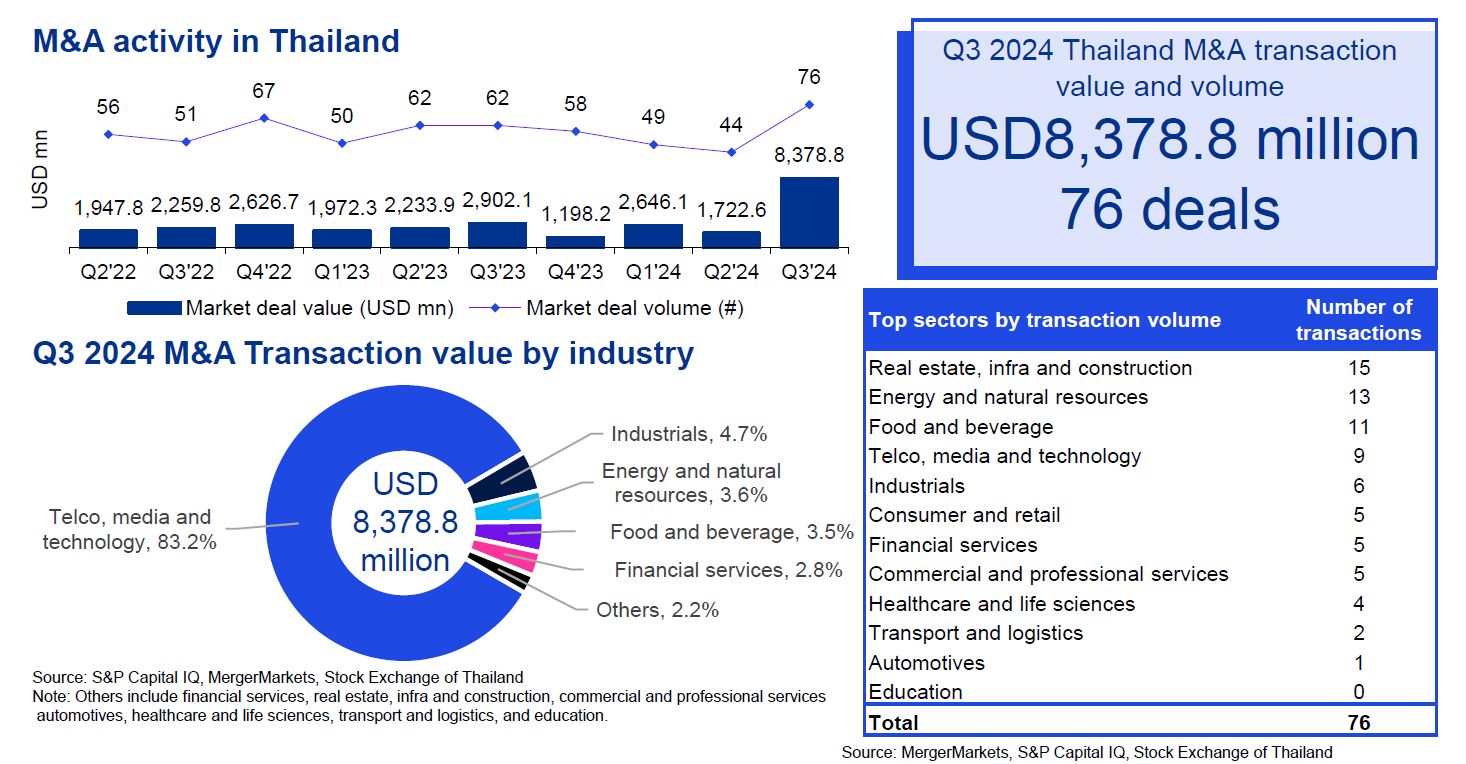

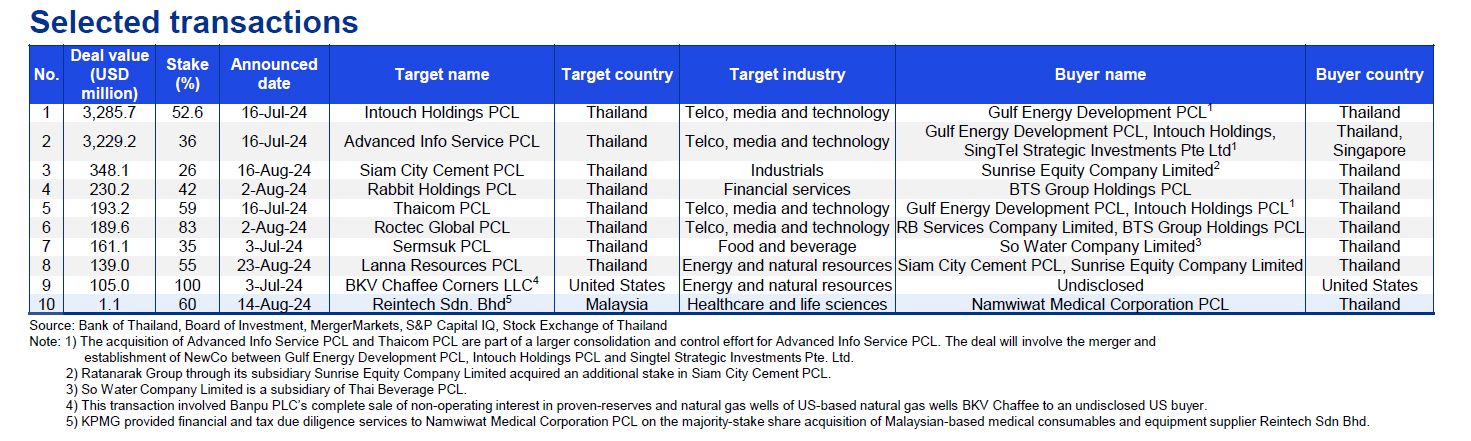

M&A activity in Q3 2024 experienced growth in both deal value and deal volume. A large domestic mega deal worth USD6.7 billion drove the increase in deal value from USD1.7 billion to USD8.4 billion. Meanwhile, deal volume increased by 72.7% from 44 deals to 76 deals. However, excluding the mega deal, average deal size dropped 35.7% from USD39.15 million in Q2 2024 to USD25.19 million in Q3 2024. There were 29 inbound deals, 42 domestic deals and 5 outbound deals, representing 41.8%, 57.5% and 0.7% of total deal value for the quarter, respectively. The sector that saw the greatest deal activity was telco, media and technology, with 9 deals representing 83.2% of total deal value.

Although the growth in deal value is mostly attributable to a domestic megadeal, positive deal sentiment can be observed, as seen in the substantially increased deal volume in the country. Companies in Thailand have maintained their focus on business consolidation through inorganic strategies, and there continues to be strong inbound interest from overseas businesses in the region. The largest deal this quarter was the merger and restructuring between Gulf Energy Development, Intouch Holdings PCL and Singtel Strategic Investments. The deal will involve a voluntary tender offer for broadband provider Advanced Info Service PCL valued at USD3.2 billion and local satellite operator Thaicom PCL valued at USD193.2 million, and a share swap with an implied consideration of USD3.3 billion between Gulf and Intouch Holdings to consolidate shareholdings, prior to the establishment of a new entity. The combined deal value is USD6.7 billion. Other notable deals include Thai-based Ratanarak Group’s purchase of an additional 25.5% stake in Siam City Cement PCL from minority shareholder Jardine Cycle & Carriage, valued at USD348.1 million. The group will own 71.9%, and the acquisition will be followed by a mandatory tender offer available to all remaining minority shareholders. This quarter, KPMG provided financial and tax due diligence services to Namwiwat Medical Corporation PCL on the majority-stake share acquisition of Malaysian-based medical consumables and equipment supplier Reintech Sdn Bhd.

Thailand’s tightened credit environment persisted throughout the quarter, as the Bank of Thailand maintained a policy rate of 2.5% for the tenth consecutive month by the end of September 2024 to manage national inflation. Effects of private and consumer debt management schemes persist as consumers continue to spend less on vehicles, with manufacturing activity for both motorcycles and vehicles continuing to decline as a result. Both the private sector and the government expressed concerns over the subsequent potential impact on exports and tourism as the Thai baht appreciated steadily against foreign currencies. Despite this, Q3 2024 saw merchandise exports grow 11.4% year-on-year, and foreign shipments for the first 8 months of the year increased 4.2% year-on-year. Multinational companies continued to invest in Thailand, with US-based IT company HP looking to move its manufacturing hub to Thailand to mitigate geopolitical risks, global hospitality group Accor ramping up its franchise model in Thailand to capitalize on positive tourism trends and EV companies preparing to utilize Thailand’s growing production infrastructure.

Thailand’s deal activity displayed growth and resilience, despite concerns over the lasting impact of consumer debt and the credit environment. National demand and export levels suggest that there is potential for continued growth in deal activity over the next quarter.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia