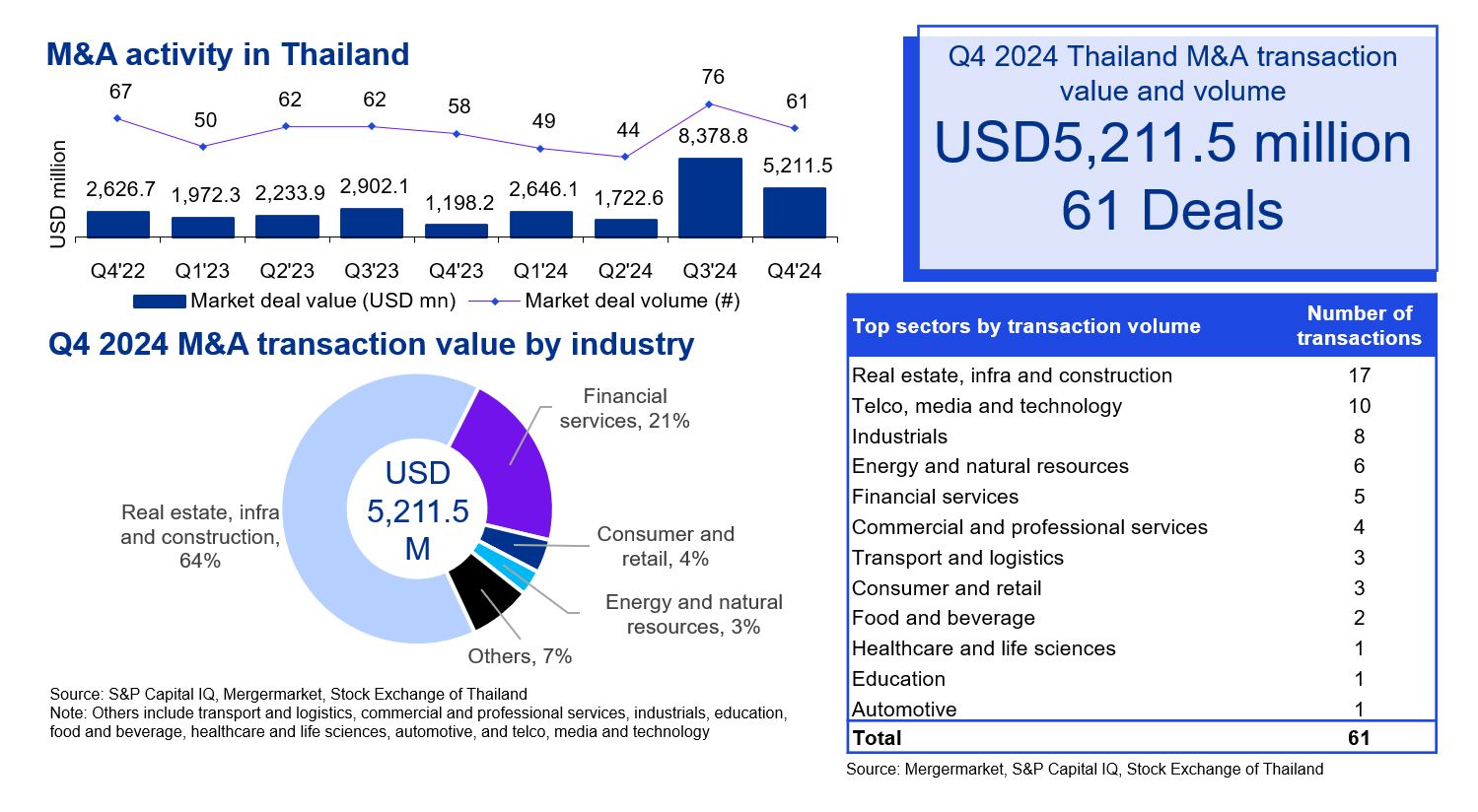

M&A activity in Q4 2024 saw a decline in both deal value (down 37.8%) and volume (down 19.7%) quarter-on-quarter, following last quarter’s mega deal between Gulf Energy Development, Intouch Holdings PCL and Singtel Strategic Investments. There were 18 inbound, 32 domestic and 11 outbound deals representing 12.0%, 9.0% and 79.0% of deal value, respectively. The sector that saw the greatest deal activity was real estate, infrastructure and construction, with 17 deals representing 64% of total deal value.

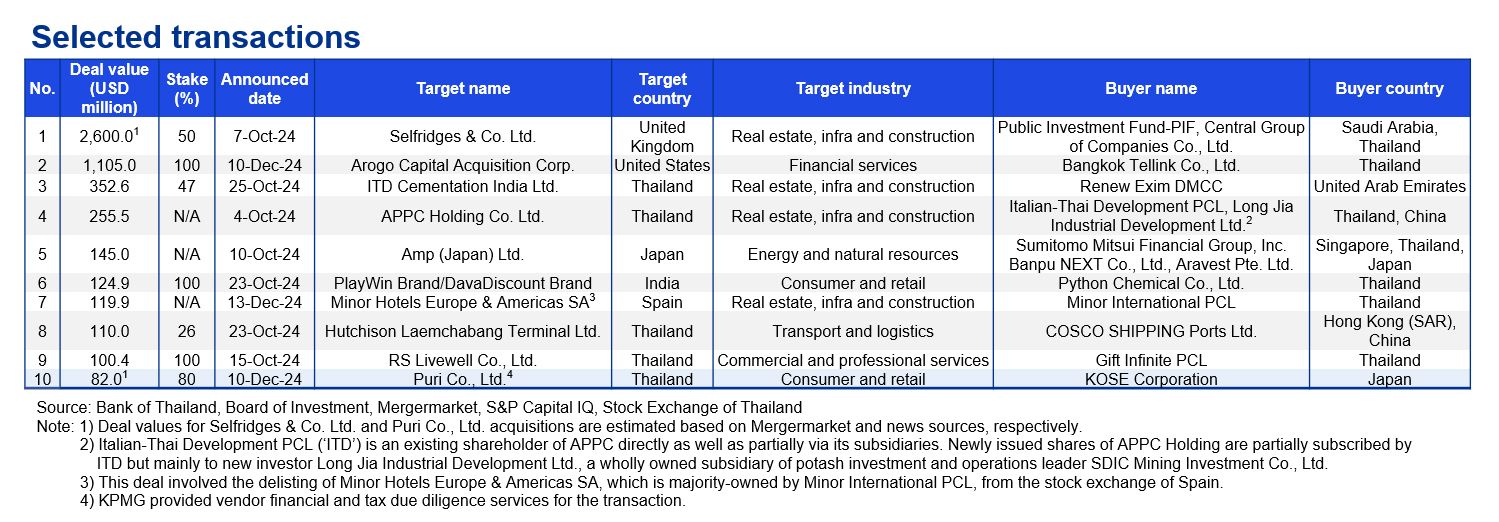

The largest deal this quarter was the buyout of UK department store operator Selfridges & Co. Ltd., by existing shareholder Central Group and Saudi Arabia’s Public Investment Fund (PIF), with a total investment of USD2.6 billion, establishing Central Group as Selfridges’ majority shareholder with a 60% stake in the group’s operating and property companies, following its initial acquisition of a 50% stake in 2021. The second-largest deal was the announced signing of a letter of intent to acquire Bangkok Tellink Co., Ltd. by a special purpose acquisition company (SPAC) for USD1.1 billion, which will fuel Bangkok Tellink’s US IPO prospects should the transaction ultimately close. Bangkok Tellink, founded in 2019 and operating under the “INFINITE” brand, is an emerging player in advanced telecommunications, mobile network technology and IoT solutions in Thailand.

In the food and beverage sector, KPMG served as the financial advisor to Freshket, a tech-enabled food supply distribution platform that raised USD8 million in funding. The round was joined by TFMAMA, Kliff Capital and other existing investors.

Thailand’s credit environment remains volatile, following the Bank of Thailand’s 0.25% policy rate reduction to 2.25% in October 2024, which occurred in the wake of the 0.5% cut by the United States Federal Reserve in September 2024. Thailand's economy is expected to grow by 2.7% in 2024, driven by the recovery of tourism, domestic spending, exports and year-end government stimuli. Headline inflation has been revised slightly downwards to 0.4% from the original forecast of 0.5%, primarily due to declining global energy prices. However, forecasts of economic indicators support the view of sustained growth, as the Fiscal Policy Office projects that private consumption and investment will increase by 3% and 2.8%, respectively, while GDP growth is expected to reach approximately 3%.

Foreign investment initiatives have attracted major companies: AirAsia is expected to invest USD100 million in the aviation sector for the construction of new aircraft maintenance, repair, and overhaul facilities in several airport locations. Additionally, Google plans to invest USD1 billion to build a data center within the region to meet growing cloud demand and to support AI adoption within Southeast Asia.

Given the supportive economic indicators and sustained interest from foreign investors, we anticipate continued stability with a positive outlook in M&A activity in Thailand through the next quarters.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals.

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30%, then the deal is included if the value is equal to or exceeds the equivalent of USD100 million.

- All deals included have been announced but may not necessarily have closed.

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected.

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia