Fewer COVID-19 measures for fully vaccinated tourists have succeeded in attracting overseas tourists, whose increasing numbers have helped boost the economy in the first quarter of this year. Thailand has so far welcomed more than 498,000 tourists, an increase from 342,000 tourists, or 46%, from the previous quarter(1). However, the Q2 season is not usually a peak travelling period for Western tourists and China still restricts outbound travel for its citizens, while the Russia-Ukraine war continues to weigh on the economy and may deter some travelers. Whilst the impact of COVID-19 subsides, the rise of inflation, material prices and continuing supply-chain shortages pose fresh challenges to growth which will have an ongoing impact on the Thai economy, as well as on other countries across the globe.

The easing of COVID-19 control measures combined with improved household and corporate earnings and ongoing government measures, has enabled economic activities to begin to normalize. The Thai economy grew by 2.2% year on year in the first quarter of 2022, accelerating from 1.8% growth in the previous quarter(2). As a result, exports, private consumption and investment have resumed growth. Of particular note, exports have reached a 30-year high and are anticipated to remain strong thanks to the weakening of the Thai baht.

The Bank of Thailand (BoT)'s financial support policies have had some impact in assisting banks and debtors affected by the economic crisis. Up to 23 May 2022, the BoT has approved THB173.2 billion in soft loan facilities to 52,332 debtors, an increase of 5,869 debtors from 14 February 2022, with the average approval limit slightly increasing to THB3.32 million per debtor(3). The asset warehousing program has also grown significantly, with a total of 346 debtors and debt worth THB47 billion now enrolled, a moderate increase of THB14.4 billion from the last three months. Creditors and banks will therefore continue to require financial assistance from the central bank in order to boost economic activities.

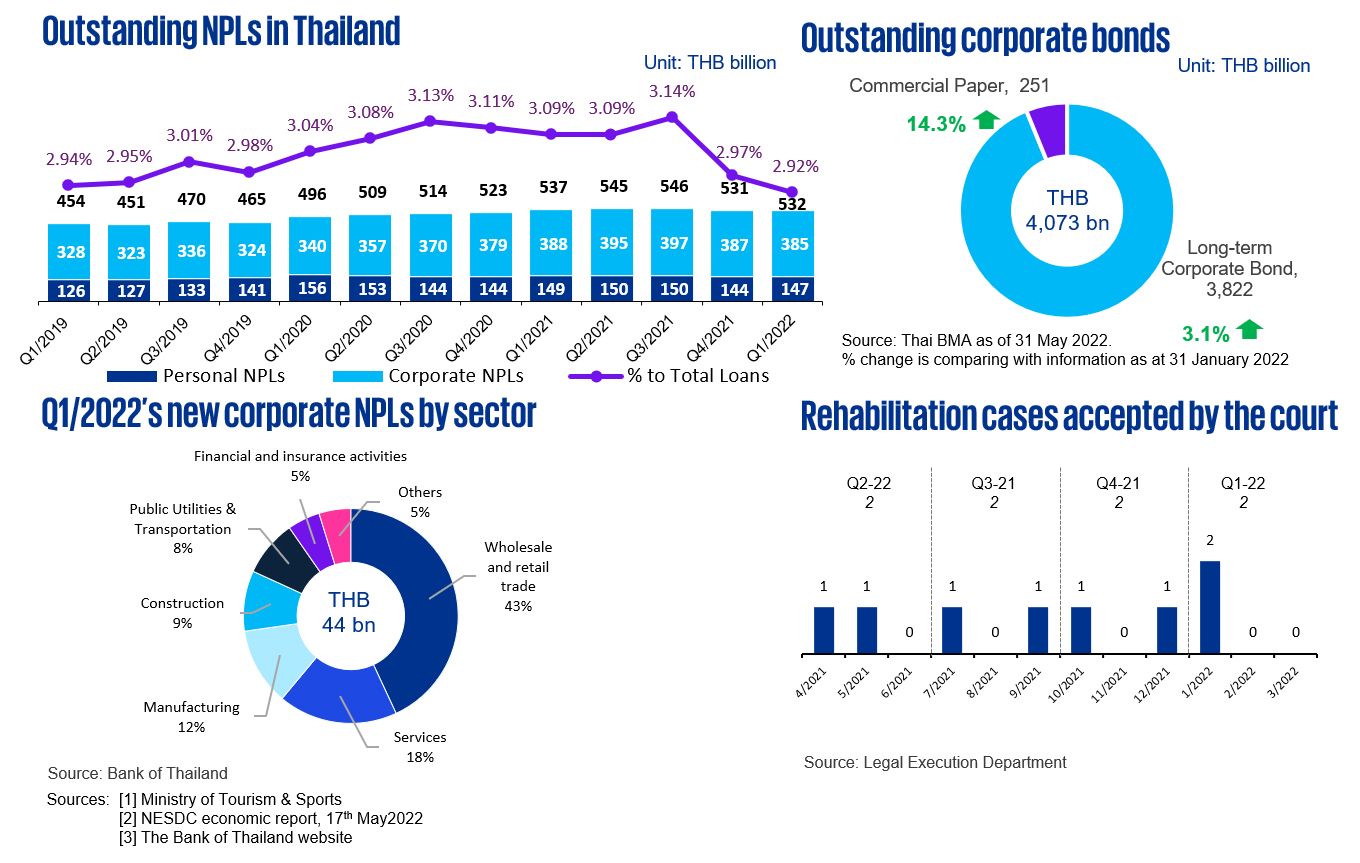

Outstanding Non-Performing Loans (NPLs) increased marginally to THB532 billion from the final quarter of 2021, with the percentage of NPLs to total loans continuing to decline, from 2.97% to 2.92%, driven by an increase in total loans which were primarily from personal borrowings. Many corporates have issued bonds to repay their debts and to invest for business working capital purposes. A higher number of commercial paper and long-term corporate bonds were issued, at 14.3% and 3.1% respectively, from January to May 2022. Another two rehabilitation cases were officially announced for court approval in the last quarter. Furthermore,

Thai Air Asia X and Syn Mun Kong Insurance (SMK) recently announced that they submitted rehabilitation filings in May, as both businesses have been severely affected by the COVID-19 pandemic. While not the first choice for many corporates, the court ordered rehabilitation process remains an option to effectively manage and restructure debt and this may be the start of a rise in such cases as we exit the COVID-19 pandemic.

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represents the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumers. The percentage to total loans represents the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q1/2022’s new corporate NPLs by sector’ represents the new and re-entered NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has accepted for consideration. The court may reject the application for rehabilitation.

KPMG Deal Advisory

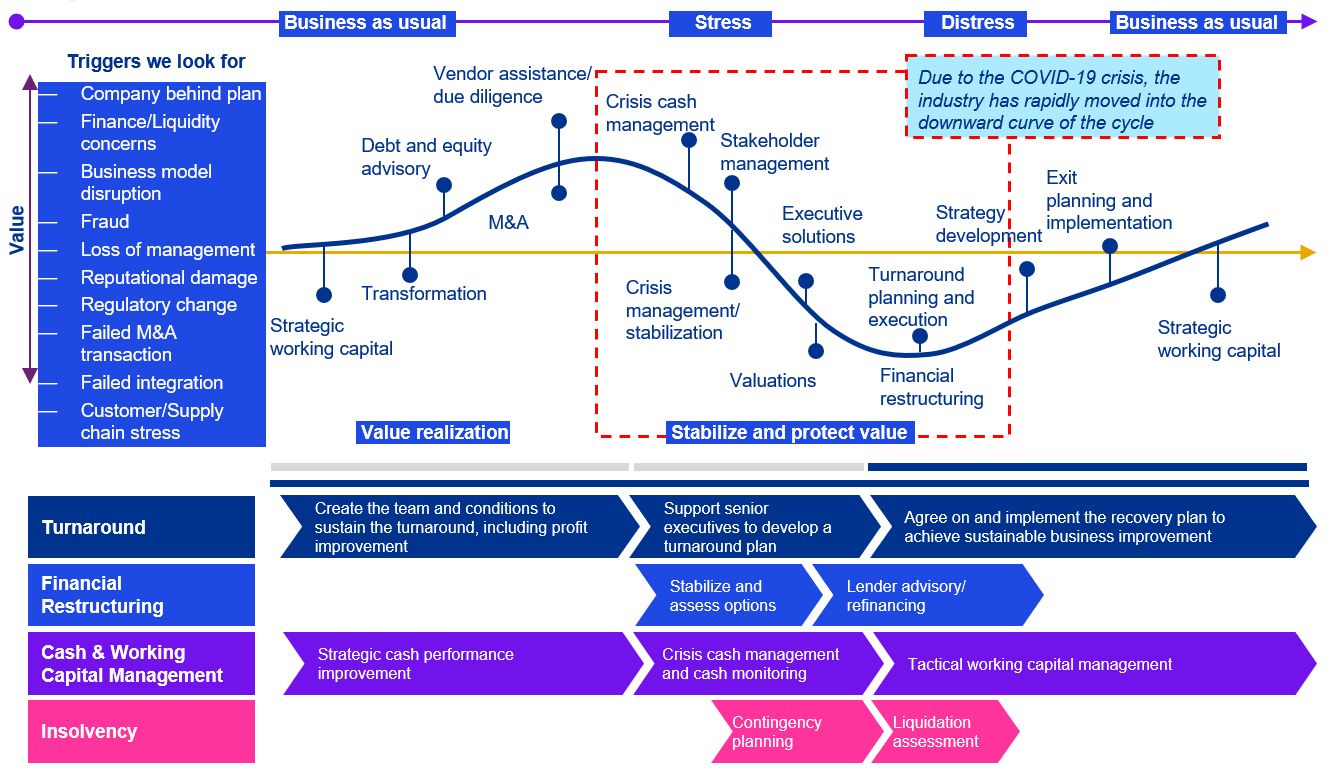

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach brings valuable insights and guidance to help you to stabilize and protect value, and then ready the business to emerge.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia