The Thai economy grew 1.4% in the fourth quarter of 2022, a softening from the 4.6% growth recorded in the previous quarter. This is due to lower exports, manufacturing, and public consumption. As a result, the overall GDP in 2022 grew by 2.6%, which was lower than the forecasted 3.2%. The long-awaited bounce back of the tourism industry is predicted to support economic recovery this year despite a weakening global economic outlook. Thailand’s economic recovery is expected to further pick up steam with China's earlier than anticipated reopening, which should provide a significant boost to the tourism industry. However, business analysts also predict that the ongoing Russia-Ukraine conflict will continue to have a detrimental effect, with high energy prices and inflation expected to continue globally. The recent failure of two US banks has led to further uncertainty in the world’s banking and capital markets. This is a stark reminder of the fragile nature of the global economy and the ripple effect such failures can have on businesses.

Core inflation in Thailand, excluding raw food and energy prices, remains at risk from demand-side inflationary pressures. On 25 January 2023, The Monetary Policy Committee (MPC) of the Bank of Thailand (BoT) announced a raise in the interest rate by 0.25 percentage points, taking the base interest rate from 1.25 to 1.50 percent. The MPC believes that a continued, gradual normalization of policy is the appropriate course considering the outlook for inflation and growth. As a rebound in tourism could further intensify demand-side pressure on inflation, the MPC will closely monitor it and consider if further interest rate rises may be required.

The Thai banking industry seems to have weathered the impact of the COVID-19 pandemic and is now preparing to support an economic recovery. Commercial banks retain their capital and loan loss provisions, and available liquidity remains strong. Consumer and business debt serviceability has recovered along with the improving economy; however, some households and SMEs still face uncertain financial stability and remain vulnerable to debt and the rising cost of living. The banks continue to provide support through loans, including the transformation loan facility which allows SMEs access to low-cost capital to assist with transformations in response to global trends such as digitalization and ESG. As of 13 February 2023, the BoT has approved soft loan facilities totaling THB212.4 billion to 59,891 debtors, an increase of 3,346 debtors from 26 September 2022(1). The asset warehousing program has seen a moderate increase in usage, with a total of 442 debtors and debt worth of THB10.7 billion.

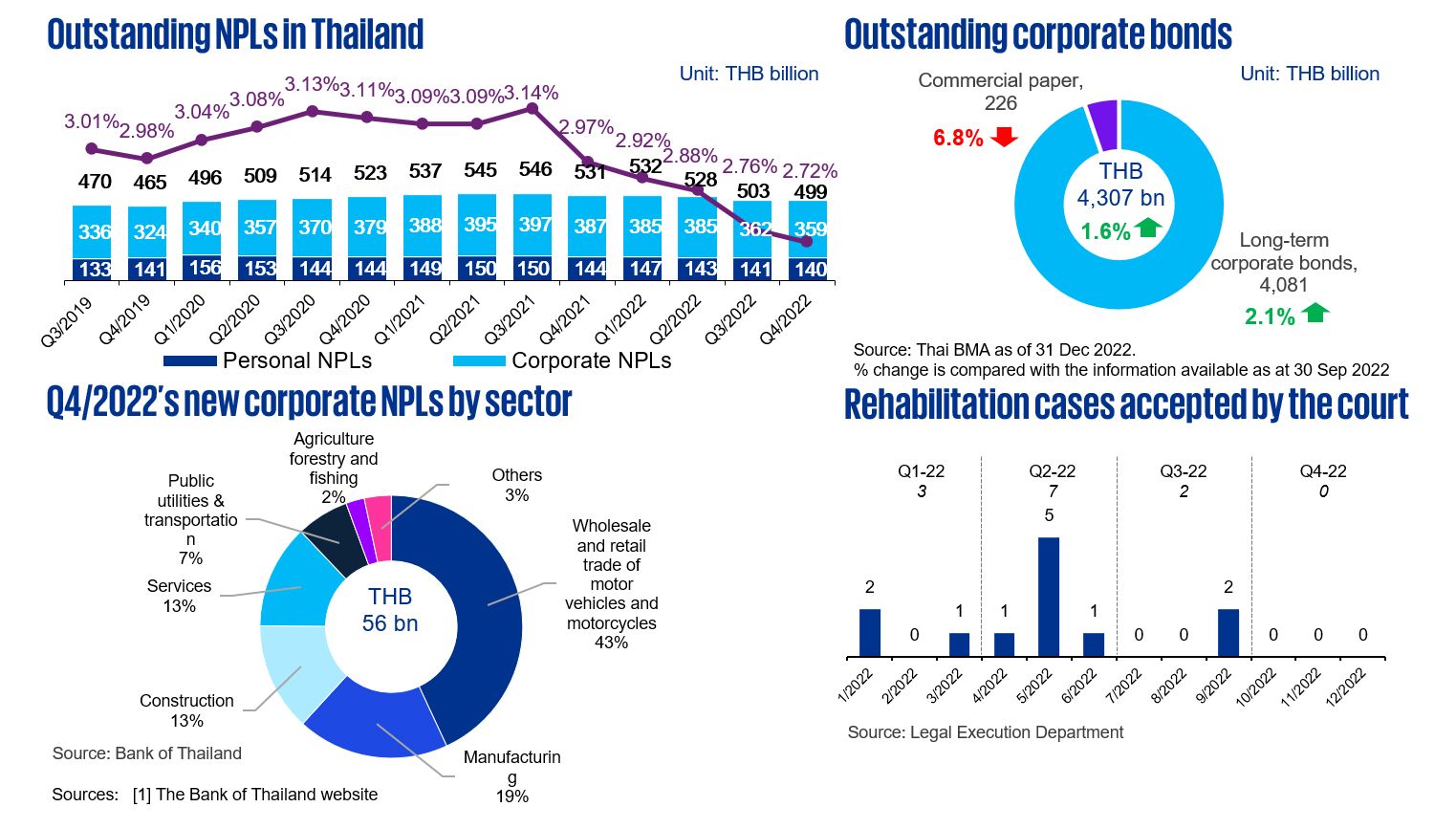

Outstanding NPLs dropped marginally, from THB503 billion in Q3 2022 to THB499 billion in Q4 2022, and the ratio of NPLs to total loans similarly declined, from 2.76% to 2.72%, as a result of the decrease in the total amount of outstanding NPLs. Corporate bonds grew 1.6% from September to December 2022, and according to The Thai Bond Market Association were expected to rise even further in 2023 as businesses try to lock in financial costs as interest rates rise. Court-ordered rehabilitation may also be a possibility for many firms, but for the time being this is still a last resort for many as there have been no new rehabilitation cases in the past three months.

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represents the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumers. The percentage to total loans represents the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q4/2022’s new corporate NPLs by sector’ represents the new and re-entered NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has accepted for consideration. The court may reject the application for rehabilitation.

KPMG Deal Advisory

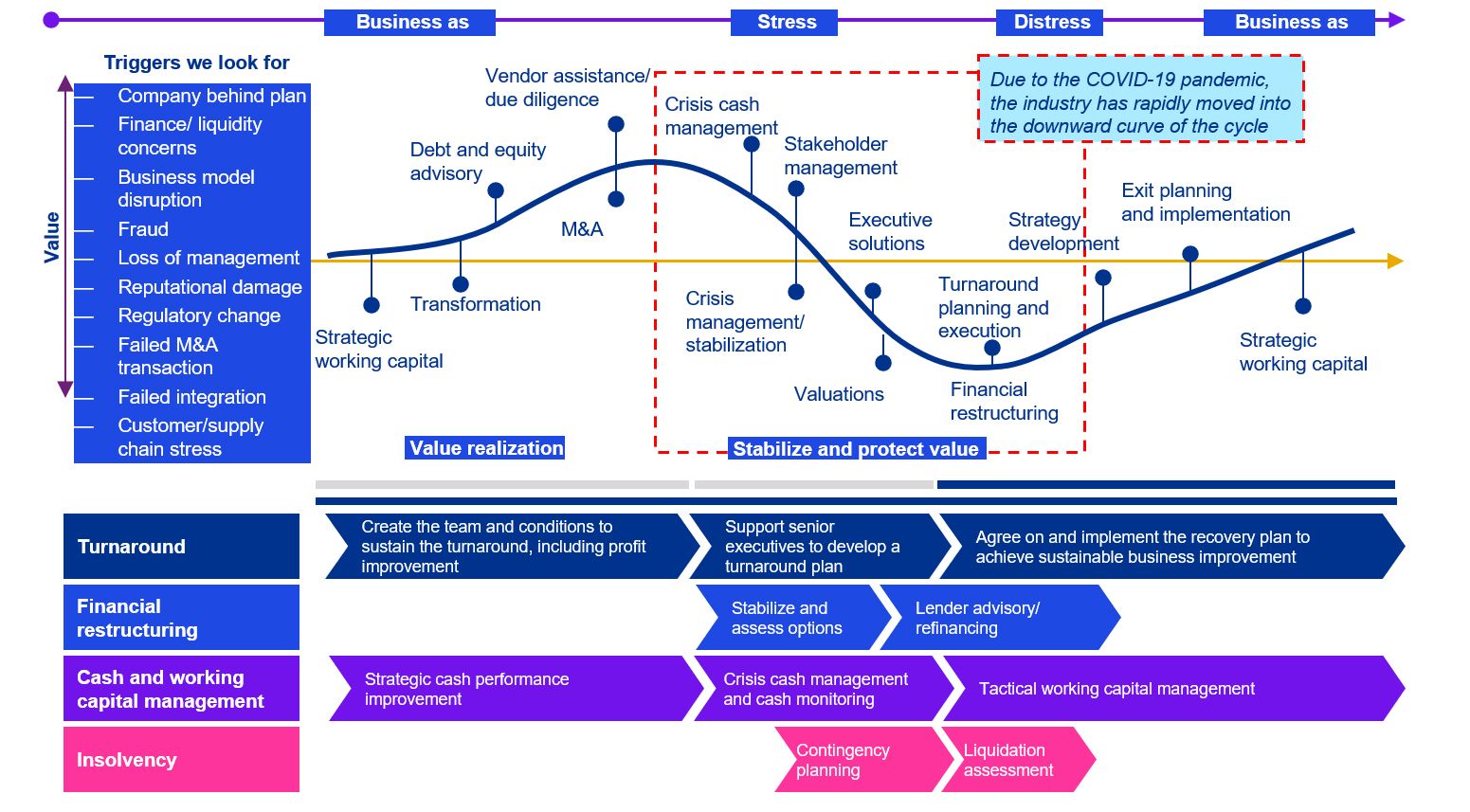

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach brings valuable insights and guidance to help you to stabilize and protect value, and then ready the business to emerge.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia