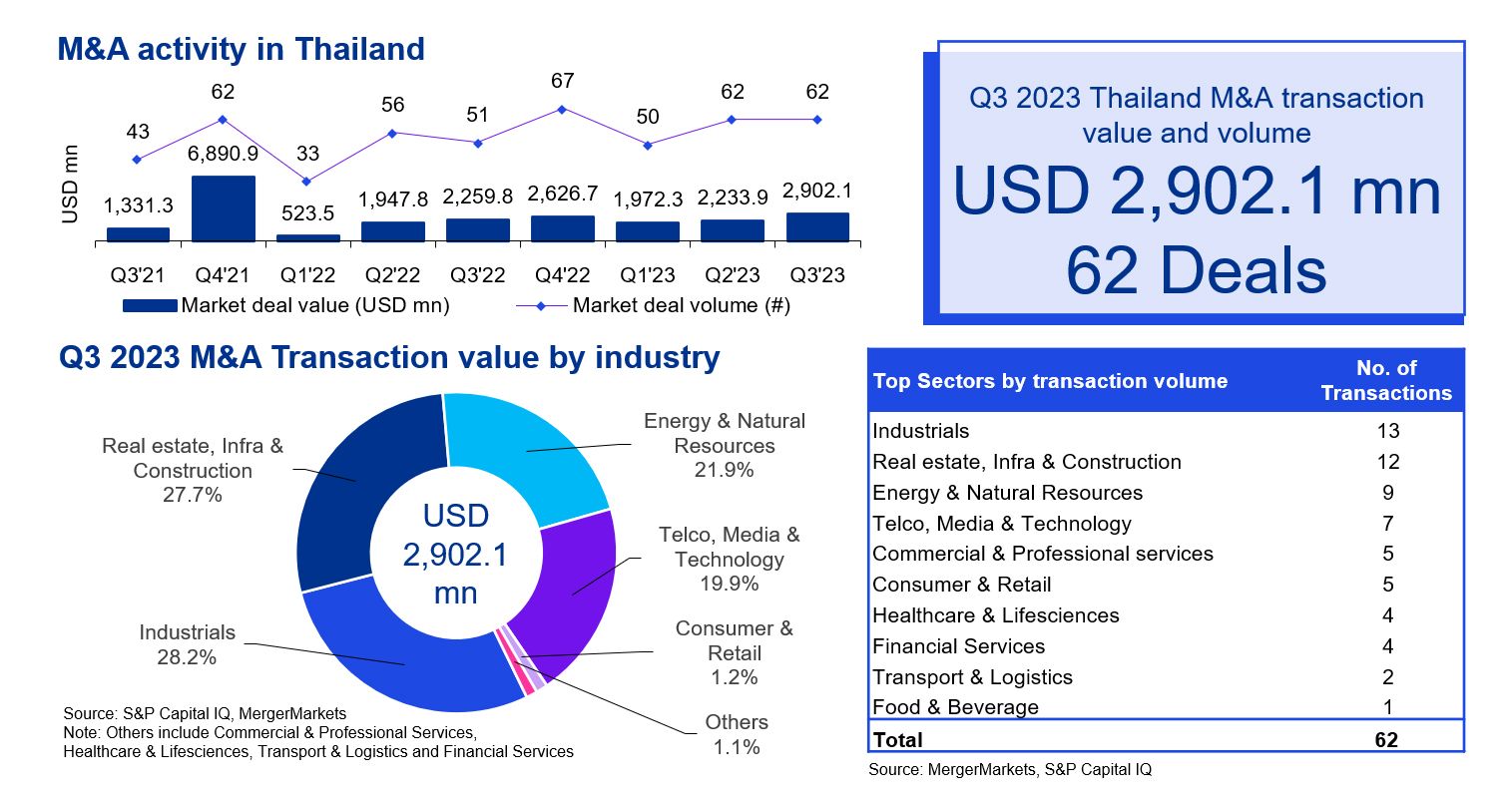

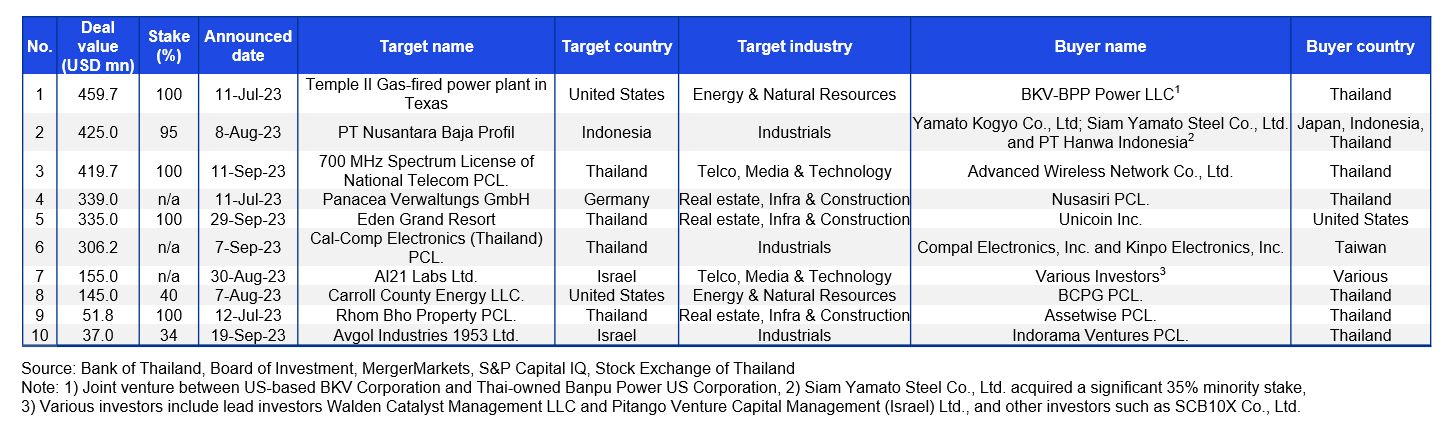

Q3 2023 saw a 30% growth in deal value, which reached over USD 2.9 billion, compared to USD 2.2 billion in the previous quarter, although deal volume remained relatively flat. Investments in Thai companies accounted for 43% of the deal value, while outbound deals represented 57%. The Industrials, Real Estate, Infrastructure and Construction sectors contributed 56% of the total deal value. A significant deal this quarter was Banpu Power PCL’s (“BPP”) USD 460 million acquisition of a gas-fired power plant located in Texas, USA. This acquisition is expected to provide opportunities in the merchant market and to optimize resource utilization for economies of scale. The deal is aligned with BPP’s Greener & Smarter Strategy to drive expansion along the energy value chain in the USA, one of BPP’s strategic growth regions.

In Q3 2023, the Bank of Thailand raised the policy rate to 2.5% in an effort to curb inflation. GDP recovery continued its upward trajectory due to domestic demand and robust private consumption. Lower unemployment at 2.6%, increasing inbound tourists and newfound political stability have also contributed to boosting consumer confidence despite rising household and corporate debt and weakened purchasing power. The Bank of Thailand's GDP growth estimate of 4.4% in 2024 is underpinned by public infrastructure, private investments and government stimulus policies. Geopolitical tensions on various global conflict fronts will pose external trade challenges should the situation exacerbate. The global economic climate along with these current affairs highlight that businesses must continue to adapt and embrace change, either through in-house efforts or inorganic strategies, in order to remain competitive.

Due to unfavorable market conditions, several major Thai IPOs, including Big C Retail Corporation and SCG Chemicals, were postponed. This decision was made in anticipation of reduced demand from foreign investors, with the expectation that most IPOs in the short term will be smaller and largely dependent on Thai investors. Many companies are exploring trade sales as an exit strategy or even sourcing private capital for expansion as an alternative means of increasing liquidity. Simultaneously, ESG investments are gaining traction in Thailand, driven by global awareness of climate change and sustainable development. The government's goals to achieve carbon neutrality and net-zero greenhouse gas emissions have spurred a nationwide shift towards ESG business models. This is supported by regulatory measures to promote ESG investing, such as ESG-related disclosure guidelines and the Thailand Sustainability Investment (THSI) list of companies that have passed the ESG criteria of the Stock Exchange of Thailand.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia