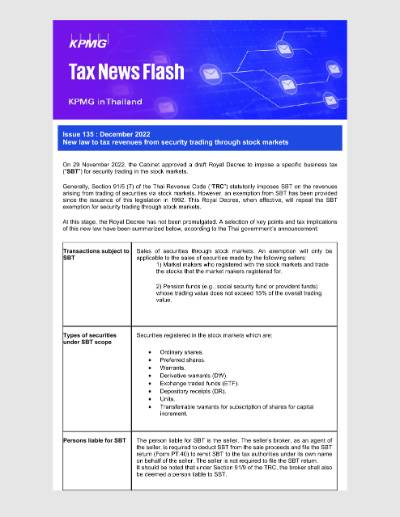

On 29 November 2022, the Cabinet approved a draft Royal Decree to impose a specific business tax (“SBT”) for security trading in the stock markets.

Generally, Section 91/5 (7) of the Thai Revenue Code (“TRC”) statutorily imposes SBT on the revenues arising from trading of securities via stock markets. However, an exemption from SBT has been provided since the issuance of this legislation in 1992. This Royal Decree, when effective, will repeal the SBT exemption for security trading through stock markets.

At this stage, the Royal Decree has not been promulgated. A selection of key points and tax implications of this new law have been summarized below, according to the Thai government’s announcement:

| Transactions subject to SBT | Sales of securities through stock markets. An exemption will only be applicable to the sales of securities made by the following sellers: 1) Market makers who registered with the stock markets and trade the stocks that the market makers registered for. 2) Pension funds (e.g., social security fund or provident funds) whose trading value does not exceed 15% of the overall trading value. |

| Types of securities under SBT scope | Securities registered in the stock markets which are:

|

| Persons liable for SBT | The person liable for SBT is the seller. The seller’s broker, as an agent of the seller, is required to deduct SBT from the sale proceeds and file the SBT return (Form PT.40) to remit SBT to the tax authorities under its own name on behalf of the seller. The seller is not required to file the SBT return. It should be noted that under Section 91/9 of the TRC, the broker shall also be deemed a person liable to SBT. |

| Tax base | Revenue derived from the stock trading (before expenses). |

| Tax rates | ● Reduced SBT rate of 0.055% (0.05% SBT plus the local tax at 10% of the SBT rate) from the effective date until 31 December 2023. ● Statutory SBT rate of 0.11% (0.1% SBT plus the local tax at 10% of the SBT rate) from 1 January 2024 onwards. |

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia