In the past few years, the Securities and Exchange Commission (“SEC”) has issued regulations allowing small and medium-sized enterprises (SMEs) and startups to raise their funds by way of private placement (PP-SME) and crowdfunding.

Recently, with the intention of the SEC to make capital markets beneficial to all under a “Capital Market for All” policy, the SEC together with the Stock Exchange of Thailand (“SET”) has issued regulations for public offerings of shares of SMEs and startups (PO-SME). Companies can now list their shares to be traded on a new secondary market called LiVE Exchange.

On 29 December 2021, the Capital Market Supervisory Board (the “CMSB”) issued key regulations regulating fundraising on LiVE Exchange:

- the Notification of the Capital Market Supervisory Board No. TorJor. 71/2564 Re: Offering of Newly Issued Shares by Public Limited Company to be a Listed Company on LiVE Exchange and Offering of Securities of Listed Company on LiVE Exchange (“TorJor. 71/2564”); and,

- the Notification of the Capital Market Supervisory Board No. TorJor. 75/2564 re: Post-obligations of Companies after Offering Newly Issued Shares for Listing on Live Exchange (“TorJor. 75/2564”)

These notifications came into effect on 16 January 2022.

Compared to the regulations on general IPOs/Pos, these rules give more leniency and flexibility to issuers (under the so-called Light-touch Supervision). Although the issuer is required to submit a registration statement and a draft prospectus in accordance with Form 69-SME-PO to the SEC (filing documents), the filing is mainly information based where the filing documents would be given to investors to give public opinions rather than to have active approval from the SEC. There is also no requirement to have a licensed financial advisor to certify the filing documents.

Under these new regulations, the offering of shares by SMEs and startups would be deemed approved by the Office of the SEC when complying with and having regulated qualifications. These include:

- being a company with requisite qualifications (e.g., being a public limited company incorporated under Thai law, directors and executive officers of the company must be on the whitelist, not being an investment company, and not involving in business that seriously violates the law and not carrying out any activity that violates or does not comply with the law.);

- offering shares to certain qualified investors e.g.

- Institutional Investor (II) e.g., Bank of Thailand, commercial banks, securities companies, and mutual funds;

- Private equity (PE) or Venture Capital (VC);

- Persons having a relationship with the company such as a.) director, executives or employee of the company or b.) major shareholders or c.) subsidiaries or associates;

- Persons having knowledge and experience in investment e.g., fund manager and investment analysts approved by the SEC; and

- High Net Worth investors (HNW) or Ultra High Net Worth investors (UHNW) having qualifications regarding knowledge and/or experience and financial position as regulated. Such as must have previous investment experience or those that have net assets of not less than THB 60 million, or annual income not less than THB 6 million, or having investments (direct investments in securities and derivatives) not less than THB 15 million or not less than THB 30 million where deposits are included.

- the offering must have a total value of offer not less than THB 10 million, but not exceeding THB 500 million, must be able to offer not less than 80% of a total value of offer by the end of offering period and must be offered through a licensed underwriter.

To be aligned with the SEC on PO-SME via LiVE Exchange, the SET has issued the criteria for the listing and securities trading on LiVE Exchange (also called as LiVEx) which is different from the criteria applied to SET and Mai markets in several keyways. For example, qualifications of securities issuers where all executives of such company must pass a preparation course for listing on the capital market etc., post-listing duties and investment models. The criteria was announced by the SET on 14 March 2022 and took effect on 31 March 2022.

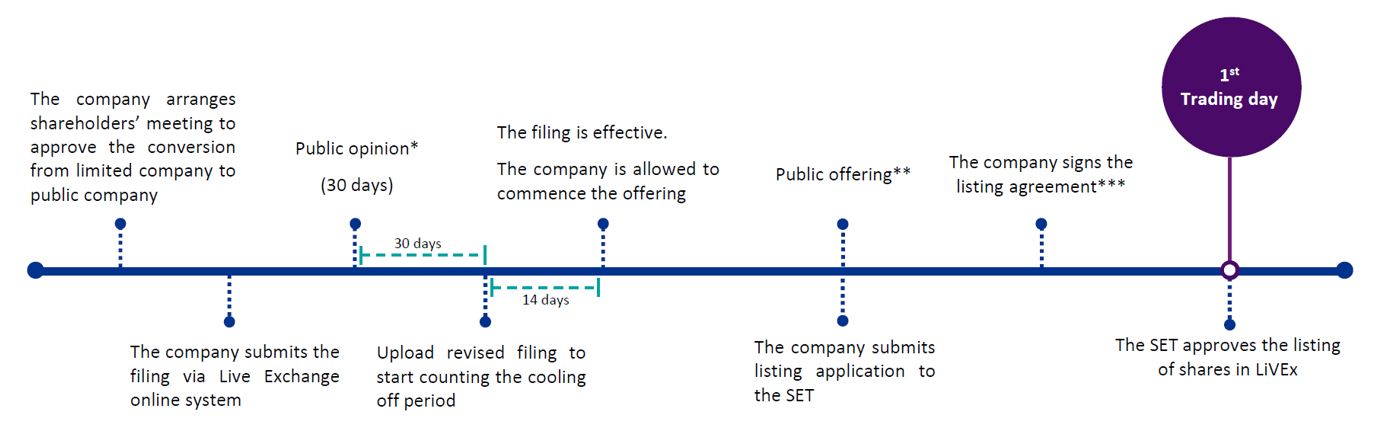

When approval for public offering from the SEC is deemed granted, the company will be qualified to submit the listing application to the SET in accordance with the SET’s regulations. Procedures of listing and offering of newly issued shares are summarized below.

* Public opinion period is the period that allows the investors to raise questions to the issuer (the company) and the company has a duty to answer those questions. During the public opinion period, the company is able to adjust and add information to the filing.

** The offering through the underwriter is required to be completed within 6 months of the date that the filing is effective.

*** The company will be able to sign the listing agreement only if the SET considers that the company fully qualified with the regulations.

Comparison of key qualifications of the issuer of SET, Mai and LiVEx is shown in below table.

| SET | Mai | LiVEx | |

| Status | Public limited company not carrying out any activity that violates or does not comply with the law and has obtained an approval from the SEC | ||

| Paid-up capital | >= THB 300 million | >= THB 50 million | N/A |

| Track record | Profit Approach

Must have the operating results in accordance with the specified requirements and continuously until the date of approval for being listed securities.

|

Profit Approach

Must have the operating results in accordance with the specified requirements and continuously until the date of approval for being listed securities.

|

Qualified entities are:

* According to Ministerial Regulations on Designation of the Characteristics of SME Promotion Act B.E. 2562 (2019), SME with medium size (medium enterprises) refer to enterprises with the following characteristics: (1) enterprises operating manufacturing business which hire more than 50 employees but not more than 200 employees or generating annual revenue in amount of more than THB 100 million but not more than THB 500 million; and (2) enterprises which are service providers, wholesalers, or retailers hiring more than 30 employees but not more than 100 employees or generating annual revenue of more than THB 50 million but not more than THB 300 million. |

Market Capitalization Approach:

|

|||

|

|

||

Silence period |

Net Profit Approach The silent period extends for one year after listing. Those who meet the criteria for strategic shareholders are not allowed to sell their shares totaling 55% of paid-up capital after the IPO. They are permitted to sell 25% of the locked-up shares after 6 months. |

The silent period extends for 3 years. Those who meet the criteria for strategic shareholders are not allowed to sell their shares totaling 55% of paid-up capital after the IPO. They are permitted to sell the 20% of locked-up shares after 1 year and every 6 months. | |

Market Capitalization Approach The silent period extends for three years after listing. Those who meet the criteria for strategic shareholders are not allowed to sell their shares totaling 55% or more of paid-up capital after the IPO. They are permitted to sell a maximum of 20% of the locked-up shares after 1 year. Upon completion of every 6-month period thereafter, those persons shall be able to gradually sell their shares at 20% of the number of all shares subject to the prohibition of sale. |

- | ||

| Listing and offering process |

|

|

|

How can KPMG assist you?

KPMG can support SMEs and startups by providing legal advice on the process of issuing and offering of the shares. KPMG can also assist in the preparation of documentation to be filed with the SEC and the SET in order to offer and list shares on LiVE Exchange.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia