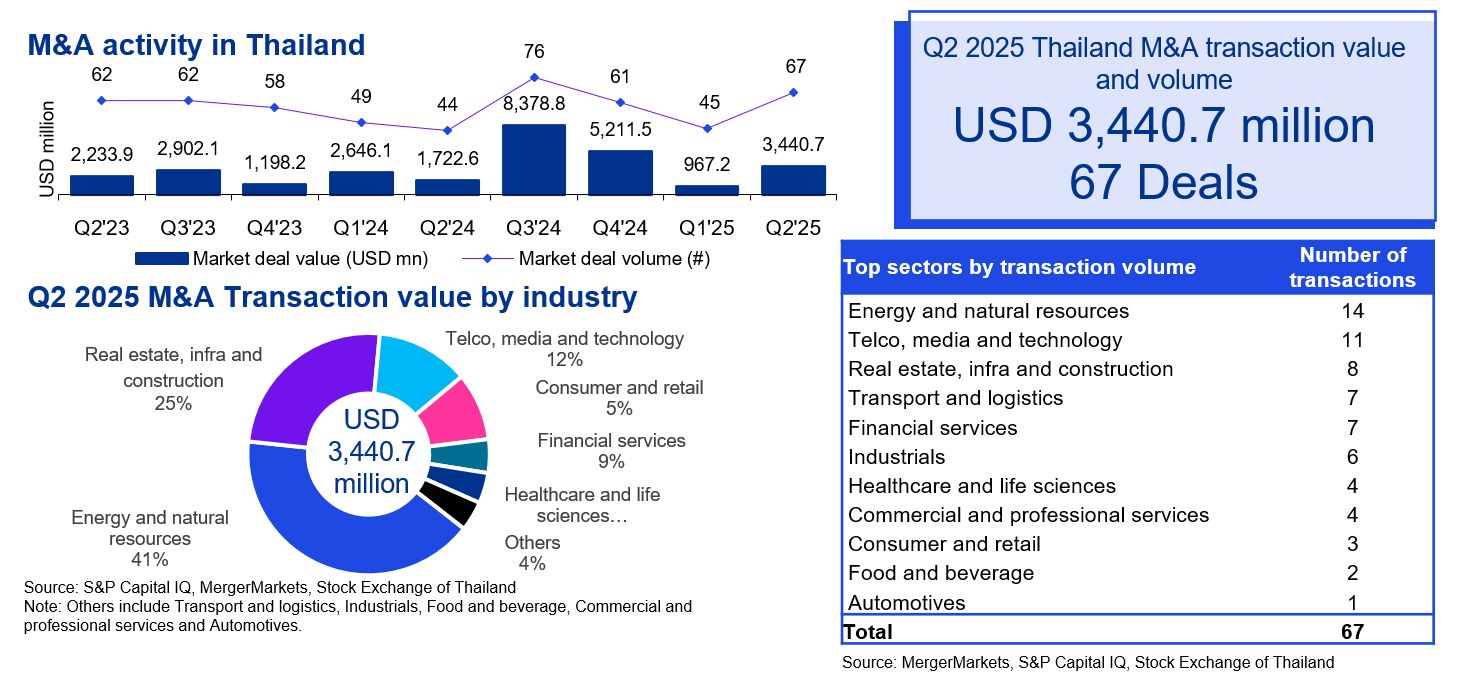

M&A activity in Q2 2025 saw growth in deal volume and value. Compared with the previous quarter, total transaction volume increased from 45 to 67 deals, while deal value increased by 255.7% from USD 1.0 billion to USD 3.4 billion. There were 12 outbound, 21 inbound and 34 domestic deals, representing 59.3%, 7.4% and 33.3% of total deal value for the quarter, respectively.

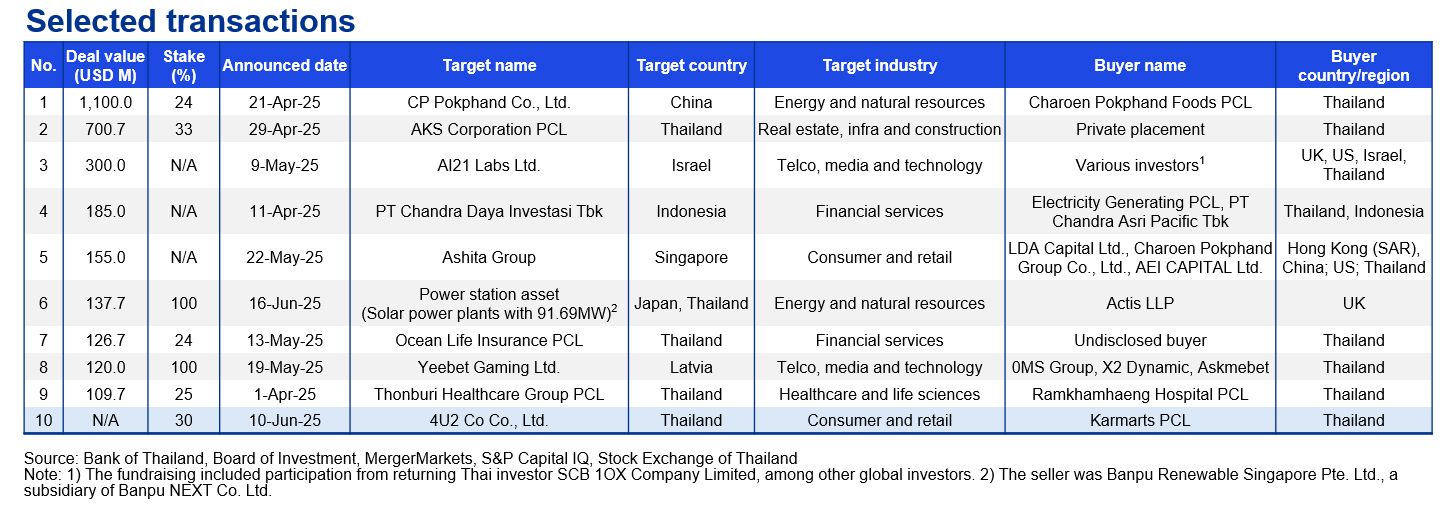

The sector with the largest deal activity and value was energy and natural resources, recording 14 deals and representing 41% of the total deal value in Q2. The largest deal was Charoen Pokphand Foods PCL's acquisition of the remaining 23.8% stake in CP Pokphand Co., Ltd. from its partner, Itochu Corporation. This transaction, valued at USD 1.1 billion, solidified Charoen Pokphand Foods PCL as the sole owner of the China-based company engaged in animal feed manufacturing.

This quarter, KPMG in Thailand acted as the lead sell-side advisor to the shareholders of 4U2 Co Co., Ltd. (4U2), a leading cosmetic brand in Thailand, facilitating the divestment of a 30% minority stake to Karmarts PCL, a prominent player in the beauty and personal care sector. The acquisition was part of a strategic move for both companies, to realize synergies and accelerate growth in Thailand’s competitive cosmetics market. In addition, KPMG provided transaction advisory services to Ramkhamhaeng Hospital PCL on their acquisition of an additional 25% stake in Thonburi Healthcare Group PCL.

According to the NESDC, Thailand’s GDP grew by 0.7% in Q1 2025 compared to Q4 2024.The Bank of Thailand (BOT) reported household debt fell to 87.4% of GDP or THB 16.35 trillion in Q1 2025, from THB 16.42 trillion in Q4 2024. Furthermore, the BOT cut interest rates to 1.75% this quarter, the lowest in two years. Domestically, the economy faces tightened credit conditions, a slowdown in tourism and vulnerability to trade disruptions from reliance on Chinese imports. Foreign tourist arrivals dropped by approximately 3% from January to May 2025 amid geopolitical concerns. The United States will end its suspension of the 36% import tariff on Thai goods on 1 August 2025 but uncertainty regarding future rates continues. Meanwhile, ASEAN peers have secured more favorable trade terms, leaving Thailand at a potential disadvantage.

Thailand’s economic outlook remains uncertain. The World Bank cut its 2025 GDP growth forecast from 2.9% to 1.8% to reflect volatility, while the BOT expects inflation to stay low at 0.5%. Investment markets are expected to remain volatile due to increasing geopolitical tensions, domestic political instability and ongoing US tariff negotiations. To stimulate economic growth, the Thai cabinet has approved a fiscal stimulus of THB 115 billion, with 30% allocated towards job creation, and the remainder to the development of new roads, power infrastructure and related facilities. However, the stimulus must be approved by 30 September 2025, and recent domestic political instability may delay progress and dampen investor sentiment. Globally, trade disruptions and expected surging oil prices continue to pose risks.

Overall, although deal indicators signified meaningful improvements in deal activity for the quarter, with growth under pressure and a generally weak economic outlook, high household debt and declining tourist numbers, acquisitions driven by market expansion may be further hindered. In contrast, we see deal flow potentially shifting toward acquisitions of smaller-cap assets in search of operational improvements or divestitures to consolidate existing portfolios. Complementing this analysis, our latest 'Doing Deals in Thailand 2025' study furnishes an insightful evaluation of Thailand's current M&A climate, enriching the perspectives discussed in this newsletter.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals.

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million.

- All deals included have been announced but may not necessarily have closed.

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected.

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia