Thai capital market outlook

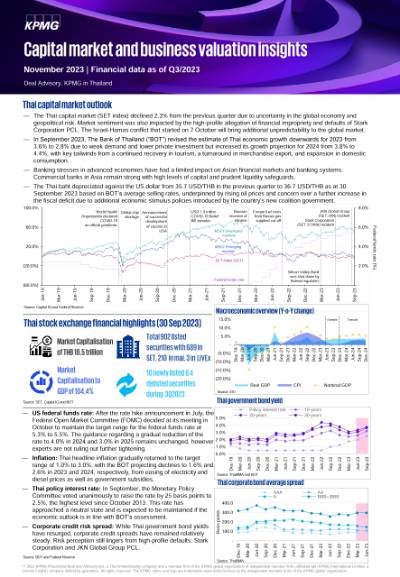

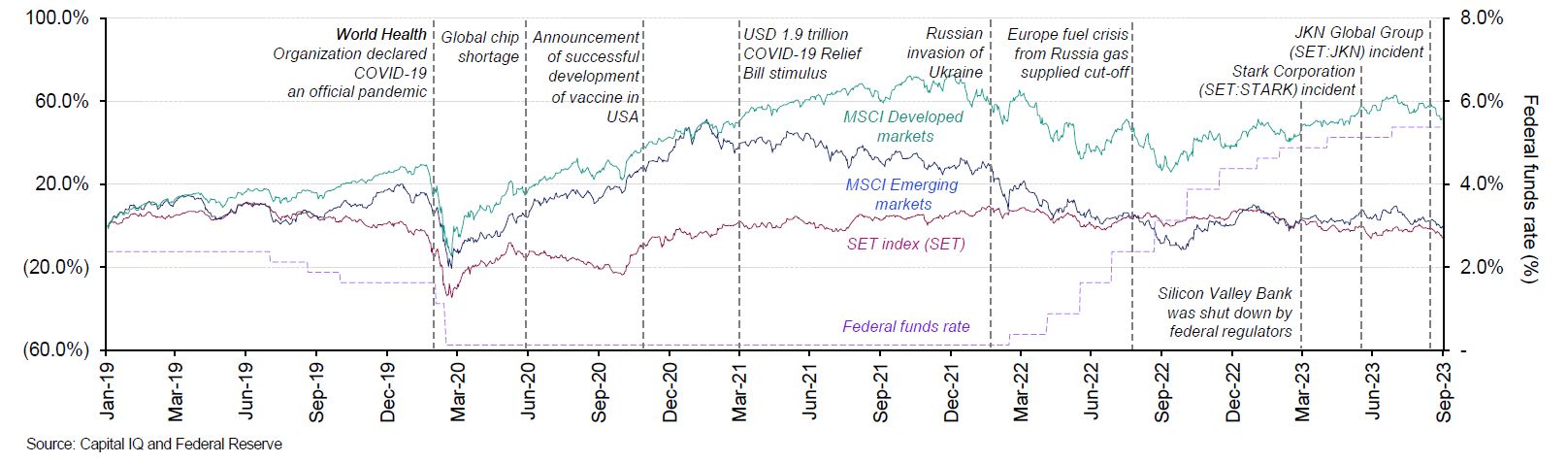

- The Thai capital market (SET index) declined 2.3% from the previous quarter due to uncertainty in the global economy and geopolitical risk. Market sentiment was also impacted by the high-profile allegation of financial impropriety and defaults of Stark Corporation PCL. The Israel-Hamas conflict that started on 7 October will bring additional unpredictability to the global market.

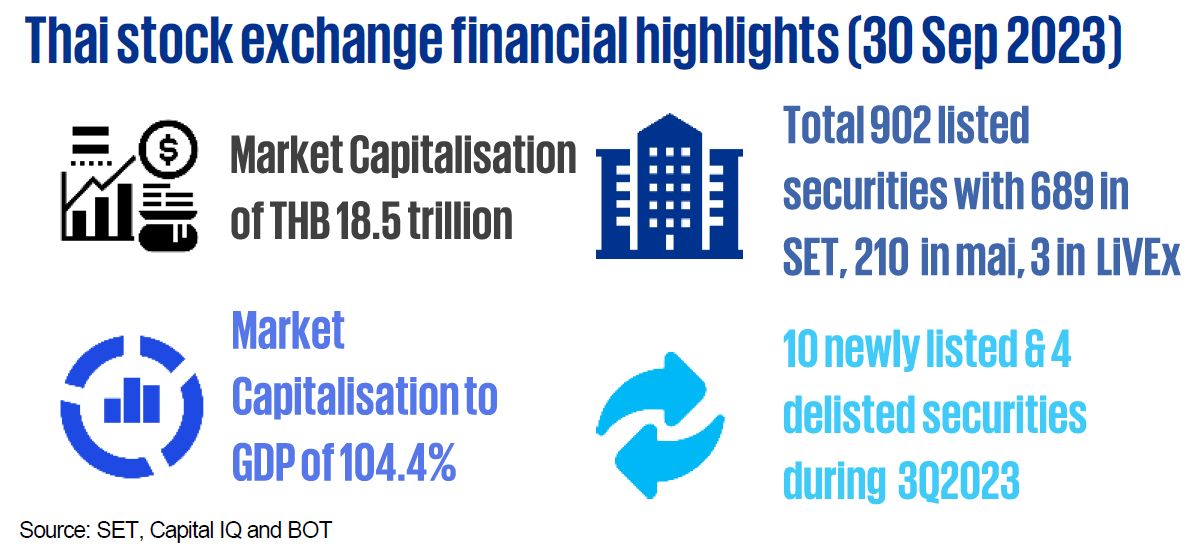

- In September 2023, The Bank of Thailand (“BOT”) revised the estimate of Thai economic growth downwards for 2023 from 3.6% to 2.8% due to weak demand and lower private investment but increased its growth projection for 2024 from 3.8% to 4.4%, with key tailwinds from a continued recovery in tourism, a turnaround in merchandise export, and expansion in domestic consumption.

- Banking stresses in advanced economies have had a limited impact on Asian financial markets and banking systems. Commercial banks in Asia remain strong with high levels of capital and prudent liquidity safeguards.

- The Thai baht depreciated against the US dollar from 35.7 USD/THB in the previous quarter to 36.7 USD/THB as at 30 September 2023 based on BOT’s average selling rates, underpinned by rising oil prices and concern over a further increase in the fiscal deficit due to additional economic stimulus policies introduced by the country's new coalition government.

- US federal funds rate: After the rate hike announcement in July, the Federal Open Market Committee (FOMC) decided at its meeting in October to maintain the target range for the federal funds rate at 5.3% to 5.5%. The guidance regarding a gradual reduction of the rate to 4.0% in 2024 and 3.0% in 2025 remains unchanged, however experts are not ruling out further tightening.

- Inflation: Thai headline inflation gradually returned to the target range of 1.0% to 3.0%, with the BOT projecting declines to 1.6% and 2.6% in 2023 and 2024, respectively, from easing of electricity and diesel prices as well as government subsidies.

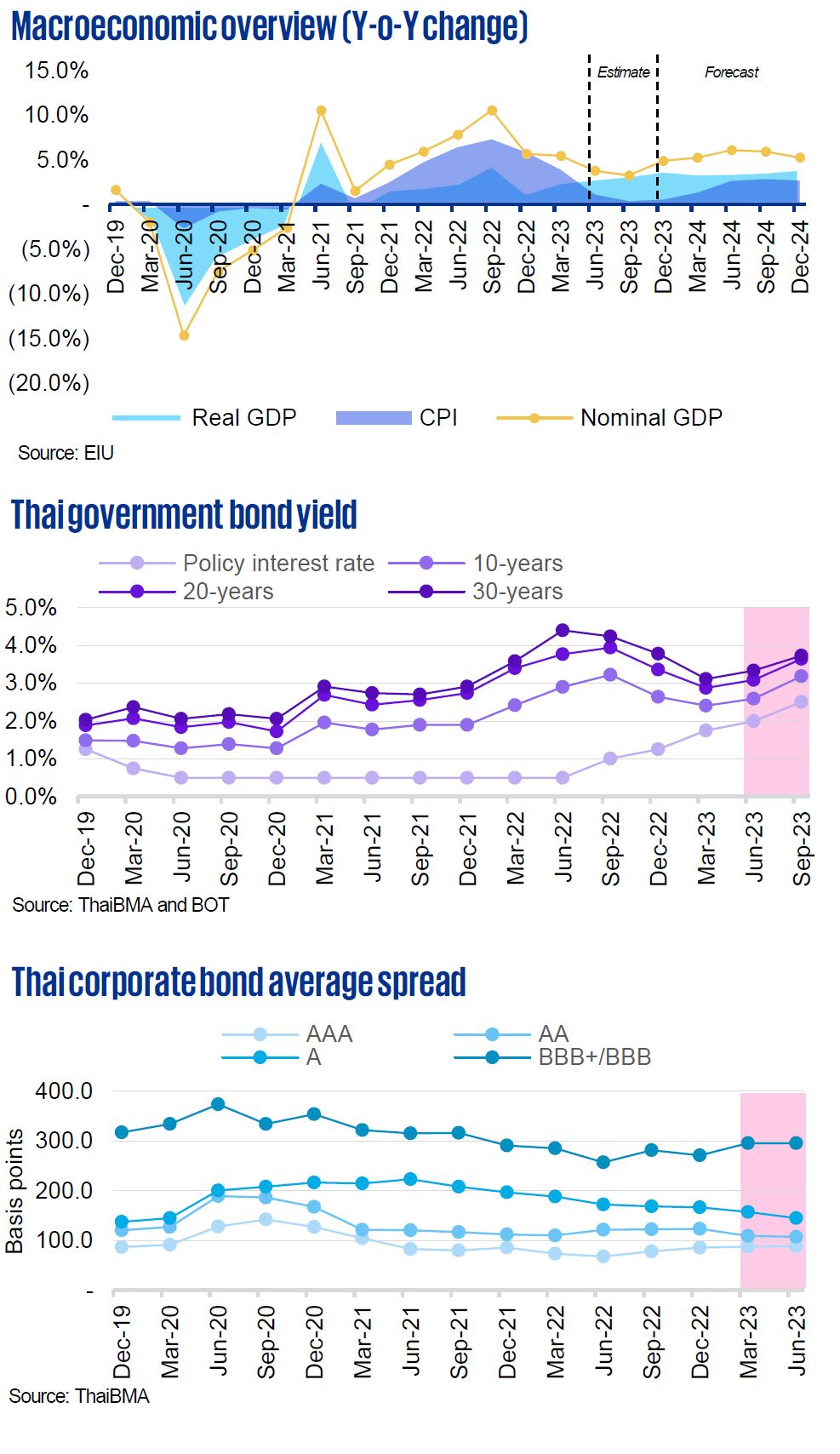

- Thai policy interest rate: In September, the Monetary Policy Committee voted unanimously to raise the rate by 25 basis points to 2.5%, the highest level since October 2013. This rate has approached a neutral state and is expected to be maintained if the economic outlook is in line with BOT’s assessment.

- Corporate credit risk spread: While Thai government bond yields have resurged, corporate credit spreads have remained relatively steady. Risk perception still lingers from high-profile defaults: Stark Corporation and JKN Global Group PCL.

Source: BOT and Federal Reserve

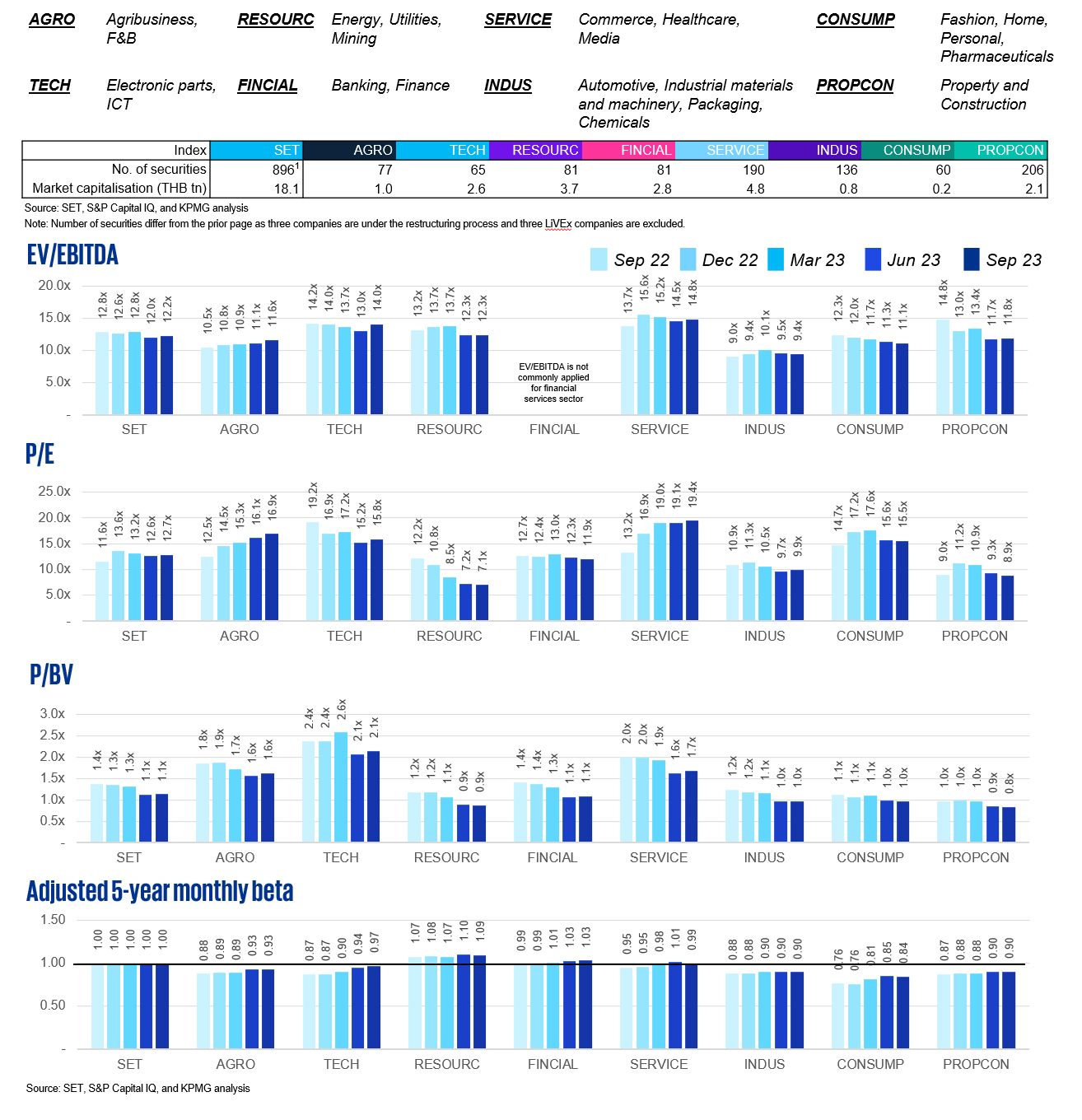

SET valuation metrics by sector (last five quarters)

The SET has eight key sector categories for listed entities. The three most-common valuation multiples across 5 quarters in these sectors illustrate movement due to both economic fundamentals and the impact of global events on market sentiment.

The multiples in Q3/2023 increased from the previous quarter while the SET index dropped, indicating a higher rate of decline in financial performance compared to the stock price decrease. RESOURC sector is the lowest in terms of price-to-earnings multiple among all the sectors in the SET index.

Sector beta represents the undiversified risk of a sector. The higher the beta, the riskier it is for that specific sector. The beta in the past 5 quarters has shown a trend of convergence towards the market beta of 1.0.

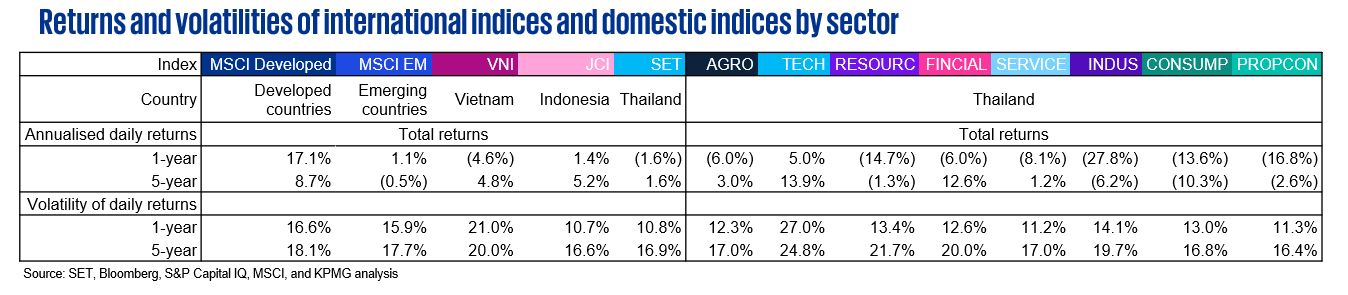

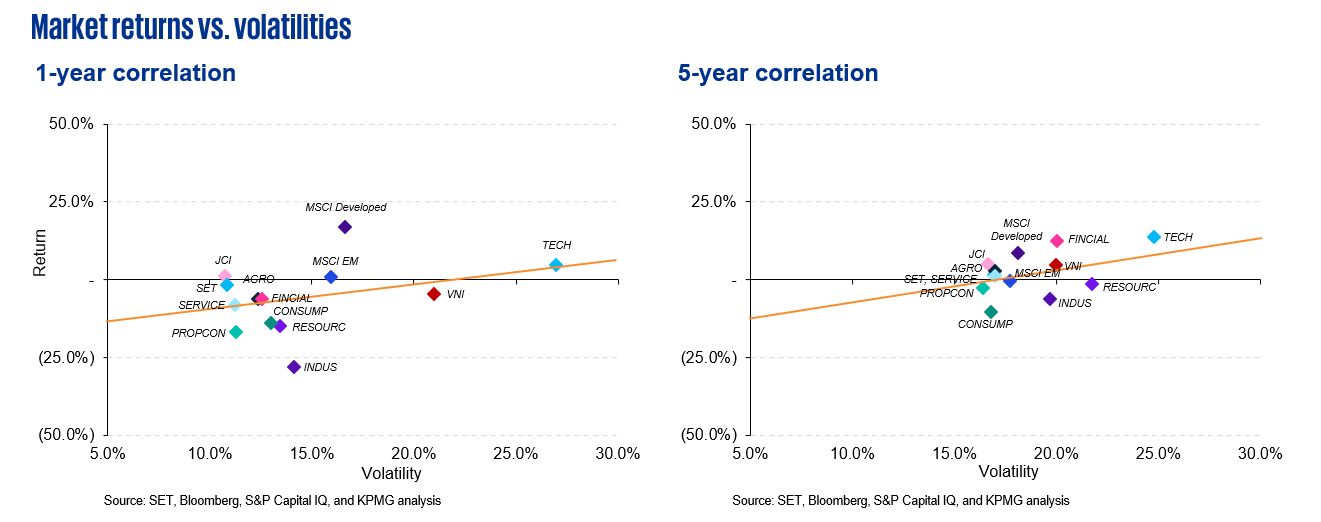

- The SET outperformed the VNI but lagged behind MSCI EM and JCI indices over the 1-year observation period. Returns appear to have been weighed down by the price performance of constituents in the traditional economy while technology players have remained the only sector with a positive 1-year annualised return. The SET and JCI had lower 1-year volatility than the other compared indices in emerging markets.

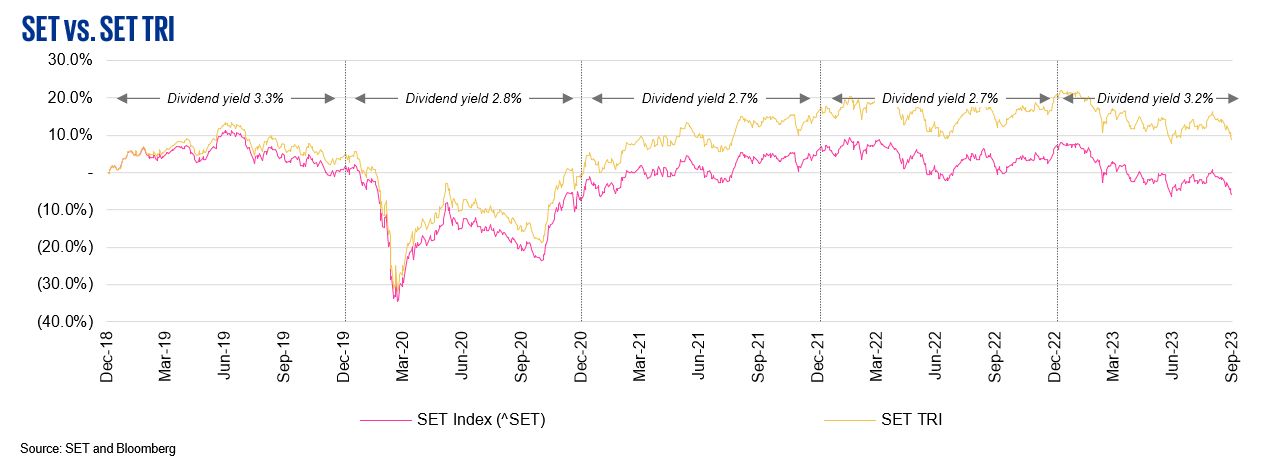

- Total return index (TRI) is an index that measures the total return from investing in securities. It comprises (1) a return arising from the change in value of the securities or “capital gain/loss”, and (2) dividends paid, assuming they are reinvested in the securities.

- Dividend yields have shown a slight declining trend owing to the expansion of value share of non-dividend-paying sectors and recent earnings trends across the traditional economy.

Data criteria

Thailand valuation multiples by sector

- The SET sector classification serves as the principal criterion for the illustrated sectors.

- The calculation of the sector valuation multiples excludes company multiples outside of the first- to third-quartile range.

- 12-month trailing multiples are derived from Q3/2022 to Q3/2023.

- Q3/2023 multiple is based on the latest available financial statement information as at Q2/2023.

- Data in historical periods may change according to Capital IQ’s retrospective adjustments.

Regression on returns and volatilities

- The total number of trading days per year is assumed to be 252 days.

- The period in the study is 1 October 2018 – 30 September 2023.

SET and SET TRI

- Annual dividend yields are based on dividend yields from Bloomberg.

KPMG Deal Advisory

"KPMG provides a full range of valuation services for all sell-side, buy-side, tax restructuring, fund raising, and joint venture transactions."

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia