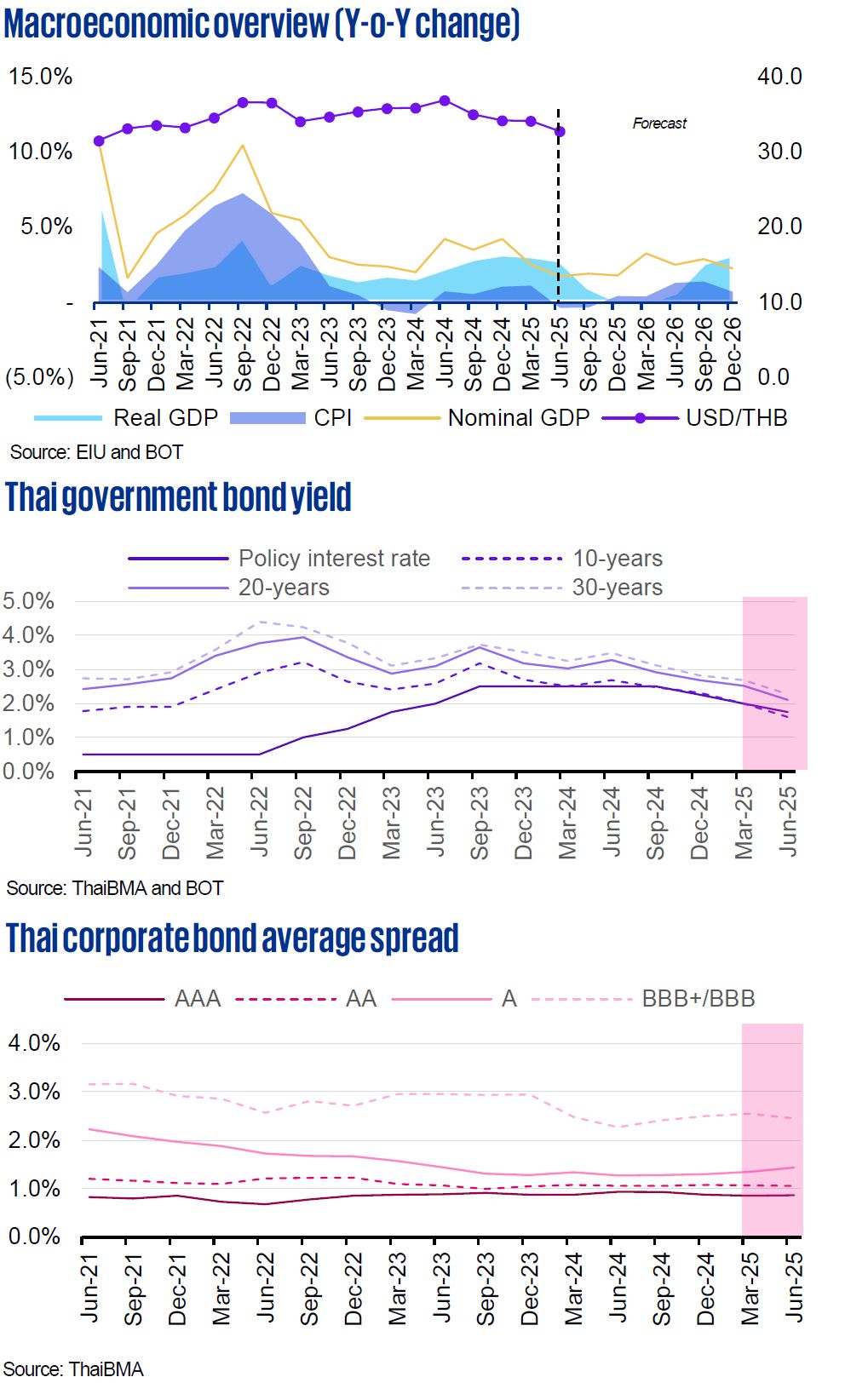

- US federal funds rate: At its July meeting, the Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate at 4.25% to 4.50%. The committee noted that it would carefully assess incoming data, the evolving economic outlook and the balance of risks.

- Thai policy interest rate: On 25 June, the MPC voted 6 to 1 to maintain the policy rate at 1.75%, highlighting that recent policy rate cuts had already provided some relief against prevailing risks and were still in the process of spilling over to the broader economy.

- Inflation: Headline inflation is forecast to remain subdued at 0.5% in 2025 and 0.8% in 2026, primarily driven by declining energy and food prices. Medium-term inflation expectations continue to be anchored within the target range of 1.0% to 3.0%.

- Yield and spread: Thai government bond yields continued to decline, reflecting investor expectations of a slowdown in the Thai economy given its relatively higher exposure to global trade policy risks compared with other countries. Credit risk spreads for riskier corporate bonds narrowed compared with the previous quarter, whereas the credit spread for A-rated bonds has widened.

Source: BOT and Federal Reserve

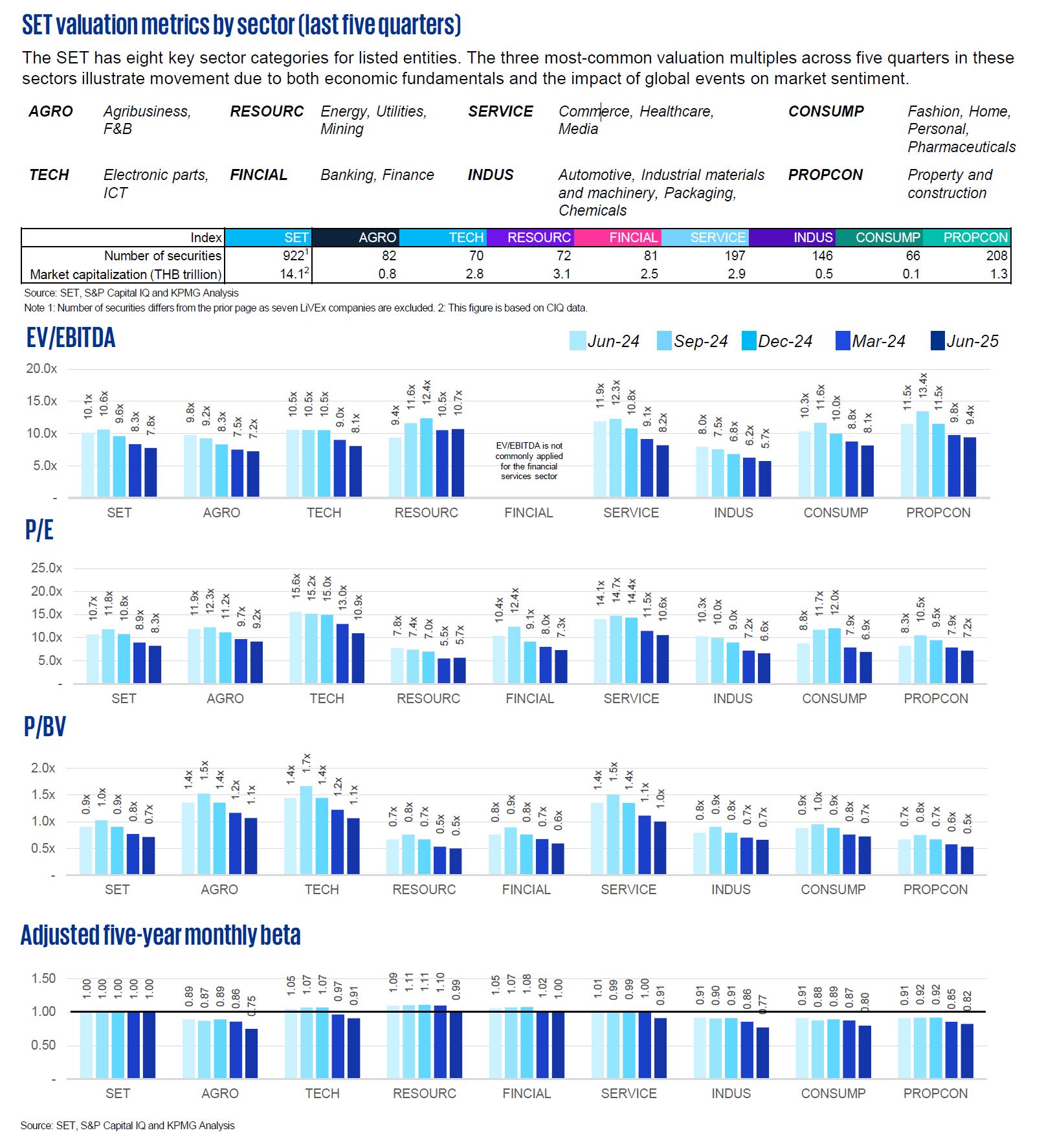

SET valuation metrics by sector (last five quarters)

The SET has eight key sector categories for listed entities. The three most-common valuation multiples across five quarters in these sectors illustrate movement due to both economic fundamentals and the impact of global events on market sentiment.

The multiples in Q2/2025 decreased compared with previous quarters across nearly all sectors, reflecting the overall stock market decline and increased market uncertainty.

Sector beta represents the undiversified risk of a sector. The higher the beta, the riskier it is for that specific sector. The betas have notably declined across all sectors.

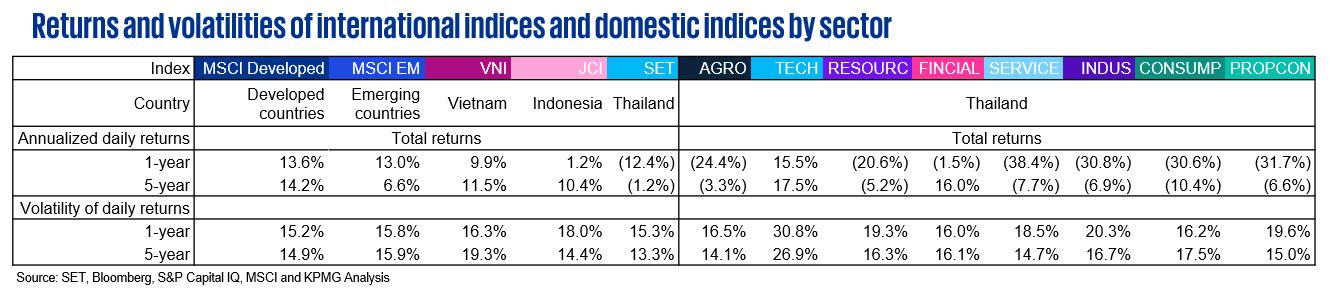

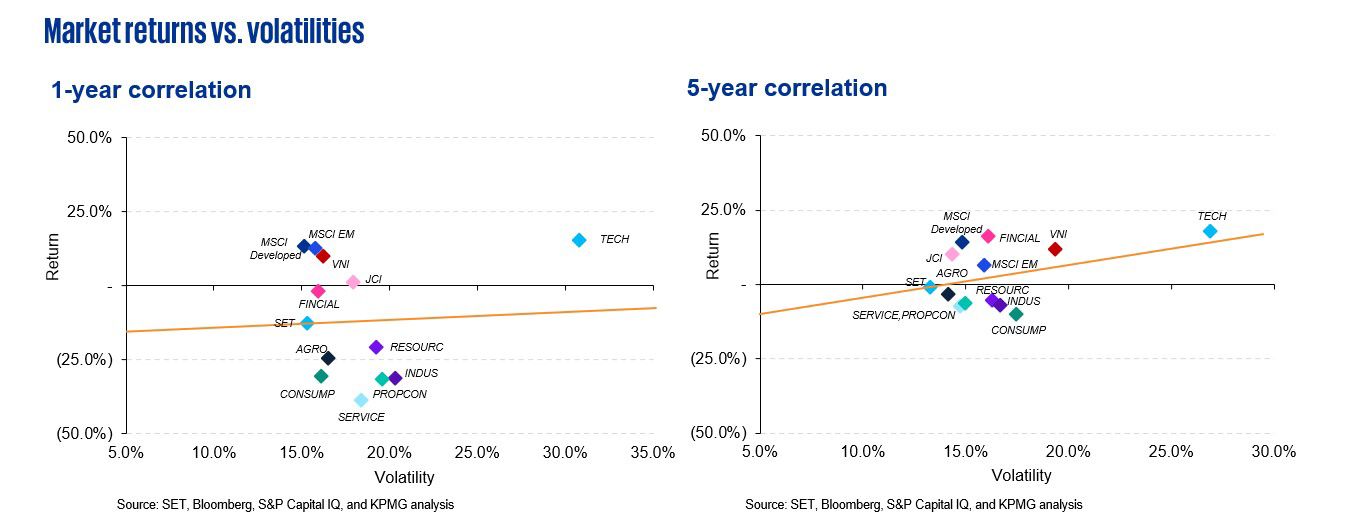

- Over both the one-year and five-year evaluation periods, the SET has continued to deliver lower returns compared to other indices. Within Thailand, the TECH sector remains the top performer across both timeframes, while the service sector recorded the lowest annualized return over the one-year period. The consistent volatility of daily returns across all market indices highlights uncertainty in the global equity market.

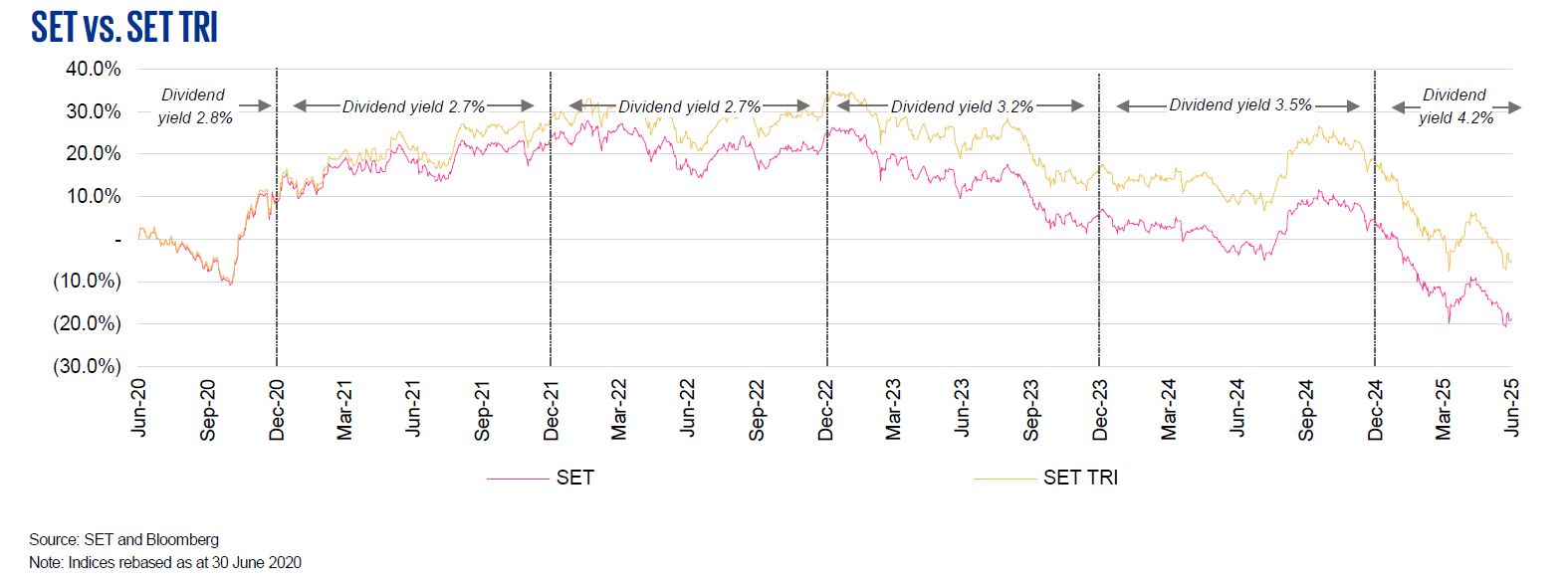

- Total return index (TRI) is an index that measures the total return from investing in securities. It comprises: (1) a return arising from the change in value of the securities or “capital gain/loss”; and (2) dividends paid, assuming they are reinvested in the securities.

- The dividend yield for 2025 continues to remain high, as the overall stock market experienced a decline in the first half of this year, ahead of an expected downturn in corporate financial performance.

Data criteria

Thailand valuation multiples by sector

- The SET sector classification serves as the principal criterion for the illustrated sectors.

- The sector valuation multiples and beta are based on the respective median.

- 12-month trailing multiples are derived from Q2/2024 to Q2/2025.

- The Q2/2025 multiple is based on the latest available financial statement information as at Q1/2025.

- Data in historical periods may change according to Capital IQ’s retrospective adjustments.

Regression on returns and volatilities

- The total number of trading days per year is assumed to be 252 days.

- The period in the study is 1 July 2020 to 30 June 2025.

SET and SET TRI

- Annual dividend yields are based on dividend yields from Bloomberg.

KPMG Deal Advisory

"KPMG provides a full range of valuation services for all sell-side, buy-side, tax restructuring, fund raising, and joint venture transactions."

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia