In 2022, the Bank of Thailand (BOT) published its Consultation Paper on Financial Landscape which outlines the key directions to be undertaken in order to reposition Thailand’s financial sector to sustainably transform into a digital economy. One of its key policies is the introduction of up to three new virtual banks, with the aim of promoting healthy competition among market players to develop innovative financial services and increase financial inclusion for consumers in the retail and SME segments.

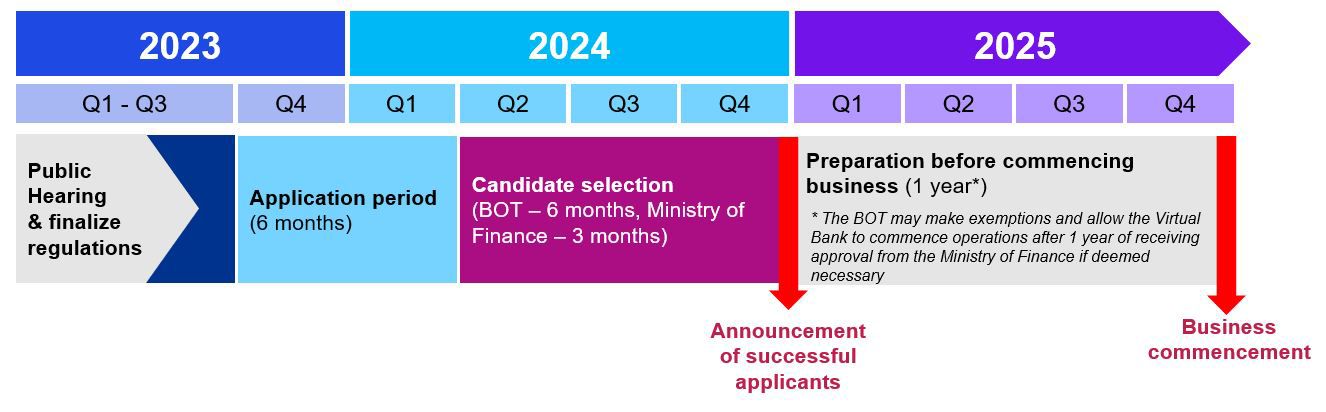

The Virtual Bank applications will likely open in Q4 of 2023, based on recent announcements by the BoT and the selected three candidates will be submitted to the Minister of Finance for final approval of license granting, which should be announced (tentatively) within 2024.

Indicative timeline

Interested in applying for the Virtual Bank Licensing? Here are some key expectations….

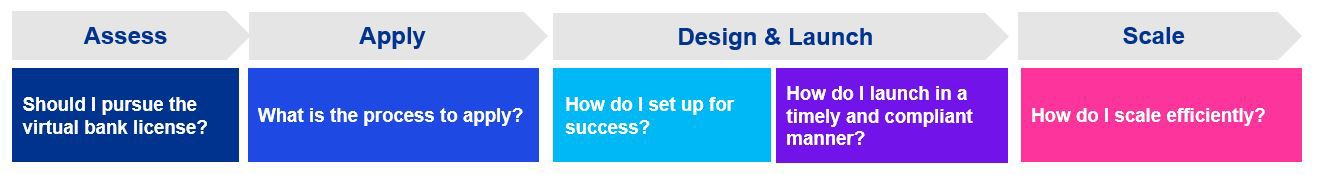

Zero to Hero: The Virtual Bank licensing journey

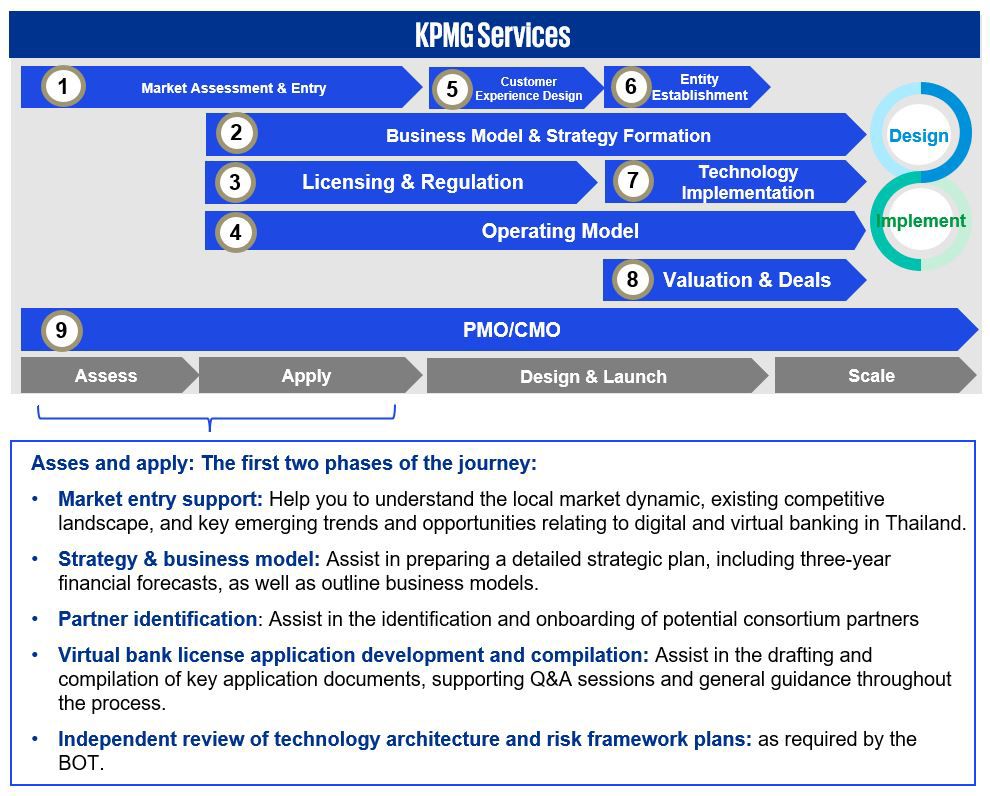

The virtual bank license opens the door to untapped opportunities to service the unbanked and underbanked segments of the population with more dynamic financial solutions and product proposition. However, in launching a virtual bank, there are several questions that need to be thought through along the journey and a number of BOT requirements that need to be evidenced.

Our services are designed to support your end-to-end journey

Download PDF

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia