On 24 January 2023, the Cabinet approved the extension of the tax measures to support the e-tax systems for another three years; from 1 January 2023 to 31 December 2025, aiming to promote the continuous use of the e-tax invoice, e-receipt, and e-withholding tax systems, as well as to encourage taxpayers to deduct and remit taxes through the e-withholding tax system.

A selection of the key tax measures approved by the Cabinet resolution are as follows:

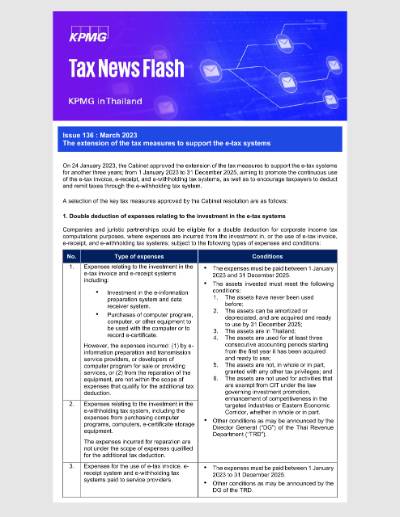

1. Double deduction of expenses relating to the investment in the e-tax systems

Companies and juristic partnerships could be eligible for a double deduction for corporate income tax computations purposes, where expenses are incurred from the investment in, or the use of e-tax invoice, e-receipt, and e-withholding tax systems; subject to the following types of expenses and conditions:

| No. | Type of expenses | Conditions |

|---|---|---|

| 1. | Expenses relating to the investment in the e-tax invoice and e-receipt systems including:

However, the expenses incurred: (1) by e-information preparation and transmission service providers, or developers of computer program for sale or providing services, or (2) from the reparation of the equipment, are not within the scope of expenses that qualify for the additional tax deduction. |

|

| 2. | Expenses relating to the investment in the e-withholding tax system, including the expenses from purchasing computer programs, computers, e-certificate storage equipment. The expenses incurred for reparation are not under the scope of expenses qualified for the additional tax deduction. |

|

| 3. | Expenses for the use of e-tax invoice, e-receipt system and e-withholding tax systems paid to service providers. |

|

2. Reduced withholding tax (“WHT”) rates for the users of the e-withholding tax system

In addition to the above measure, the same Cabinet resolution also resolved to reduce WHT rates to 1% for certain types of payments made through e-withholding tax system between 1 January 2023 and 31 December 2025.

The measure to reduce WHT rates for payments made through the e-withholding tax system was previously extended to cover the period through 31 December 2022 under the Departmental Instruction no. Taw Paw 336/2564, reducing the statutory WHT rates to 2%. This latest Cabinet resolution has the effect of extending the period to 31 December 2025, and further reducing the rate to 1%.

The reduced WHT rate of 1% as mentioned above applies to the payments, e.g.:

| Payment to A Juristic company or juristic partnership (Exclude Foundations or Association) |

Payment to individual |

|---|---|

|

|

KPMG’s observations

The extension of the aforementioned tax measures is an indication that the e-tax system is one of the top priorities for the TRD. It is recommended that the taxpayers should consider utilizing these systems to take advantage of double deduction benefits as well as reduced WHT rate. The reduced WHT rates should help taxpayers manage their cash flow and reduce the requirements for requesting tax refunds as a result of excess WHT over annual CIT.

How KPMG can help

KPMG professionals have experience in assisting taxpayers in setting up and implementing e-tax systems. The KPMG team includes tax expert that can assist in analyzing your VAT and WHT processes and implications, as well as IT professionals to work together with your accounting and IT teams in order to facilitate a smooth transition to e-tax environments.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia