On 7 March 2023, the Thai Cabinet approved a draft Royal Decree to exempt taxes on the trading of investment tokens (i.e., digital tokens that specify the right of a person to participate in an investment in a project or business) in order to promote fundraising activities through the use of technology and to drive Thailand’s economy.

When promulgated, the effect of this Royal Decree will enable tax exemptions for the offering (in the primary market) or trading (in the secondary market) of investment tokens similar to the offering/trading of securities in the stock markets.

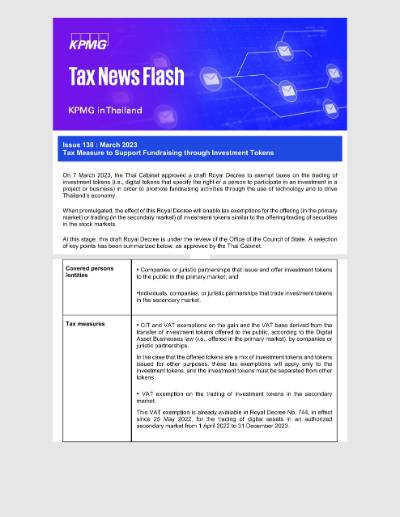

At this stage, this draft Royal Decree is under the review of the Office of the Council of State. A selection of key points has been summarized below, as approved by the Thai Cabinet:

| Covered persons /entities |

|

|

Tax measures |

|

| Procedures and conditions |

|

| Effective Date | This law will have retroactive effect from 14 May 2018, which is the effective date of the Emergency Decree on Digital Asset Businesses B.E. 2561 (2018). |

KPMG’s observations

This tax exemption further supports Thailand’s position as a crypto-friendly country, and the Cabinet’s willingness to attract further investments in the face of an increasingly digitalized economy.

How KPMG can help

At KPMG in Thailand, we have extensive expertise of advising our clients on specific tax exemptions available for different types of business operations.

We will continue to monitor further developments and announcements relating to this tax measure to ensure our clients are kept well informed. Should you have any questions, please reach out to any of the key contacts below or your usual KPMG contact.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia