GDP growth projection for the year increased marginally to 2.7% in the third quarter from the previous estimate of 2.6% (2.2%-3.2% range) by The Bank of Thailand (BOT). This adjustment was mainly driven by the increasing number of tourists. International arrivals are currently expected to reach 36.0 million in 2024, up from 35.5 million, bolstered by the expansion of the visa-free policy to include 93 countries. The tourism sector is also benefitting from increased spending per trip, reaching THB47.0k per foreign tourist. Additionally, private consumption is anticipated to rise due to income growth and government stimulus, along with an increase in exports driven by recovery in the global electronics market.

Inflation outlook remains stable, with the BOT expecting a gradual return to the target range (1.0%-3.0%) by the end of 2024. Headline inflation remains unchanged, with energy prices being revised down due to a reduction in the global crude oil price. Core inflation remained unchanged as well, while the labor market continued to improve. The trade balance improved to a surplus of USD5.8 billion, resulting from the significant improvement in electronics exports to the US and a supply shortage from other trading partners.

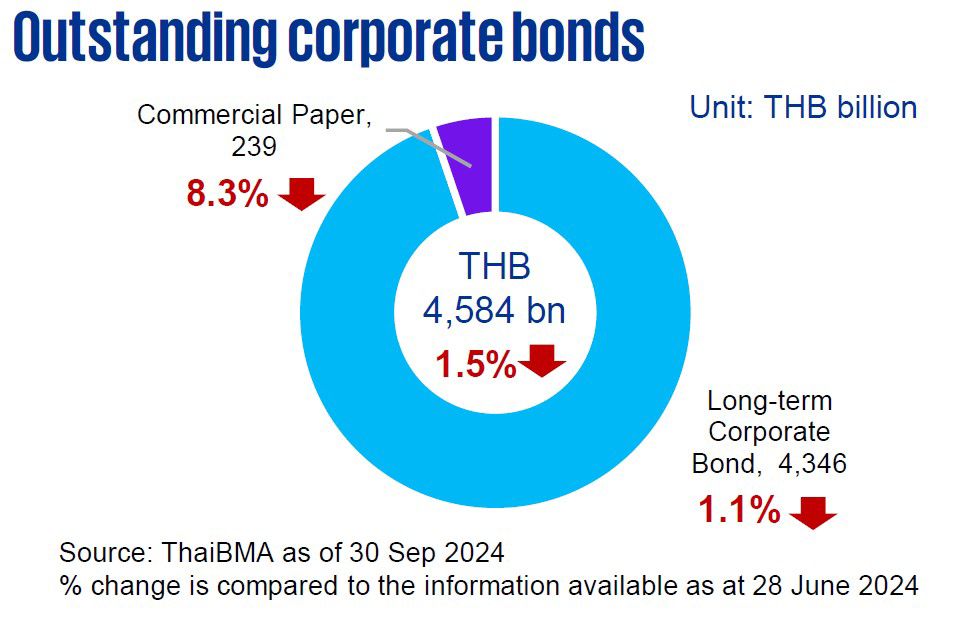

Even though Thailand’s economy continues to improve going into the fourth quarter, liquidity and the corporate bond market remain under pressure. The Thai Bond Market Association (ThaiBMA) reported total outstanding corporate bonds of THB4,584 billion as of September 2024, which is a 1.5% decrease from the data as of June 2024 and includes the combination of an 8.3% decrease in commercial paper and a 1.1% decrease in long-term corporate bonds. The corporate bond market value continues to decline due to investors’ remaining uncertainty regarding the corporate governance and profitability of high-yield bond issuers (rated BBB- and below). The majority of these issuers are listed companies that are either newly established, have high debt obligations or have unstable cash flow. These companies seek financing options that are cheaper than debt from financial institutions, and raising funds through high-yield bonds is a suitable solution. However, these companies must focus on operational excellence and effective cost management to ensure revenue-generating capabilities and profitability in order to gain investors’ confidence.

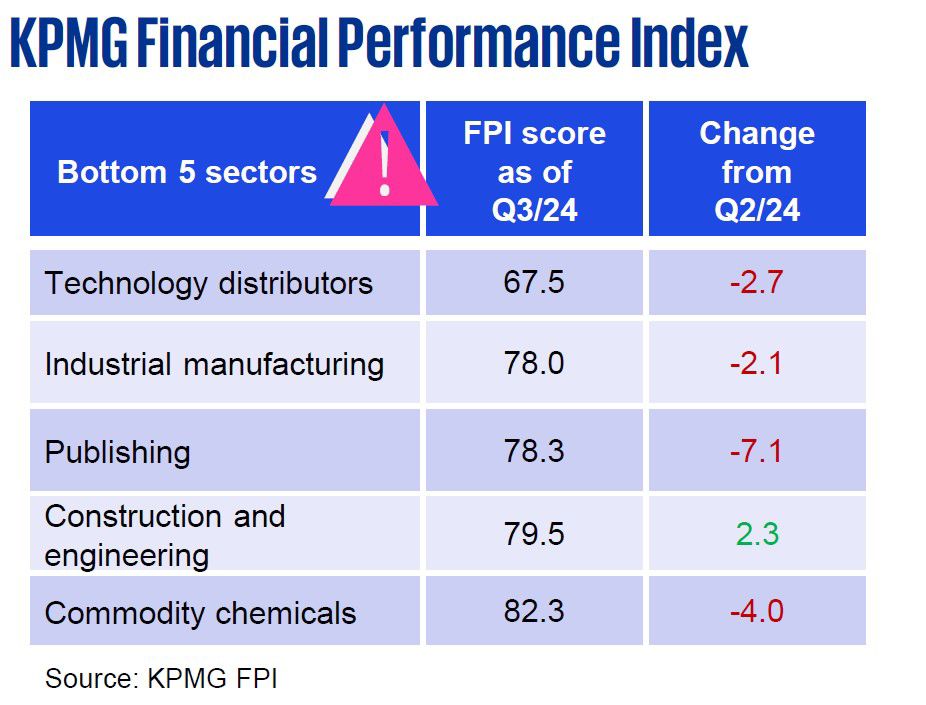

Based on the KPMG Financial Performance Index (KPMG FPI), which evaluates financial performance across industries, there were notable changes in the bottom five sectors as of the third quarter of 2024. The technology distributors sector became the weakest performer, with the lowest FPI score, largely due to sustained investments needed to adapt to rapidly evolving trends. Meanwhile, the industrial manufacturing and publishing sectors joined the bottom five, impacted by workforce reductions and concerns about news neutrality, respectively. In contrast, the construction and engineering sector has seen slight improvement, supported by the completion of government procurement contracts tied to the FY2024 Budget.

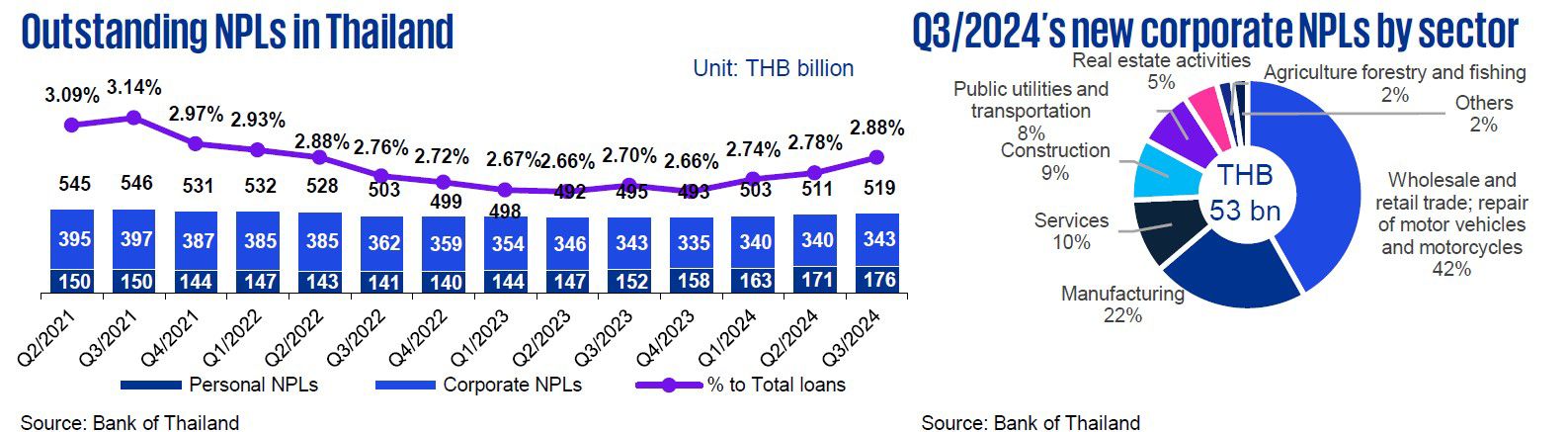

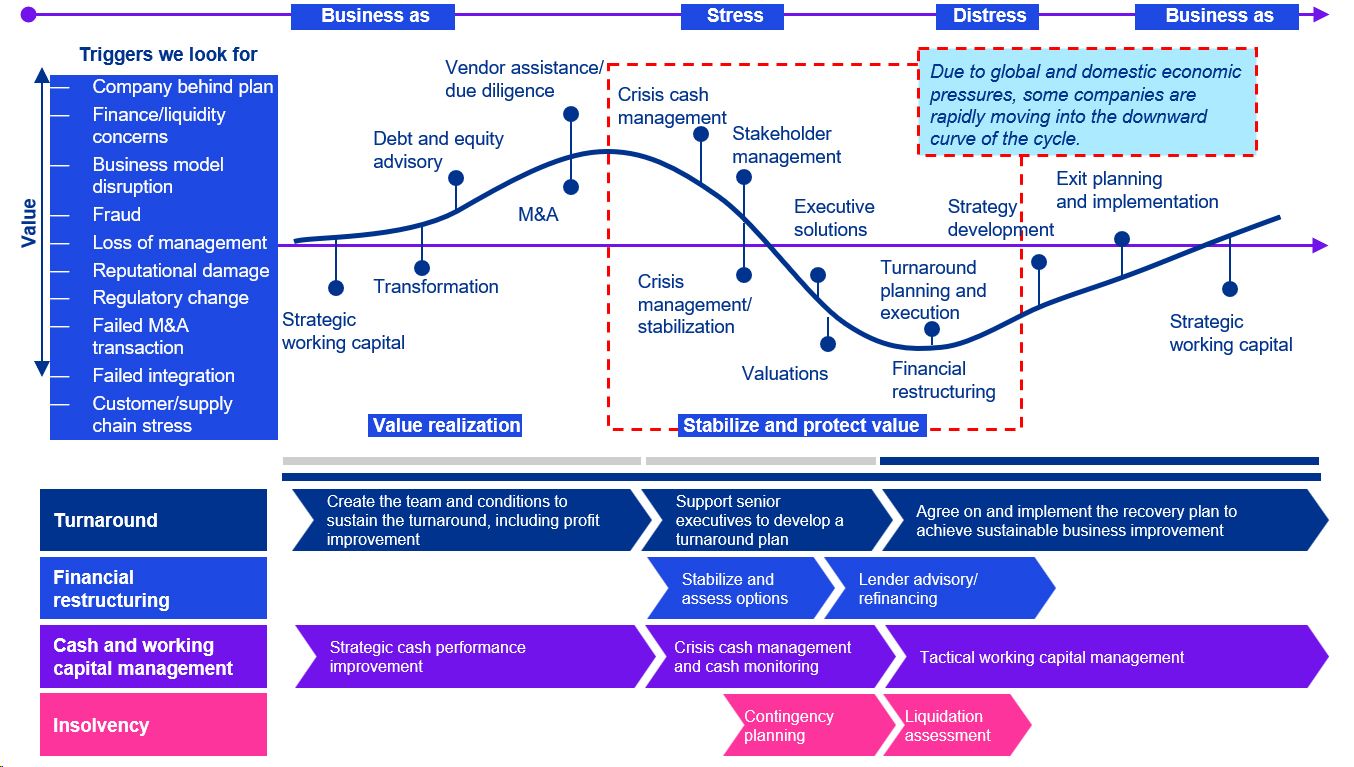

Outstanding Non-Performing Loans (NPLs) increased from THB511 billion to THB519 billion in the third quarter of 2024, and the percentage of NPLs rose from 2.8% to 2.9%. This upward trend in recent quarters suggests increasing financial strain for businesses and individuals. For companies navigating such challenges, an effectively executed turnaround can revitalize their business.

Data criteria

- The value data provided in the ‘Outstanding NPLs in Thailand’ chart represents the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal borrowers. The percentage of total loans represents the total outstanding NPLs to total outstanding loans.

- The pie chart ‘Q3/2024’s new corporate NPLs by sector’ represents the new and re-entered corporate NPLs which occurred during the period. Personal consumer NPLs are excluded.

- The ‘KPMG Financial Performance Index’ (KPMG FPI) is a metric that draws from a probability of financial default model based on explanatory variables that include financial and market variables.

KPMG Deal Advisory

Our approaches address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The changing situation in the Thai corporate bond market is pushing some businesses into the Stressed and Distressed part of the cycle. Our experienced approach brings valuable insights and guidance to help you to stabilize and protect value, and then ready the business to emerge sustainably.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia