In the second quarter of 2024, the Bank of Thailand (BOT) revised its GDP growth projection for the year to 2.6%, up from the previous estimate of 2.5% (2.0%-3.0% range). This adjustment is largely attributed to the significant 26.3% increase in the number of tourists, a clear indicator of the nation's recovering momentum. With approximately 35.5 million tourists expected this year, bolstered by the recent extension of the visa-free policy, the sector is experiencing robust growth. Additionally, private consumption and investment are anticipated to rise, along with an increase in exports driven by stronger global demand.

BOT is aiming to maintain inflation within a target range of 1.0% to 3.0%. Headline inflation slightly declined due to a reduction in global crude oil price and a high supply of domestic fresh produce. Core inflation remained stable. The labor market observed a slight improvement. The trade balance worsened from the previous month due to the decrease in exports, which was mainly driven by an oversupply of goods fueled by Chinese products in destination markets, while imports increased.

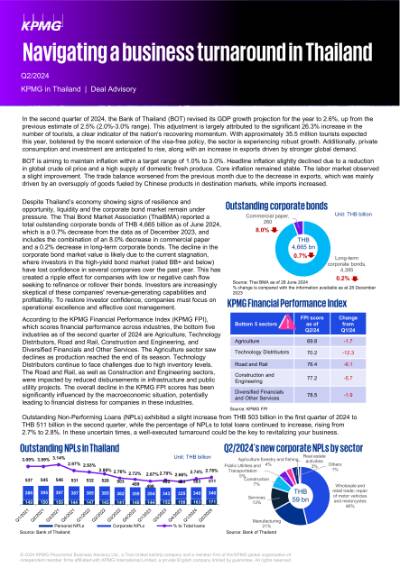

Despite Thailand’s economy showing signs of resilience and opportunity, liquidity and the corporate bond market remain under pressure. The Thai Bond Market Association (ThaiBMA) reported a total outstanding corporate bonds of THB 4,665 billion as of June 2024, which is a 0.7% decrease from the data as of December 2023, and includes the combination of an 8.0% decrease in commercial paper and a 0.2% decrease in long-term corporate bonds. The decline in the corporate bond market value is likely due to the current stagnation, where investors in the high-yield bond market (rated BB+ and below) have lost confidence in several companies over the past year. This has created a ripple effect for companies with low or negative cash flow seeking to refinance or rollover their bonds. Investors are increasingly skeptical of these companies' revenue-generating capabilities and profitability. To restore investor confidence, companies must focus on operational excellence and effective cost management.

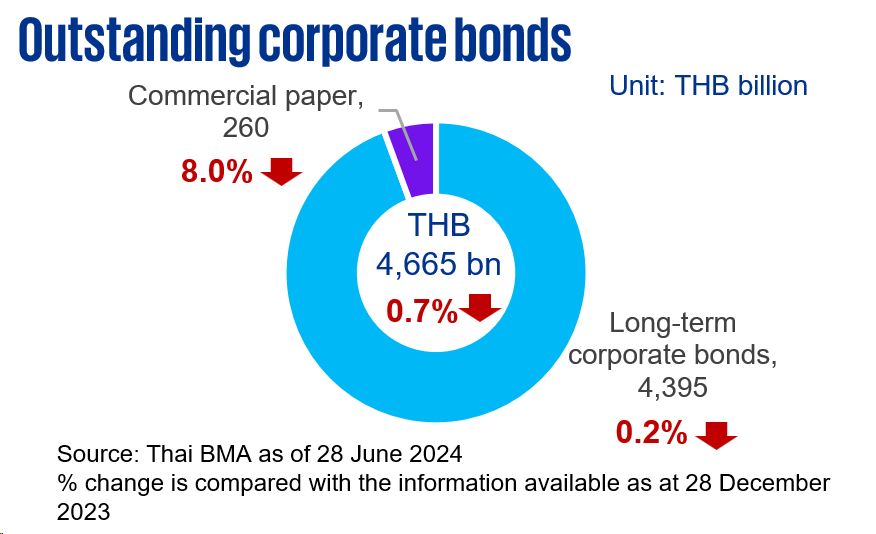

According to the KPMG Financial Performance Index (KPMG FPI), which scores financial performance across industries, the bottom five industries as of the second quarter of 2024 are Agriculture, Technology Distributors, Road and Rail, Construction and Engineering, and Diversified Financials and Other Services. The Agriculture sector saw declines as production reached the end of its season. Technology Distributors continue to face challenges due to high inventory levels. The Road and Rail, as well as Construction and Engineering sectors, were impacted by reduced disbursements in infrastructure and public utility projects. The overall decline in the KPMG FPI scores has been significantly influenced by the macroeconomic situation, potentially leading to financial distress for companies in these industries.

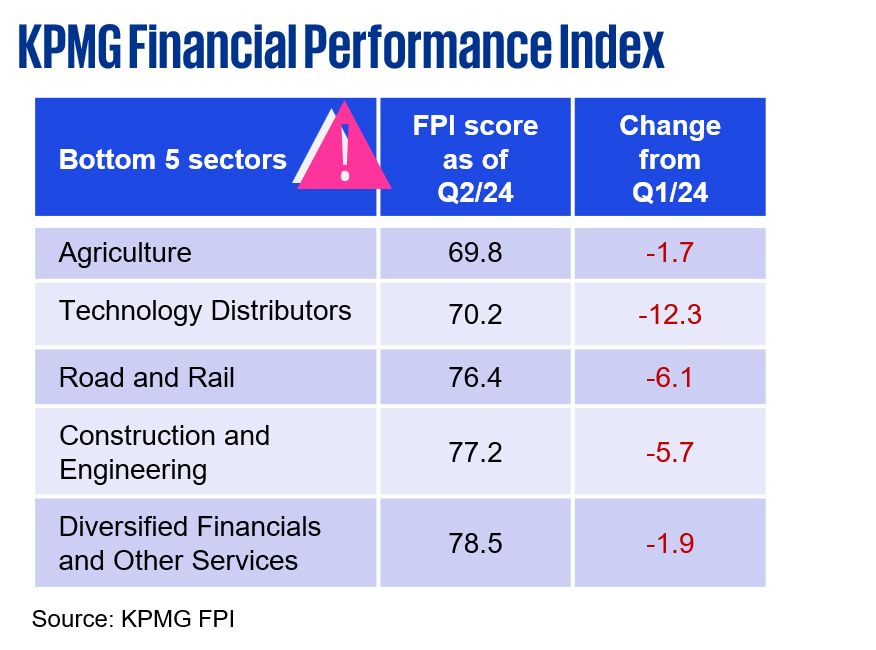

Outstanding Non-Performing Loans (NPLs) exhibited a slight increase from THB 503 billion in the first quarter of 2024 to THB 511 billion in the second quarter, while the percentage of NPLs to total loans continued to increase, rising from 2.7% to 2.8%. In these uncertain times, a well-executed turnaround could be the key to revitalizing your business.

Data criteria

- The value data provided in the ‘Outstanding NPLs in Thailand’ chart represents the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumers. The percentage of total loans represents the total outstanding NPLs to total outstanding loans.

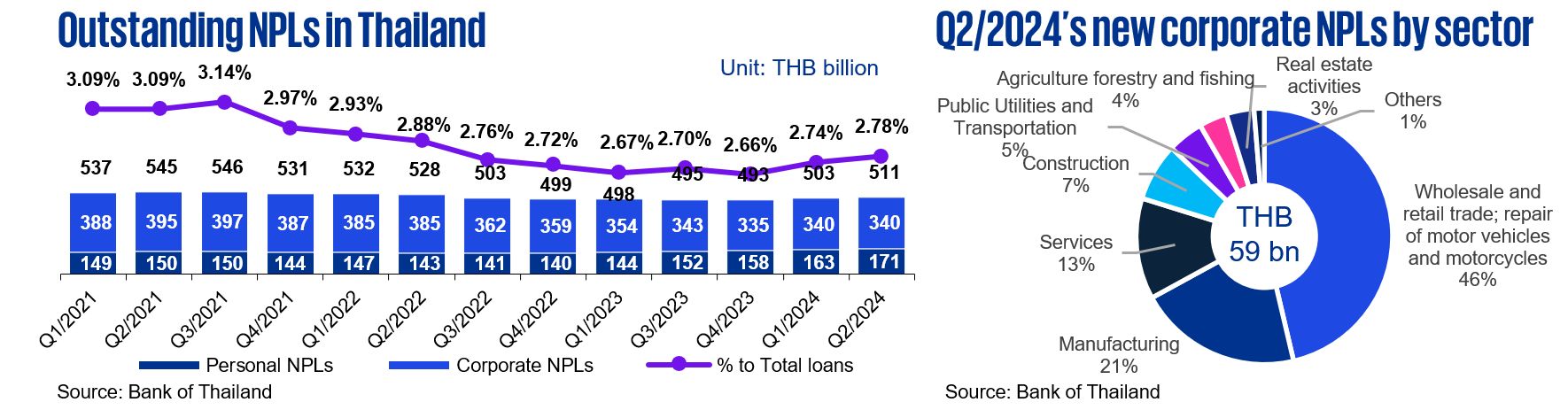

- The pie chart ‘Q2/2024’s new corporate NPLs by sector’ represents the new and re-entered corporate NPLs which occurred during the period. Personal consumer NPLs are excluded.

- The ‘KPMG Financial Performance Index’ (KPMG FPI) is a metric that draws from a probability of financial default model based on explanatory variables that include financial and market variables.

KPMG Deal Advisory

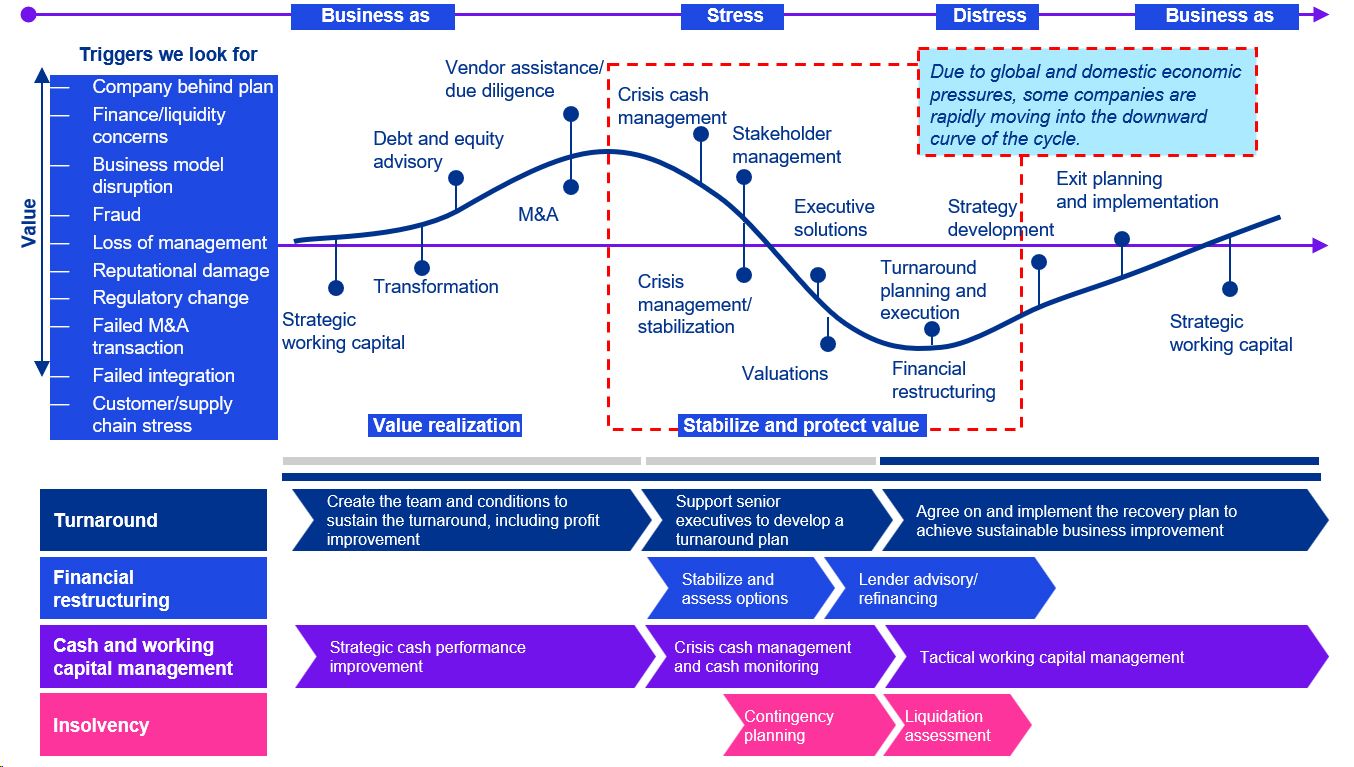

Our approaches address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The changing situation in the Thai corporate bond market is pushing some businesses into the Stressed and Distressed part of the cycle. Our experienced approach brings valuable insights and guidance to help you to stabilize and protect value, and then ready the business to emerge sustainably.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia