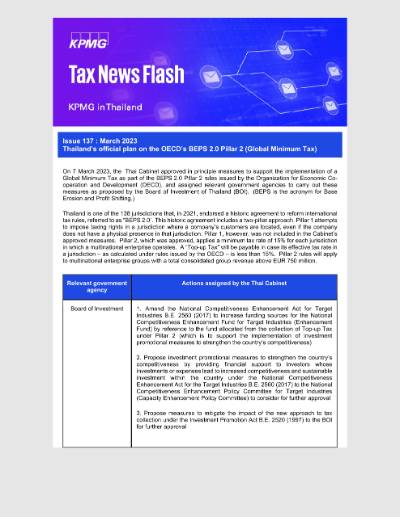

On 7 March 2023, the Thai Cabinet approved in principle measures to support the implementation of a Global Minimum Tax as part of the BEPS 2.0 Pillar 2 rules issued by the Organization for Economic Co-operation and Development (OECD), and assigned relevant government agencies to carry out these measures as proposed by the Board of Investment of Thailand (BOI). (BEPS is the acronym for Base Erosion and Profit Shifting.)

Thailand is one of the 138 jurisdictions that, in 2021, endorsed a historic agreement to reform international tax rules, referred to as “BEPS 2.0”. This historic agreement includes a two-pillar approach. Pillar 1 attempts to impose taxing rights in a jurisdiction where a company’s customers are located, even if the company does not have a physical presence in that jurisdiction; Pillar 1, however, was not included in the Cabinet’s approved measures. Pillar 2, which was approved, applies a minimum tax rate of 15% for each jurisdiction in which a multinational enterprise operates. A “Top-up Tax” will be payable in case its effective tax rate in a jurisdiction – as calculated under rules issued by the OECD – is less than 15%. Pillar 2 rules will apply to multinational enterprise groups with a total consolidated group revenue above EUR 750 million.

| Relevant government agency | Actions assigned by the Thai Cabinet |

Board of Investment |

|

| Ministry of Finance (Revenue Department) | Enact laws and/or determine appropriate approaches as follows:

|

Key contents from the Thai Cabinet’s briefing

- The measures proposed by the BOI to the Thai Cabinet aim to improve investment promotional measures and make them in line with the OECD’s proposed new approach to tax collection, in order for Thailand to retain its ability to attract investment and maintain its production base of large multinational companies, which is important for enhancing the country’s competitiveness.

- The OECD’s Inclusive Framework on BEPS allows member states to participate and determine the direction and means for implementing anti-BEPS measures. In this respect, Thailand became a member of the Inclusive Framework on BEPS in June 2017. At the 13th Inclusive Framework on BEPS meeting held on 8 October 2021, the OECD presented the two-pillar approach.

The Revenue Department announced that it is in the process of drafting a bill to collect Top-up Tax with an indicative timeframe for the draft bill to be released for approval within 2023 and effective in 2025.

Our observations

Pillar 2 presents affected multinational enterprises with comprehensive challenges. For these groups with the ultimate parent entity (UPE) in Thailand, it is advisable to consider performing a tax impact assessment as soon as possible since Pillar 2 includes a set of interlocking rules that allow jurisdictions outside Thailand that adopted Pillar 2 rules, with effect from 2024, to collect Top-up Tax before the rules are in effect in Thailand. For those groups with its UPE outside Thailand, due consideration should be made on potential updates to the BOI’s current investment promotional measures and how Pillar 2 would impact the level of tax paid in Thailand.

Impacted groups should also assess whether the data necessary to perform the Pillar 2 calculations are readily available, and whether enhancements to existing ERP systems will need to be done to systematically extract the relevant data.

KPMG in Thailand has practical and hands-on experience supporting multinational enterprise groups – with headquarters in Thailand and overseas – with Pillar 2 advice and training, performing impact assessments, and providing implementation support. For any queries in relation to Pillar 2, please contact the following persons at KPMG in Thailand or reach out to your usual contact at KPMG.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia