In August 2022, the Board of Investment (BOI or Board) announced new categories covering high precision machinery. By obtaining the BOI promotion certificate of these new categories, five-year or eight-year corporate income tax exemption is granted. The BOI categories for machinery existing from the past are limited to those such as automation, and their tax incentives are mainly for three or five-year. These new categories include a better tax incentive with eight-year. The new categories are not limited to the manufacturer of the machinery itself, but also include the manufacture and repair of related equipment and parts, which means that specific machinery manufacturers as well as companies in related industries may be able to apply in this category.

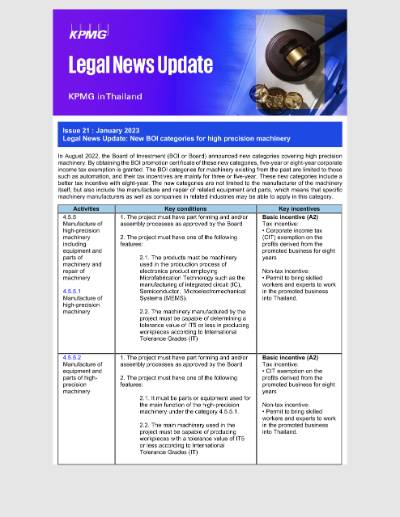

| Activities | Key conditions | Key incentives |

4.5.5 Manufacture of high-precision machinery including equipment and parts of machinery and repair of machinery 4.5.5.1 Manufacture of high-precision machinery |

1. The project must have part forming and and/or assembly processes as approved by the Board 2. The project must have one of the following features: 2.1. The products must be machinery used in the production process of electronics product employing Microfabrication Technology such as the manufacturing of integrated circuit (IC), Semiconductor, Microelectromechanical Systems (MEMS). 2.2. The machinery manufactured by the project must be capable of determining a tolerance value of IT5 or less in producing workpieces according to International Tolerance Grades (IT) |

Basic incentive (A2) Tax incentive:

Non-tax incentive:

|

| 4.5.5.2 Manufacture of equipment and parts of high-precision machinery | 1. The project must have part forming and and/or assembly processes as approved by the Board 2. The project must have one of the following features: 2.1. It must be parts or equipment used for the main function of the high-precision machinery under the category 4.5.5.1. 2.2. The main machinery used in the project must be capable of producing workpieces with a tolerance value of IT5 or less according to International Tolerance Grades (IT) |

Basic incentive (A2) Tax incentive:

Non-tax incentive:

|

| 4.5.5.3 Repair of high-precision machinery | 1. The project must involve the repair of key parts used for the main function of high-precision machinery 2. The project must have expenses on salaries for machinery repair personnel of at least 1,500,000 Baht per year which must be new employment or must have investment (excluding cost of land and working capital) of at least 1,000,00 Baht |

Basic incentive (A3) Tax incentive:

Non-tax incentive:

|

Please check whether you fall into any of the above categories. We hope you will utilize it for your business expansion and investment activities in Thailand.

How can KPMG Law assist you?

With our immense experience assisting various clients with both BOI and foreign business license applications, KPMG can provide legal advice and assist with the required approval requesting process. For more information, please feel free to contact us.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia