What is Value Creation?

In today’s rapidly changing and uncertain environment, businesses need to be able to adapt quickly in order to both protect and create value for their stakeholders. To do this effectively, as well as having a robust strategy, business leaders need to leverage data to understand the value drivers of their business and make informed, value-based, decisions.

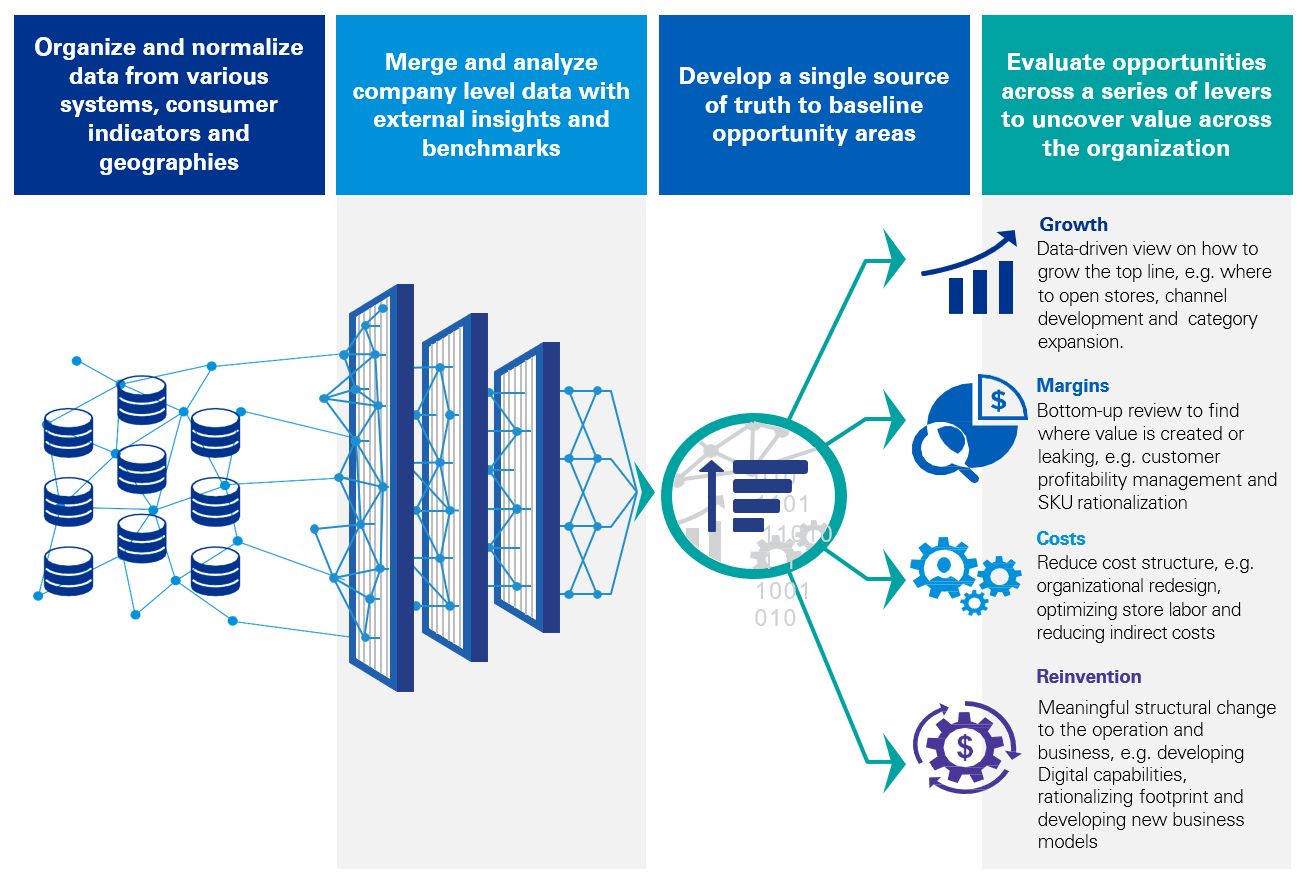

Our value creation approach deploys a powerful combination of hypothesis-led thinking with advanced data analytics. Together with our deep sector knowledge and functional expertise, this enables us to provide you with a unique set of insights specific to your business.

When is Value Creation relevant to a business?

Our value creation approach identifies potential improvements and can be deployed across a number of situations:

Pre-Deal – During the acquisition or sales process, we help you to understand the potential to create value from the target company, unlocking value for either the buyer or seller. So, whichever side you are on you can be confident that your valuation incorporates potential upsides, backed by robust analytics and implementation considerations

Post-Deal – After closing the deal, we perform a deep-dive into the company’s financial and operational data to identify where to reposition assets to enhance EBITDA and cash flow. We can then assist in implementing the right initiatives to deliver this improvement to ensure value is delivered ahead of any exit or IPO.

Whilst our approach has been developed with a deal lens in mind, it is equally relevant for any corporate that is looking to grow or improve their financial performance and needs help developing a robust plan to create value. With access to KPMG’s global experts, we can provide you with detailed, actionable insights to drive value, whatever your current situation.

Our collaborative, and data-driven approach

At KPMG Thailand, we use our experience to generate a list of potential value creation hypotheses, which we will then validate and refine through a combination of data analytics, using both internal and external market data, and collaborative discussions with you about the challenges you are facing and future strategy of your business. Hypotheses could include using geospatial analytics to identify the best locations for your store expansion plans, or analyzing the true profitability of your products or services.

How we can help

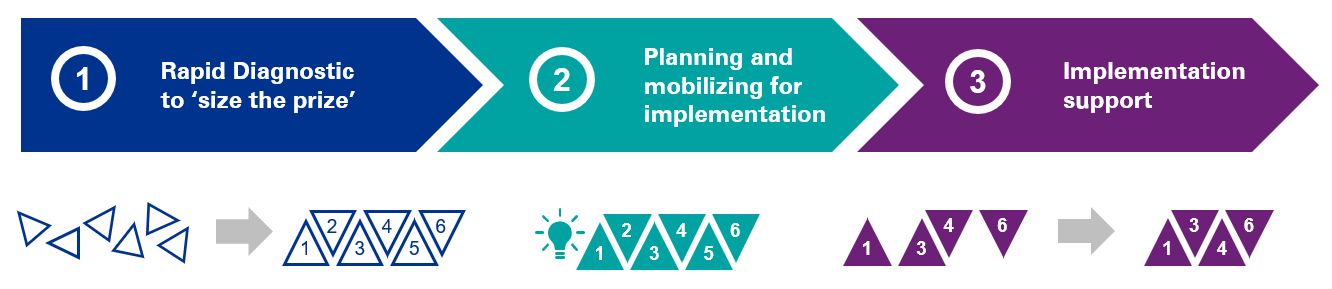

1. Rapid Diagnostic to ‘size the prize’

- Extract financial, operational and commercial data

- Understand business operating models, structures and processes

- Perform a detailed diagnostic of cash and operating profitability across targeted business areas

- Develop tactical options for quickly realizing savings opportunities while exploring longer-term options

- Prioritize EBITDA and working capital opportunities, identify interdependencies and assess implementation costs and resourcing needs

2. Planning and mobilizing for implementation

- Develop tailored plans to implement EBITDA and working capital opportunities

- Consolidate plans to form a unified schedule for implementation, including resources, one-off costs, and risk/mitigation actions

- Validate schedule and resource requirements for each workstream, and across business units

- Establish reporting structure to measure program success

- Draft project charters to ensure all team members are working towards a common defined goal

3. Implementation support

- Rapidly Implement the opportunities to create value

- Establish the Project Management Office

- Assign work stream ownership to key stakeholders

- Execute implementation plan for working capital and EBITDA opportunities

- Carefully track the implementation of benefits and one-time costs

- Review progress and milestones with management

- Full handover with regular input from KPMG experts on focused points

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia