Due to Thailand moving away from quarantine requirements for fully vaccinated tourists with the introduction of the “Test and Go” scheme, the tourism sector saw a slight recovery which boosted economic growth in the fourth quarter of 2021. In December, Thailand welcomed 230,000 tourists which is the highest number since March 2020. However, growth has not returned to pre-pandemic levels, and the recovery is still fragile with the Omicron variant now prevalent in Thailand. The war between Russia and Ukraine continues to escalate and whilst the focus should remain on the safety and wellbeing of the people in Ukraine, it is beginning to impact economies across the globe. For Thailand, the most significant short-term impact is likely to be the effect from increasing fuel prices and supply chain shortages as well as a reduction in the number of Russian tourists, whilst a weakened global economy will also impact Thailand’s export and manufacturing industries.

Following the relaxation of containment measures and the re-opening of borders, Thailand's GDP saw a growth of 1.6% in 2021, thanks to increasing exports and improved domestic activity. The Bank of Thailand (BoT) estimated that the Thai economy had bottomed out in Q3 2021 and has since entered the recovery phase. This is supported by Thailand's economic recovery in Q4 being faster than projected, with a growth of 1.8% from the previous quarter, owing primarily to strong exports and a rebound in domestic activity, and it is expected that the economy will continue to grow at a rate of 3.5% to 4.5% in 2022.

The Bank of Thailand's financial support policies have effectively helped banks and debtors who have been impacted by the economic crisis. Up to 14 February 2022, the BoT had approved THB151.2 billion in soft loan facilities to 46,463 debtors, an increase of 6,741 debtors in the last three months, with an average approval limit of THB3.25 million per debtor. The asset warehousing program has also grown significantly, with a total of 285 debtors and debt worth THB40 billion now enrolled, up from THB14.4 billion in the third quarter. These increases show that debtors and banks continue to require the central bank’s financial support despite the recovery of the economy in Q4 2021.

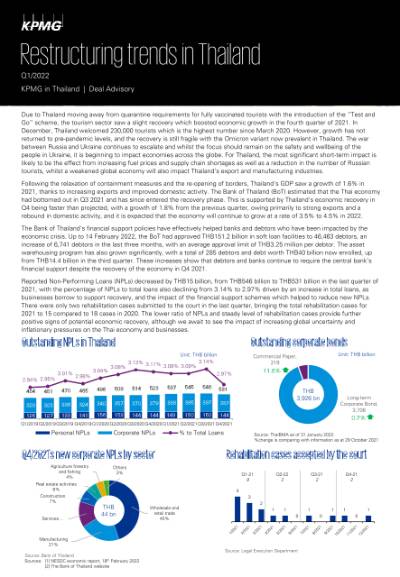

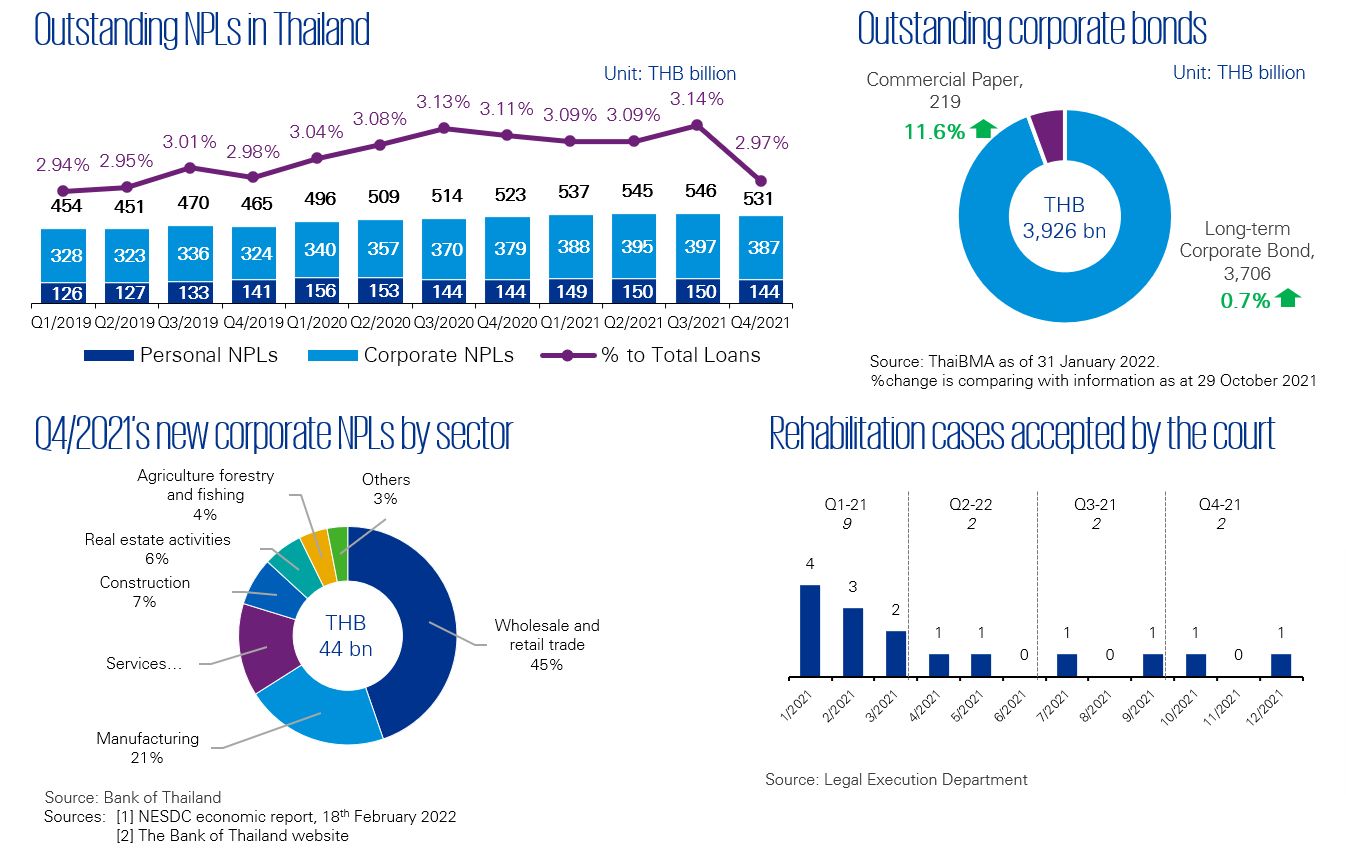

Reported Non-Performing Loans (NPLs) decreased by THB15 billion, from THB546 billion to THB531 billion in the last quarter of 2021, with the percentage of NPLs to total loans also declining from 3.14% to 2.97% driven by an increase in total loans, as businesses borrow to support recovery, and the impact of the financial support schemes which helped to reduce new NPLs. There were only two rehabilitation cases submitted to the court in the last quarter, bringing the total rehabilitation cases for 2021 to 15 compared to 18 cases in 2020. The lower ratio of NPLs and steady level of rehabilitation cases provide further positive signs of potential economic recovery, although we await to see the impact of increasing global uncertainty and inflationary pressures on the Thai economy and businesses.

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represent the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumer. The percentage to total loans represent the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q4/2021’s new corporate NPLs by sector’ represents the new and re-entered NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has accepted for consideration. The court may reject the application for rehabilitation.

KPMG Deal Advisory

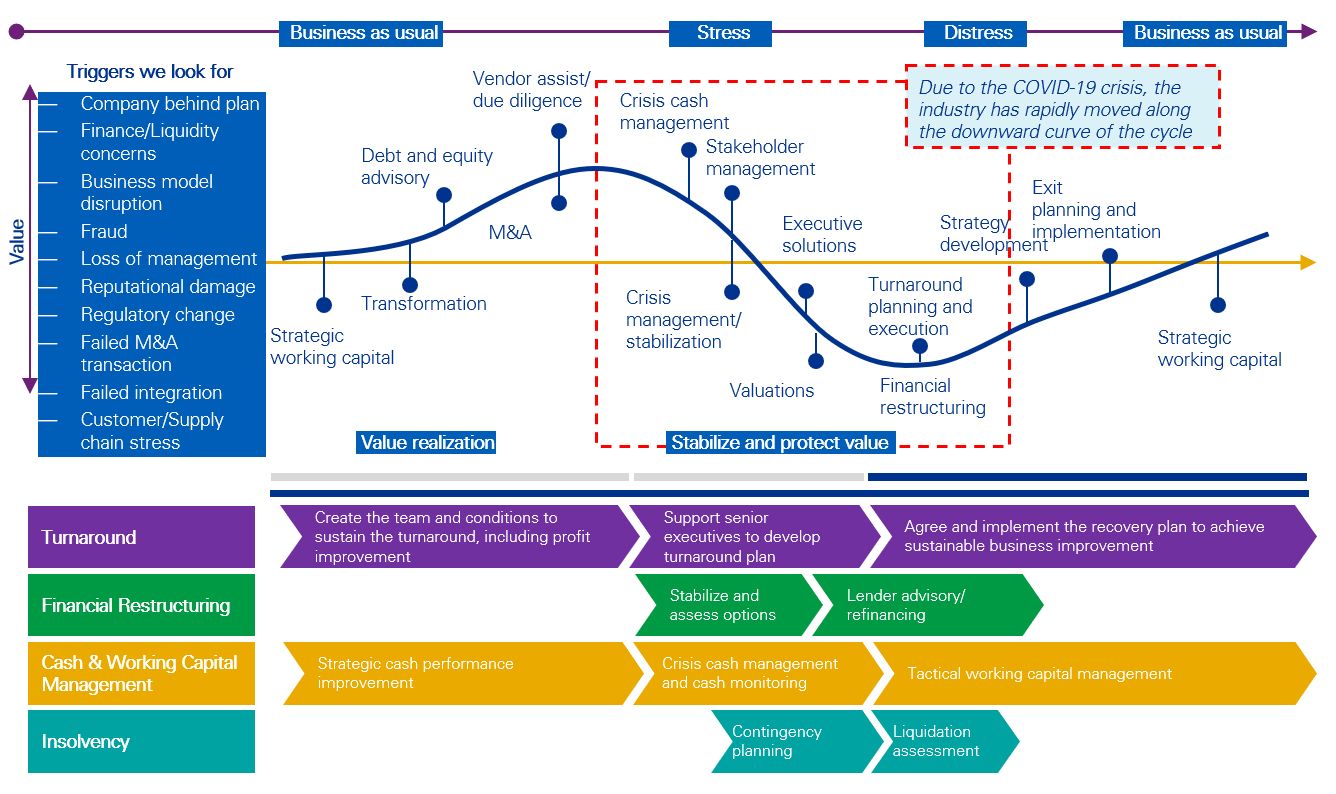

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach bring valuable insights and guidance to help you to stabilize, protect value, and then ready the business to emerge.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia