Following the National Electric Vehicle Policy Committee (“EV Board”) resolutions 3/2564 and 1/2565 to launch an “EV Tax Incentive Package”, as endorsed by the Cabinet resolution of 15 February 2022, the relevant government bodies, i.e. Ministry of Finance and Excise Department, have recently issued their respective notifications to implement the EV Package (for year 2022-2025), with the aim of stimulating BEV demands by equalizing the price of BEV and internal combustion engine vehicles.

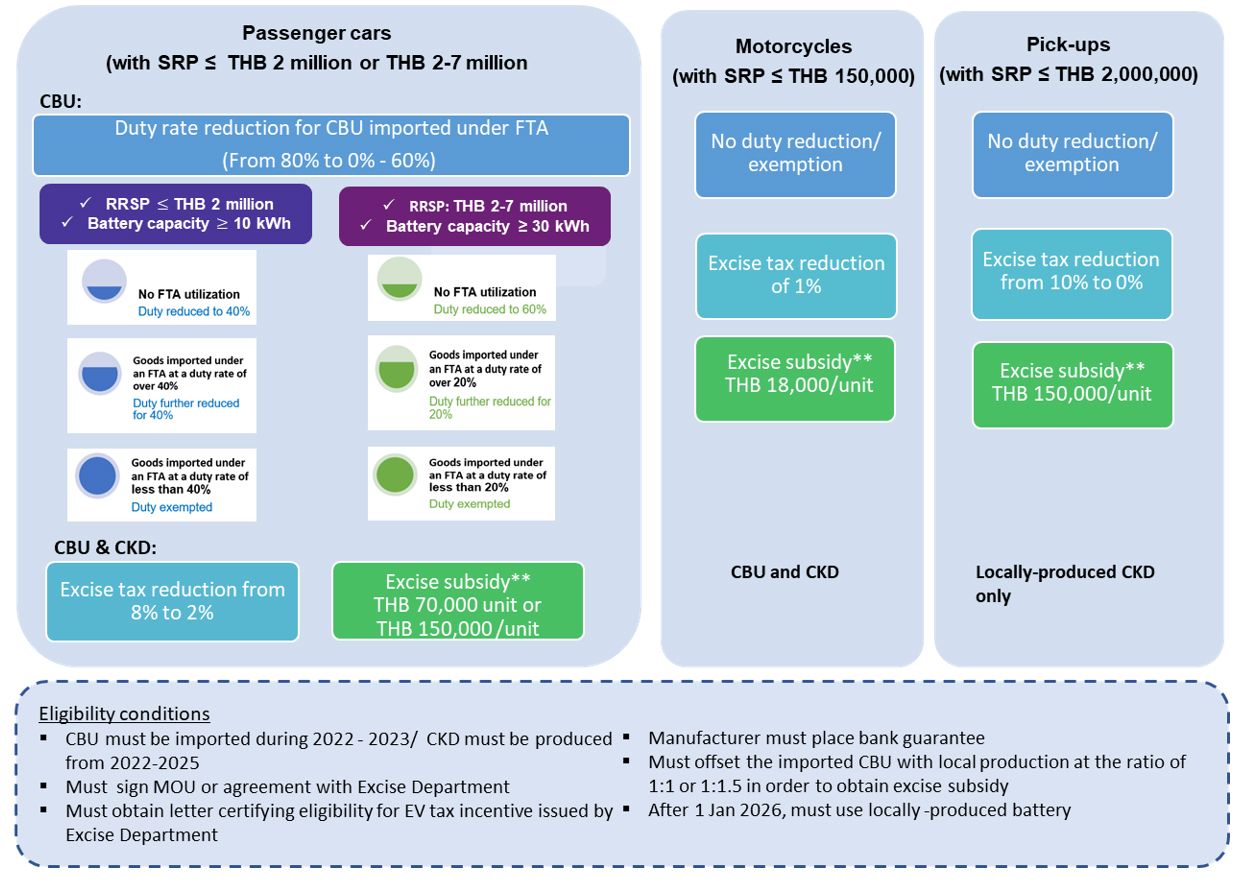

The current EV package which covers three types of BEV vehicles: passenger cars, motorcycles and pick-up trucks mainly consists of duty reduction privileges for CBU imported for market trial, excise tax reduction privileges, and excise subsidies. Details are summarized below.

1. Duty reduction privileges for CBU BEVs imported for market trial

Under the abovementioned Ministry of Finance notification, importation of CBU BEV passenger cars (“CBU BEV”) with less than 10 seats will be entitled to the following duty reduction privileges, depending on their FTA utilization.

1.1 CBU BEVs with a battery size of over 10 kilowatt-hour (kWh) and suggested retail price (SRP) of less than 2 million THB:

- For those not imported under an FTA, the import duty rate will be reduced from 80% to 40%.

- For those imported under an FTA at a duty rate of less than 40%, import duty will be exempted.

- For those imported under an FTA at a duty rate of over 40%, import duty will be further reduced by 40%.

1.2 CBU BEV with a battery size of over 30 kWh and an SRP of more than 2 million THB, but not exceeding 7 million THB:

- For those not imported under an FTA, the import duty rate will be reduced from 80% to 60%

- For those imported under an FTA at a duty rate of less than 20%, import duty will be exempted

- For those imported under an FTA at a duty rate of 20% or more, the import duty will be further reduced by 20%.

2. Excise Tax Reduction from 8% to 2% for BEV passenger cars and 0% for BEV pick-up trucks is pending an excise regulation by which to implement the policy guidelines.

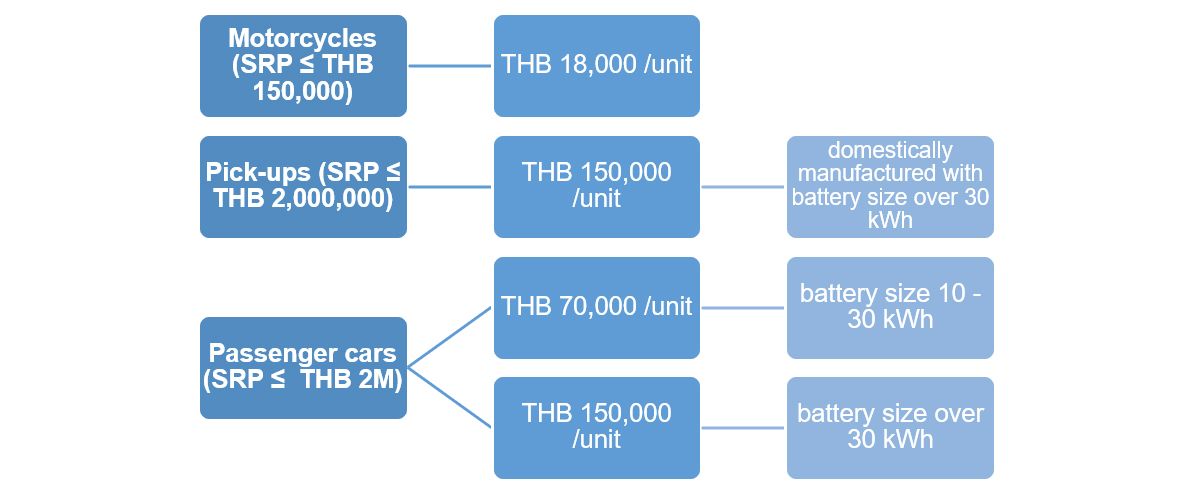

3. Excise Tax Subsidy

The Excise Department has announced an excise subsidy package per aforesaid Excise Notification dated 21 Mar 2022 for electric motorcycles, pick-up trucks and passenger cars. Details are as illustrated below.

The excise tax subsidy is applicable to both imported and locally produced BEV (for pick-ups, the subsidy is only granted to locally produced vehicles). Eligible manufacturers who also import CBU BEVs during 2022-2023 are required to offset production by producing any model of vehicle (if the CBU BEVs have an SRP of not over THB 2 million and a battery capacity of 10 kw per hour), or by producing vehicles similar to the imported models (if the CBU has an SRP between 2-7 million THB), at an import to local production ratio of 1:1 by the end of 2024. Extension of the deadline for the production offset to 31 December 2025 is allowed, but the offset production ratio will increase to 1:1.5.

In addition to the conditions above, locally produced BEVs are required to meet local materials requirement prescribed in Excise Notification dated 21 March 2022.

Non-compliance with the conditions specified in the Excise Notification, such as performing minor changes to the eligible BEVs without approval or not complying with offset production ratio requirement, shall result in a revocation of EV tax incentives and a liability to pay all applicable duties and tax, plus fines, penalties and surcharges under relevant customs and excise laws. In addition, excise subsidies will be recalled and bank guarantees will be forfeited.

Therefore, business operators should carefully study the conditions and requirements of each privilege in order to prevent risk of non-compliance.

If you have any queries or would like our assistance with the excise procedure or duty privileges, please do not hesitate to contact KPMG Thailand’s Trade & Customs team.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia