Capital market performance

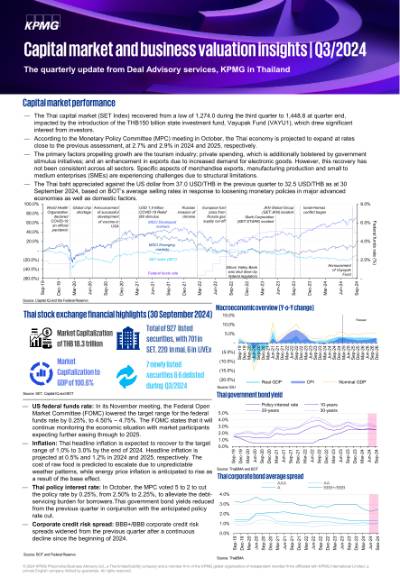

- The Thai capital market (SET Index) recovered from a low of 1,274.0 during the third quarter to 1,448.8 at quarter end, impacted by the introduction of the THB150 billion state investment fund, Vayupak Fund (VAYU1), which drew significant interest from investors.

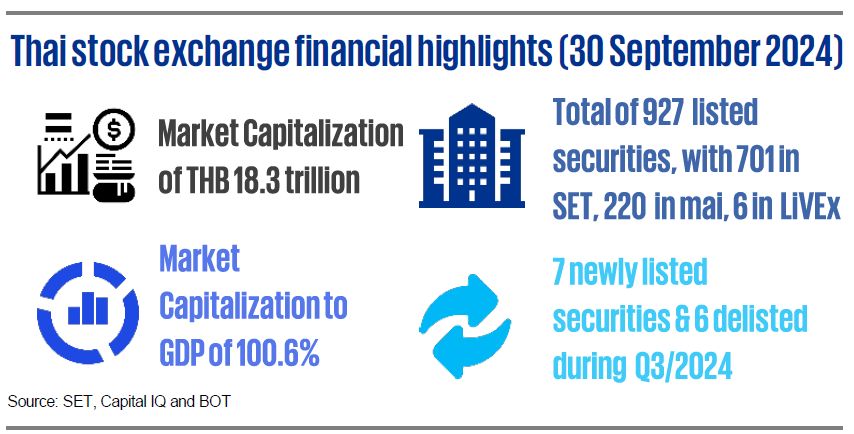

- According to the Monetary Policy Committee (MPC) meeting in October, the Thai economy is projected to expand at rates close to the previous assessment, at 2.7% and 2.9% in 2024 and 2025, respectively.

- The primary factors propelling growth are the tourism industry; private spending, which is additionally bolstered by government stimulus initiatives; and an enhancement in exports due to increased demand for electronic goods. However, this recovery has not been consistent across all sectors. Specific aspects of merchandise exports, manufacturing production and small to medium enterprises (SMEs) are experiencing challenges due to structural limitations.

- The Thai baht appreciated against the US dollar from 37.0 USD/THB in the previous quarter to 32.5 USD/THB as at 30 September 2024, based on BOT’s average selling rates in response to loosening monetary policies in major advanced economies as well as domestic factors.

- US federal funds rate: In its November meeting, the Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate by 0.25%, to 4.50% – 4.75%. The FOMC states that it will continue monitoring the economic situation with market participants expecting further easing through to 2025.

- Inflation: Thai headline inflation is expected to recover to the target range of 1.0% to 3.0% by the end of 2024. Headline inflation is projected at 0.5% and 1.2% in 2024 and 2025, respectively. The cost of raw food is predicted to escalate due to unpredictable weather patterns, while energy price inflation is anticipated to rise as a result of the base effect.

- Thai policy interest rate: In October, the MPC voted 5 to 2 to cut the policy rate by 0.25%, from 2.50% to 2.25%, to alleviate the debt-servicing burden for borrowers.Thai government bond yields reduced from the previous quarter in conjunction with the anticipated policy rate cut.

- Corporate credit risk spread: BBB+/BBB corporate credit risk spreads widened from the previous quarter after a continuous decline since the beginning of 2024.

Source: BOT and Federal Reserve

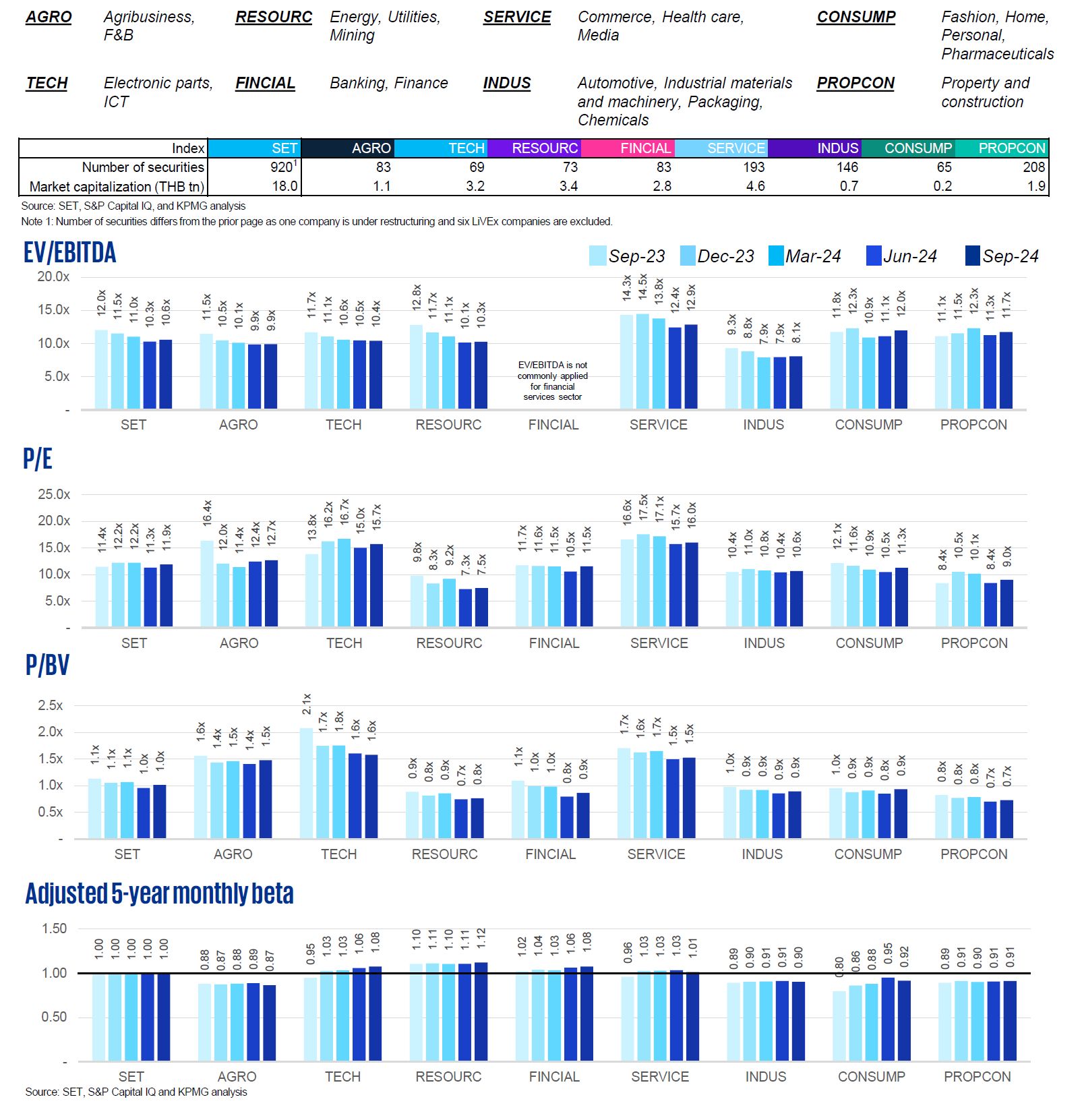

SET valuation metrics by sector (last 5 quarters)

The SET has eight key sector categories for listed entities. The three most-common valuation multiples across 5 quarters in these sectors illustrate movement due to both economic fundamentals and the impact of global events on market sentiment.

The multiples in Q3/2024 increased from the previous quarter across all sectors.

Sector beta represents the undiversified risk of a sector. The higher the beta, the riskier it is for that specific sector. The betas have shown a nearly equal proportion of increases and decreases, indicating distinct reactions in terms of volatility to the market flux within each sector.

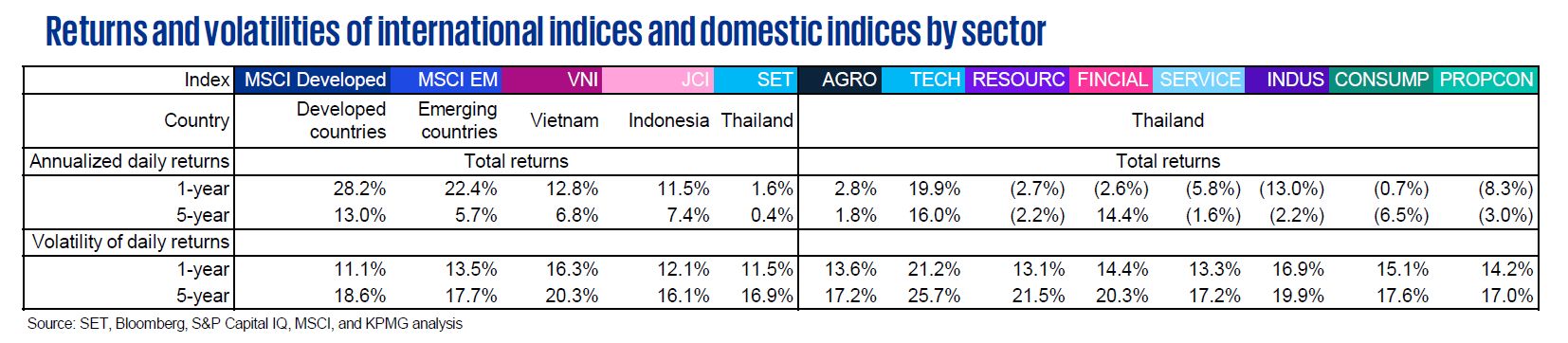

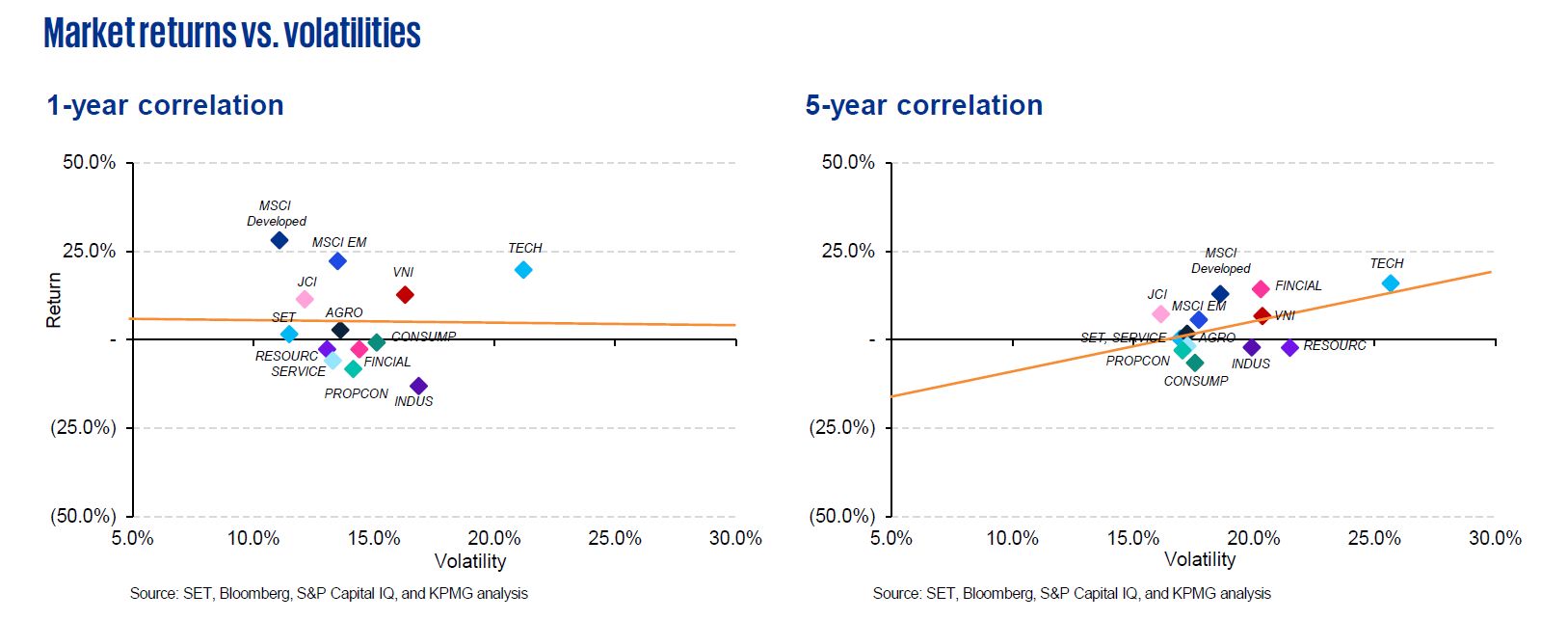

- Throughout both one-year and five-year observation periods, the SET lagged behind all other analyzed indices. For one-year annualized daily returns, the MSCI Developed recorded the highest absolute returns and demonstrated the best performance after adjusting for volatility. In Thailand, the TECH sector notably outperformed all other market sectors both in one-year and five-year durations.

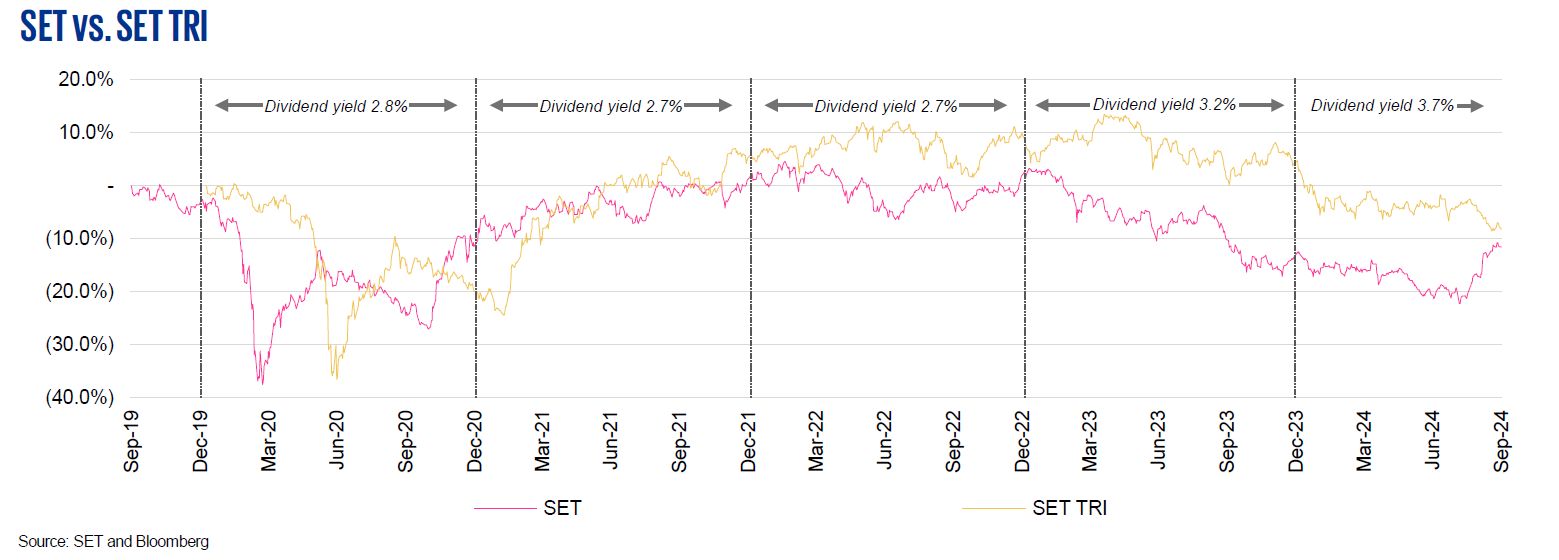

- Total return index (TRI) is an index that measures the total return from investing in securities. It comprises (1) a return arising from the change in value of the securities or “capital gain/loss” and (2) dividends paid, assuming they are reinvested in the securities.

- At 3.7%, 2024 dividend yield is the highest since 2020.

Data criteria

Thailand valuation multiples by sector

- The SET sector classification serves as the principal criterion for the illustrated sectors.

- The sector valuation multiples and beta are based on the respective median.

- 12-month trailing multiples are derived from Q3/2023 to Q3/2024.

- Q3/2024 multiple is based on the latest available financial statement information as at Q2/2024.

- Data in historical periods may change according to Capital IQ’s retrospective adjustments.

Regression on returns and volatilities

- The total number of trading days per year is assumed to be 252 days.

- The period in the study is 1 October 2019 – 30 September 2024.

SET and SET TRI

- Annual dividend yields are based on dividend yields from Bloomberg.

KPMG Deal Advisory

"KPMG provides a full range of valuation services for all sell-side, buy-side, tax restructuring, fund raising, and joint venture transactions."

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia