Thailand’s 2022 economic outlook is improving and is anticipated to reach its pre-pandemic level, with expected growth this year of 3.1%, a rise from 2.9% forecasted in June, due to upticks in private consumption, incoming foreign tourists, and exports. The export sector has benefited from a weaker Thai baht, which may boost revenue. While the Thai economy overall is showing signs of improvement, its recovery is threatened by increased inflationary and exchange-rate risks, as well as impacts from the ongoing Russia-Ukraine war, which has disrupted global supply chains and driven a surge in fuel prices.

The objectives in the upcoming months are to control inflation and strengthen the currency without jeopardizing the nascent recovery, which shall require careful handling. The Bank of Thailand's (BoT) monetary policy committee recently voted to moderately increase the one-day repurchase rate by 25 basis points, from 0.75% to 1.00%. The BoT believes that the inflationary pressure has peaked and will begin gradually falling, returning to its target range of 1%-3% in the second quarter of 2023. However, should the growth and inflationary outlook change, the BoT is prepared to adjust the size and timing of policy normalization.

Financial support from banks and momentum from the economic recovery have helped to improve businesses’ debt serviceability. As of 29 September 2022, the BoT has approved soft loan facilities of THB191.4 billion to 56,545 debtors, an increase of 4,213 debtors from 23 May 2022(1), while usage of the asset warehousing program has increased slightly over the past three months, with a total of 387 debtors and debt worth THB7.3 billion. These programs, along with other existing financial measures, will continue to be in effect until April 2023. The BoT introduced further regulations known as ‘Transformation loans’ in September 2022 to assist businesses that need to transform as a result of global trends, such as increasing digitalization and enhanced focus on the ESG agenda, to ensure they have sustainable business models.

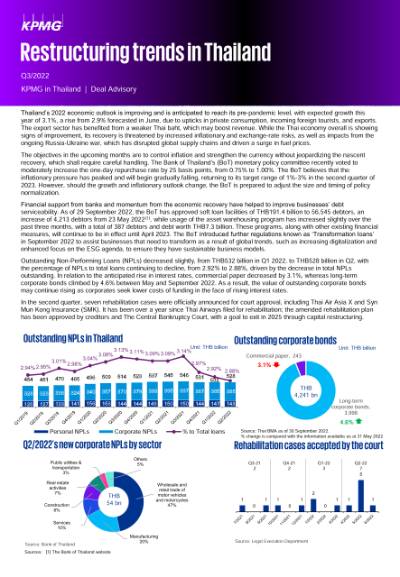

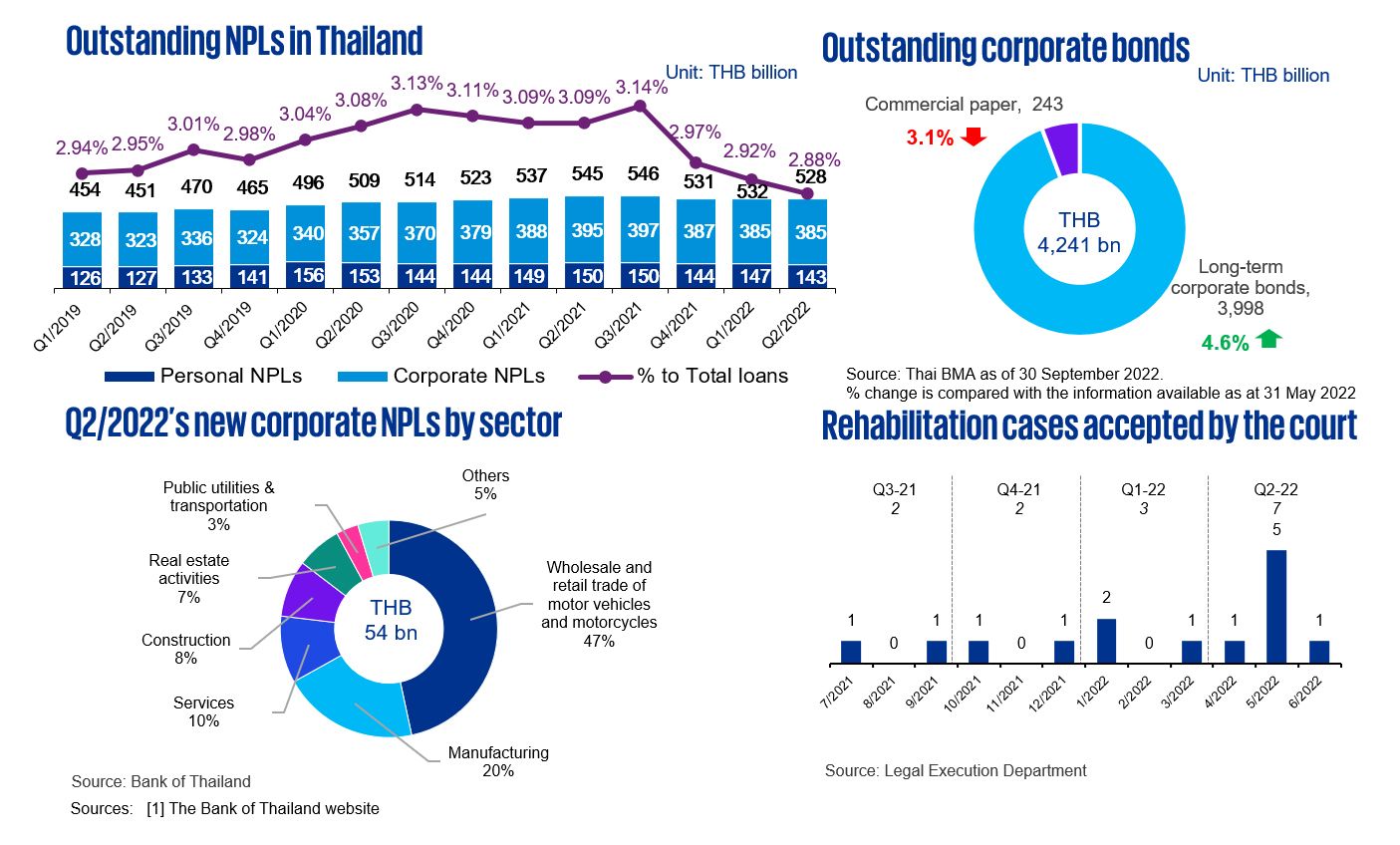

Outstanding Non-Performing Loans (NPLs) decreased slightly, from THB532 billion in Q1 2022, to THB528 billion in Q2, with the percentage of NPLs to total loans continuing to decline, from 2.92% to 2.88%, driven by the decrease in total NPLs outstanding. In relation to the anticipated rise in interest rates, commercial paper decreased by 3.1%, whereas long-term corporate bonds climbed by 4.6% between May and September 2022. As a result, the value of outstanding corporate bonds may continue rising as corporates seek lower costs of funding in the face of rising interest rates.

In the second quarter, seven rehabilitation cases were officially announced for court approval, including Thai Air Asia X and Syn Mun Kong Insurance (SMK). It has been over a year since Thai Airways filed for rehabilitation; the amended rehabilitation plan has been approved by creditors and The Central Bankruptcy Court, with a goal to exit in 2025 through capital restructuring.

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represents the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumers. The percentage to total loans represents the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q2/2022’s new corporate NPLs by sector’ represents the new and re-entered NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has accepted for consideration. The court may reject the application for rehabilitation.

KPMG Deal Advisory

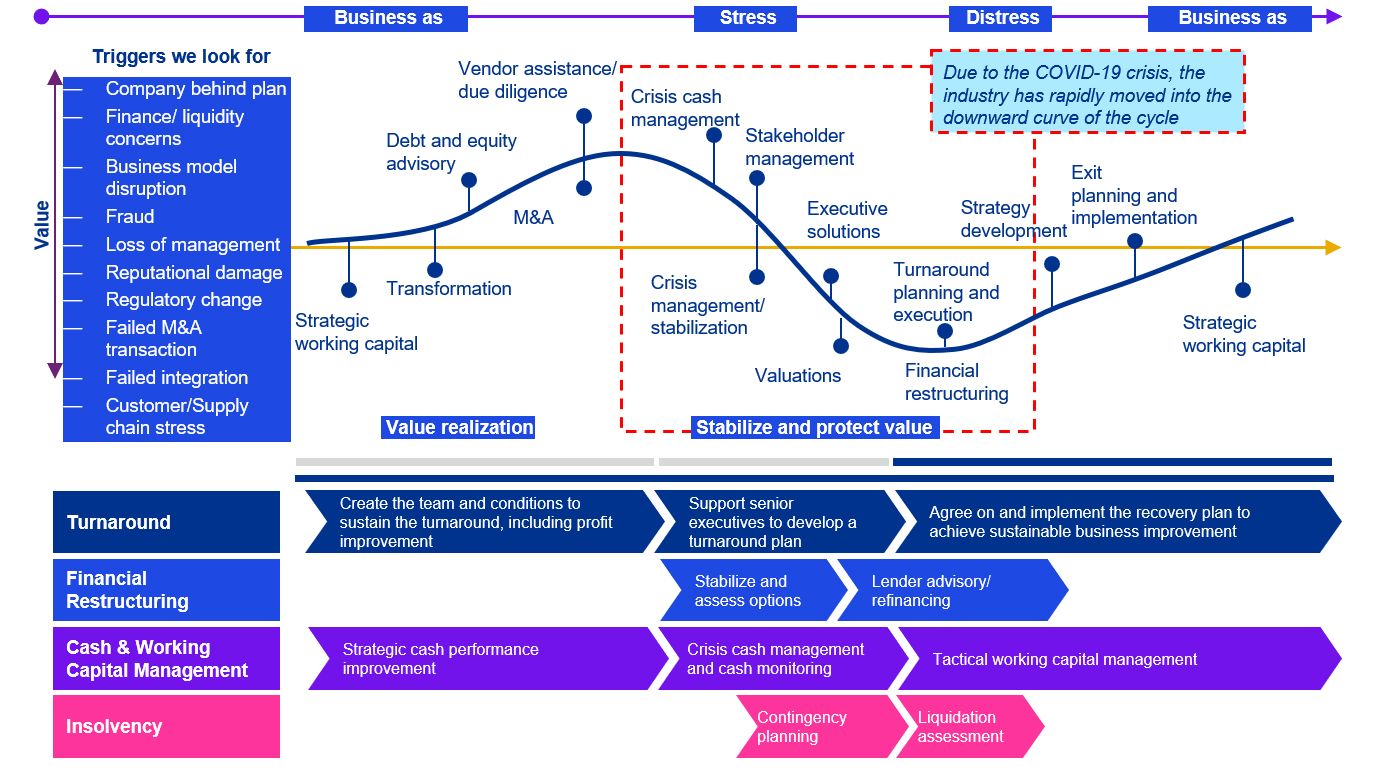

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach brings valuable insights and guidance to help you to stabilize and protect value, and then ready the business to emerge.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia