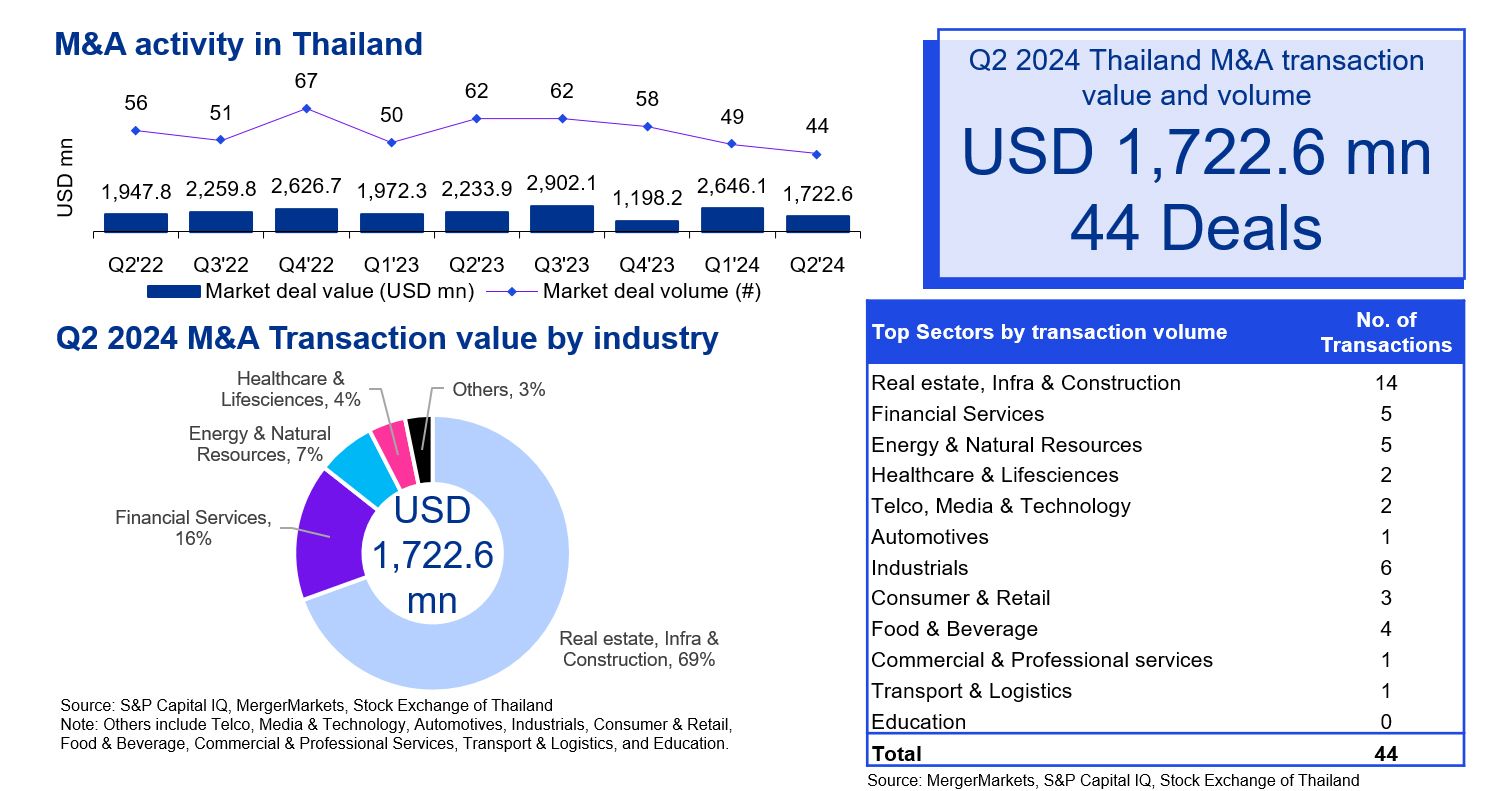

M&A activity in Thailand experienced a downturn in the second quarter of 2024, with a 34.9% decline in deal value to USD 1,722.6 million and a 10.2% decrease in deal volume, amounting to 44 deals, compared with 49 in the previous quarter. Of the 44 deals, 37 were inbound or domestic, representing 31.2% of the total deal value, while 7 outbound deals accounted for 68.8% of the deal value. 22 deals were domestic, unchanged from the previous quarter. The Real Estate, Infra & Construction and Financial Services sectors represented 85.6% of total deal value.

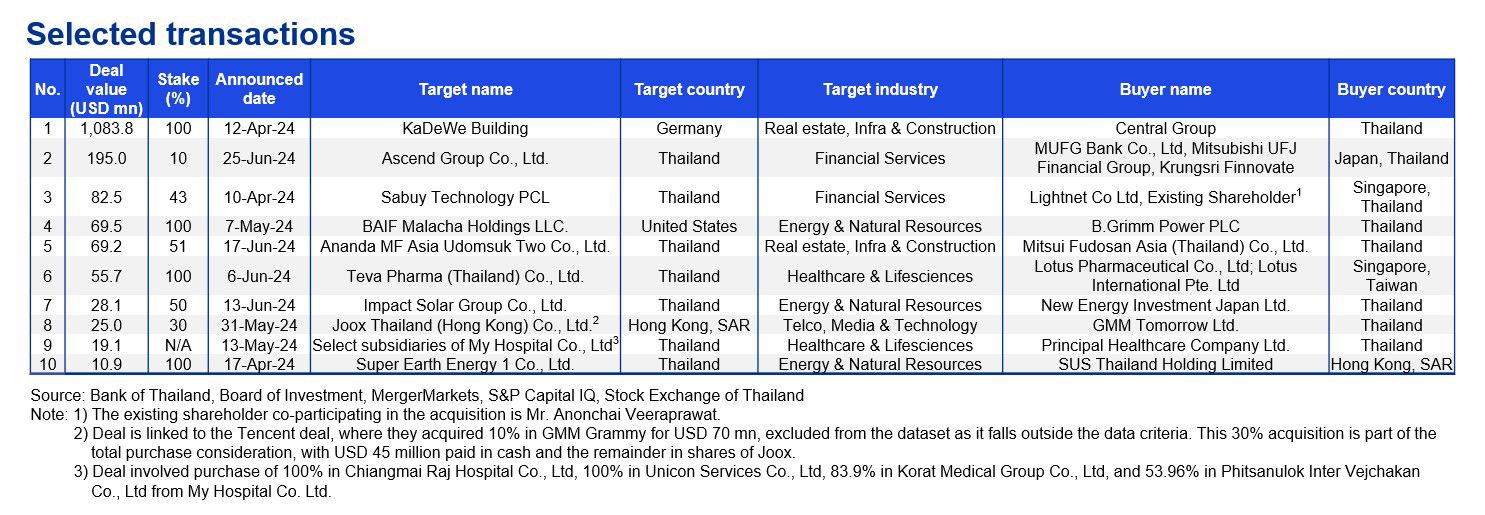

The drop in deal flow can be attributed to a slowdown in outbound deals, signaling a more cautious approach among Thai corporations towards their cross-border inorganic growth strategies. The major deal was Central Group’s estimated USD 1.1 billion acquisition of the KaDeWe building from Austria-based holding company Signa Prime Selection AG. Central Group had previously co-invested with Signa in the KaDeWe Group, which operates three luxury department stores in Germany. While Central Group holds a 50.1% stake in the operating company, Signa remained the sole owner of all property prior to this acquisition. The second largest transaction was the USD 195 million fundraising by MUFG Group to invest in Ascend Group, a Thai-based online payment platform offering notable services such as TrueMoney.

Ongoing uncertainties persist in Thailand’s economic environment, particularly around the credit sector, leading to concerns about overall consumer demand. Key indicators are pointing towards weaknesses in the economy, as evidenced by a notable drop in auto/motorcycle manufacturing and sales reported by the Federation of Thai Industries (FTI) for Q1 2024, mainly due to lower auto financing approvals. Additionally, the Real Estate Information Center (REIC) highlighted a continued decline in housing transfers, especially in the low-rise segment, citing an increase in housing loan rejections as the main cause. Despite the challenges, the Bank of Thailand (BOT) maintains a relatively positive outlook, expecting 3.0% GDP growth for the year, and the BOT has sustained the policy rate at 2.5% for the third consecutive quarter.

The Thai deal landscape appears resilient despite the monetary weaknesses, but monitoring key developments will be crucial to understand the outlook for deal flow. The potential launch of a tripartite credit guarantee model for SMEs by the BOT, or the further adoption of short-term adjustments of MRR by local banks to sustain aggregate demand, could significantly impact the market.

In conclusion, while challenges persist, the Thai M&A landscape remains dynamic, and organic as well as inorganic strategic initiatives will be vital to navigate the evolving economic landscape.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals.

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30%, then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million.

- All deals included have been announced but may not necessarily have closed.

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected.

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia