On 8 March 2022, the Cabinet approved two tax relief measures to support the trading of digital assets and the investment in Thai start-ups. The details of the tax relief measures are summarized below.

VAT and personal income tax exemption provided for the trading of digital assets

The Cabinet approved the principles of two draft Royal Decrees issued under the Revenue Code and a draft Ministerial Regulation for tax reliefs on digital asset trading in order to conform with the development of digital assets. The tax benefits provided under these measures are described as follows:

- Value added tax – will be exempt from 1 April 2022 to 31 December 2023 for (1) the transfer of cryptocurrencies or digital tokens traded in the digital asset exchange platforms approved by the Minister of Finance, and (2) the transfer of digital currencies issued by the Bank of Thailand under the Bank of Thailand’s digital currency development project.

- Personal income tax – will be exempt for the profits derived from the transfer of cryptocurrencies or digital tokens on the amount that exceeds the investment as equal to any losses arising from transferring cryptocurrencies or digital tokens incurred in the same tax year. The personal income tax exemption applies to the transfer of crypto currencies and digital tokens from 14 May 2018 in the digital asset exchange platforms that are approved by the Minister of Finance as per the method, procedures and conditions prescribed by the Director-General of the Revenue Department.

The Royal Decrees and the Ministerial Regulation associated with these tax benefits are expected to be announced soon.

Tax measure to support the fundraising of start-ups

In order to continuously promote the investment in Thai start-ups and expand Thailand’s economy, the Cabinet approved the draft Royal Decree issued under the Revenue Code to update tax benefits previously provided to investors who invest in Thai start-ups under Royal Decrees Nos. 597 and 636 as proposed by the Ministry of Finance.

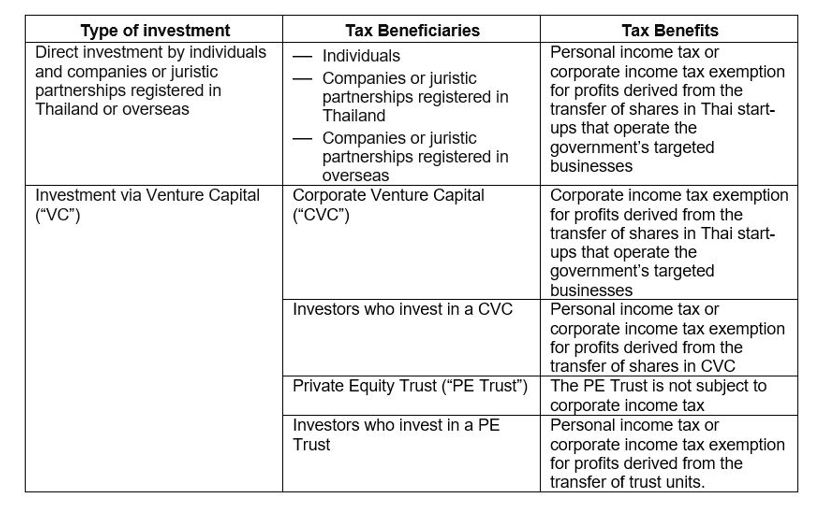

A summary of the tax benefits is set out in the table below.

The above tax benefits will apply from the effective date of the Royal Decree until 30 June 2032. The Royal Decrees and supplementary regulations associated with these measures are expected to be announced soon.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia